The Central Bank of Nvidia

NVDA has replaced the Fed. The next phase of the cycle.

It all began with the launch of Chat GPT on November 30th, 2022. The environment was negative after the “transitory inflation” debacle — and the Fed was hiking rates and shrinking its balance sheet.

The Nasdaq 100 was down ~37% in roughly one year — investors were losing big.

Chat GPT launched without much fanfare but massively accelerated ideals of AI; Artificial Intelligence. The idea that a technology could replace and substitute human intelligence.

Would we soon not need to work? Would everything be taken care for us by machines? The possibilities were literally endless.

As it happens, that is the perfect setup for a Sorosian-type reflexive boom/bust cycle: A market process where human expectations directly create the reality that they envision.

There is however a catch — there is a reality beyond our capacity to understand it, and when our expectations get too far divorced from that — the process becomes unsustainable and liable to reverse.

Layer 1: INCEPTION

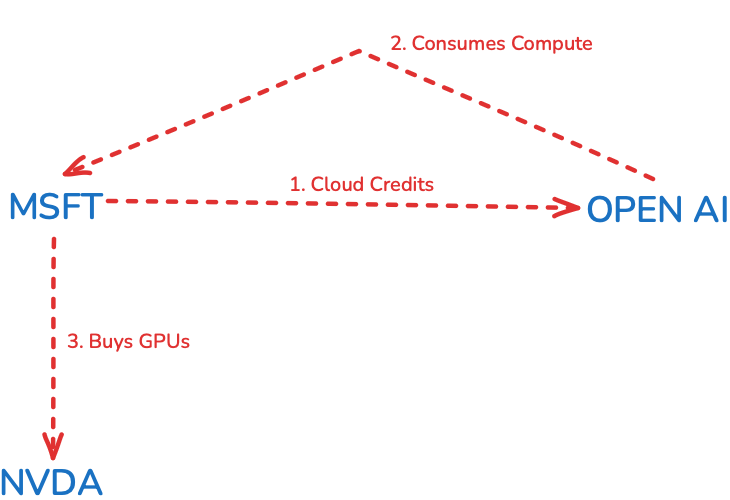

The inception of the process was Microsoft’s pivotal investment into Open AI, not with Dollars but with “Cloud Credits”. This enabled Open AI to train their LLMs, and then run them (i.e. inference) for all of us to use.

Note: this was the first instance of self-funded demand.

This kicked off a process of AI chatbot proliferation with Grok and Claude launching soon thereafter. Open AI now has 700mln weekly users, up 4X from last year.

The demand for compute since inception has just been insatiable. Never mind whether it has positive ROI or if it wasted on funny images — that doesn’t matter right now.

Ideas and dreams of AI took further hold, as humans saw in front of their eyes what it could do. This wasn’t just a consumer technology — this was an enterprise technology, with serious existential implications of productivity and innovation.

It was do or die — who stayed behind would perish. And who was going to serve enterprise in this massive project of intelligence?

Layer 2: The Hyperscalers

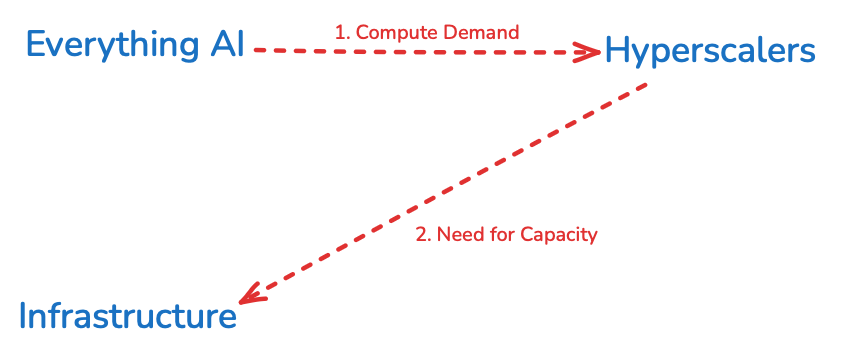

The Big 3 of Cloud were about to embark on the growth spurt of their lives. AI becoming mainstream meant demand for compute would explode — and only they could provide it to the world..

But there was one small detail — would they make any money off it?

As the mantra of “everything AI” gripped markets — common business sense went out the window: ROI did not matter, as long as valuations played along.

We explained this process in the Techno-Imperial Cycle here.

Retail and Enterprise compute demand flowed to the Hyperscalers, and they in turn embarked in major data centre buildout to serve those needs. Picks and shovels like NVDA were a clear beneficiary — the stock was up 239% for 2023. The Nasdaq was up 50% in the same time period.

Whatever they were doing, it was working. As we explained, the market was not worried about banal things such as ROI, they were focused on grand ideals of AI like AGI (Artificial General Intelligence) and amassing more compute.

“If intelligence is log of compute, whoever can do lots of compute is a big winner” — Satya Nadella

Layer 3: Nvidia-as-a-Catalyst (NaaC)

While all this is evolving, Nvidia is actively building the future they want to see — and no, they didn’t call it NaaC 😂 but they should have!

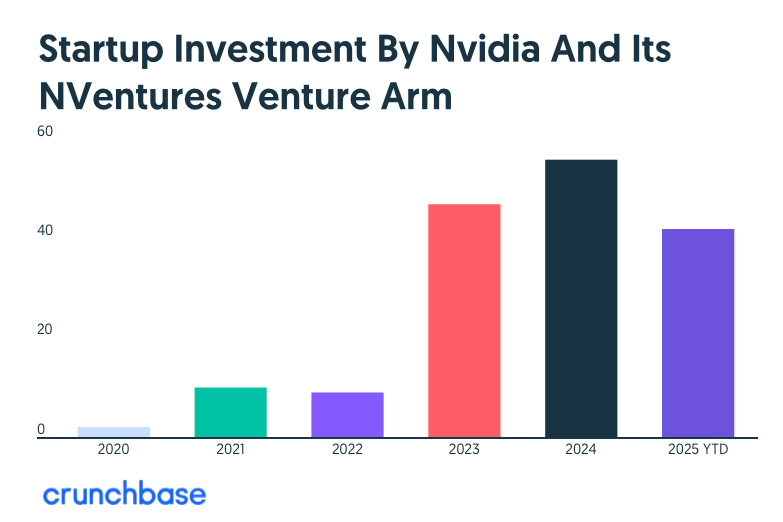

What was ~10 investments per year in ‘21 and ‘22, exploded to close to 50 by 2023, up to almost 60 in 2024 and — keeping the pace for 2025 YTD. It’s clear that Nvidia wants to be its own catalyst and we will soon see why.

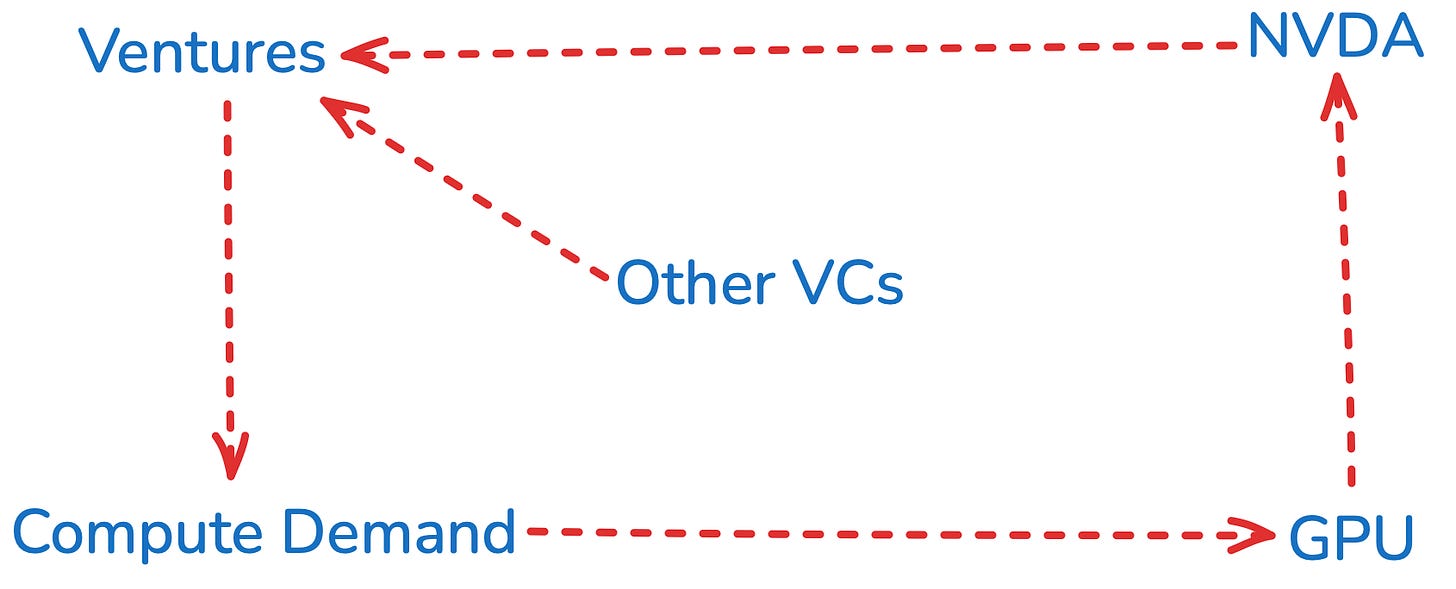

Together with the “Everything AI” moment, Nvidia and its venture arm saw the opportunity to recycle their profits into AI-related ventures.

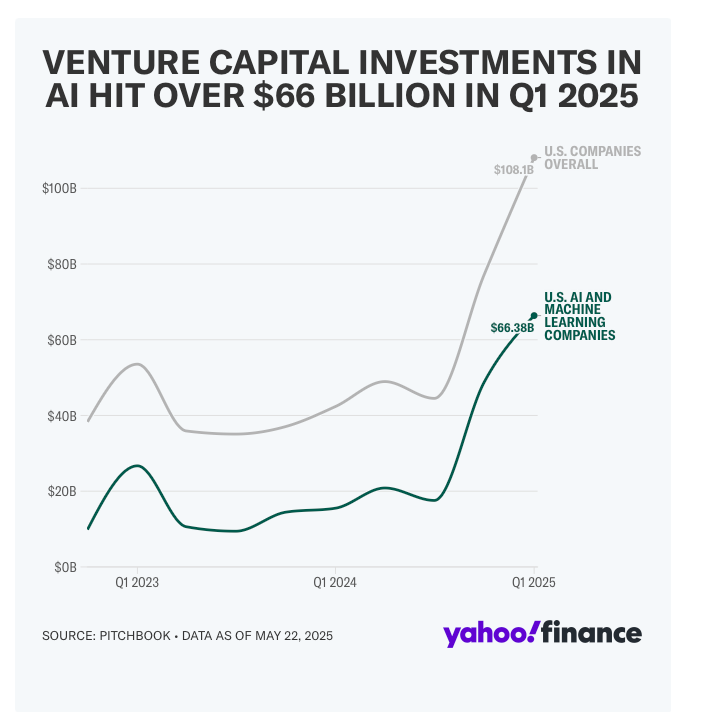

But it wasn’t just Nvidia; the global VC industry saw an opportunity to multiply a dollar by 10X or 100X by betting on the right AI horse.. As we discussed, the ROI is in the valuations!

Global VC investments in artificial intelligence and machine learning totalled $76.5 billion and accounted for over 70% of the value of all venture capital deals during the period. Some $66 billion of those investments were in US AI companies.

—> 3/4 of all VC money flowed into AI-related startups

This directly benefits Nvidia as those startups require compute👇

But that wasn’t enough — Nvidia’s strategy was to try and unlock the NEXT stage of AI: Disruptive breakthroughs and discoveries that would propel the AI ecosystem further and multiply the TAM.

For example, just last month NVDA announced a strategic 2bln GBP investment into the UK’s AI Startup Ecosystem. Link.

NVIDIA today announced an investment of £2 billion in the U.K. market to catalyse the nation’s AI startup ecosystem and scale the next generation of globally transformative AI businesses. The new capital will be used to foster economic growth, develop more innovative AI technologies, create new companies and jobs, and empower the U.K. to compete in the AI market globally.

Keyword: Catalyse. Nvidia is using their recently gotten riches to create the future they want to see. It’s all in the money multiplier.

But for the time being, there has been no groundbreaking killer application or “breakthrough” for AI besides chatbots, coding and image generation.

This is just not enough for what Jensen and Nvidia are trying to create. And so NVDA is stuck selling GPUs and AI Infrastructure for these legacy use cases…

But for how long?

Until recently NVDA sold into China, but we warned in mid-August how that would not continue — see AI Wars: China just pulled the plug.

The market seemed aloof about the setup and felt that NVDA would soon be back in (Chinese) business. We faded that expectation and a month later 👇

That being said, NVDA stock did not react negatively to this catalyst, but let’s continue with the next phase of the process and how things turned awry due to the China complication.

China banned NVDA’s AI chips on September 17th

11 days later, Open AI announces the mega deal with NVDA

I don’t know who went to whom for this — but I can tell you both needed each other. Open AI has been separating from Microsoft and has been actively looking for other suitors to power their plans.