The NVDA Double Top

How I shorted NVDA for an ~8% profit in 2 days

“STOP thinking about the money, START thinking about trading good.” —Philo

I have been known to be a prolific NVDA shorter — this is how I played it this time.

But before we get to that, here’s how we recently traded the Yen for 2/2 profitable trades in brilliant fashion. In this post I explain both my fundamental thesis and the technicals I used to enter and exit.

The NVDA Double Top

This is the chart I shared in the Philochat (Philoinvestor Community Chat).

We were already turning majorly bearish on NVDA and the AI Hype Cycle — and shared our thesis both in the Philochat and in longer-form posts like The Central Bank of NVDA.

We explained how Nvidia’s deal making had replaced the Fed’s QE — and how GPUs and Compute became the new Reserve Currency now that the USD’s sway was fading.

Jensen Vs Trump 2.0

But things hit a wall when China “abruptly” pushed back against US Semis selling their chips into China 👇

The things here between Trump 2.0 and broader American Supremacy is that it connects to AI Supremacy: Trump wants to have a lever against Xi as he will probably meet with him 17 more times during his Administration — to negotiate trade deals and try to twist each other’s arms.

—> But all Jensen wants to do is sell his GPUs into China, especially now that Domestic GPU sales are peaking with only Crazy Zuckerberg not realising that ROI on this is probably negative!

From two hours ago: *US TO BLOCK NVIDIA’S SALE OF SCALED-BACK AI CHIPS TO CHINA - THE INFORMATION.

If this holds true, Jensen could have further problems especially as Open AI is calling for a Government “Backstop” for Data Center investments (?!?!) and Sam Altman is taking heat for his remarks and attitude in the podcast with Satya.

Getting to the point…

On Wednesday I shorted NVDA as it was confirming its double top pattern and wrote about it on the Philochat.

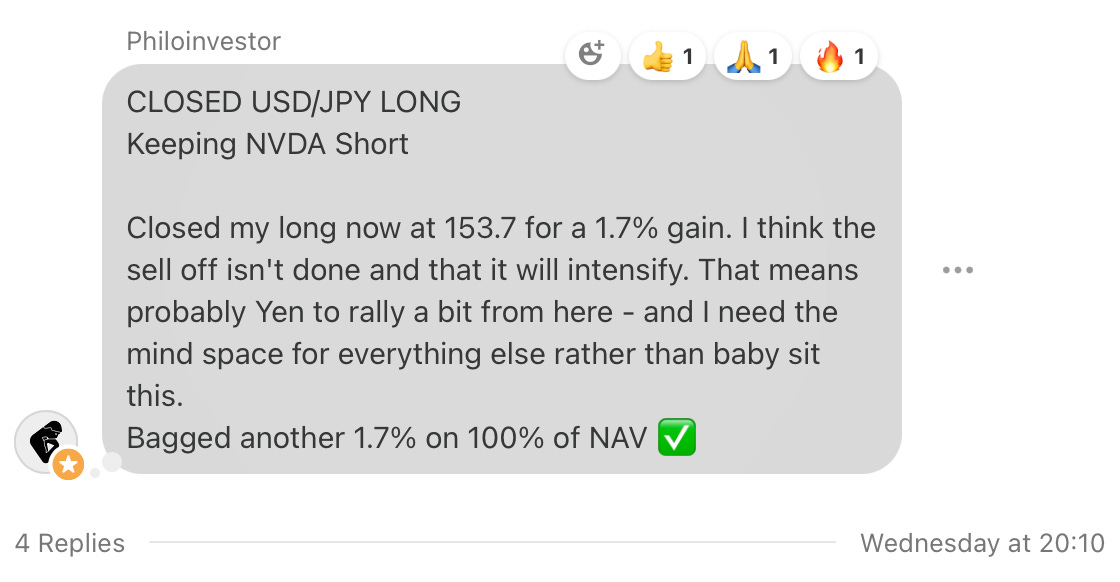

But not only that, I closed my USD/JPY Long at 153.7 for a 1.7% profit on 100% of NAV because I expected a broader sell-off which would probably push the Yen a bit higher.

—> USD/JPY now at 153.

—> Two days after shorting and the trade is $15 in the money (+7.6%)..

—> Both moves worked with yesterday being a great day for my P&L while the Nasdaq was down almost 2%.

The China export restriction timing couldn't be worse for Jensen with datacenter capex showing signs of fatique. The double top formation is textbook here, especially when you consider how much of NVDA's valuation hinges on sustaining these ridiculous growth rates. What really concerns me is the lack of downstream ROI visibility, which could trigger a serious re-rating if hyperscalers start pulling back. Your USD/JPY hedge makes perfect sense in this environmnt.