Making sense of TPUs, Debasement and Takaichi

End of Year Mega Breakout by Philo - #Issue 18

Issue #17 here

Issue #18

Why Breakout by Philo?

First, don’t be this guy 👇

Breakout by Philo gives readers an unbiased and unemotional look into markets from a technical perspective.

I have found this approach 1) incredibly fruitful 2) and the source of a persistent and consistent edge in markets, partially because it’s very hard to do.

I have been doing this for ~20 years in one form or another. Consider this the highly developed version of blending technical analysis, macro and themes into understanding markets and generating actionable intelligence.

Sometimes there’s nothing much to say, sometimes there’s a lot. But you have to be here for the turns, or else you miss them. And even if you’re not actively trading right now — you need to follow markets and what’s going on.

Opportunities come out of nowhere — 50% of life is showing up.

The Backdrop & Our Focus

“I’m the reserve currency now” — Precious Metals filling in for the Dollar

Tech/AI leading the indices all by themselves — now starting to turn

AI Supremacy via Trump 2.0

Global Macro things

Risk: Is the process is turning into Bust?

Risk: The ASIC/TPU threat

Catalyst: Trump 2.0 redeeming himself with The Brink and Back trade

Brazil trying to turn but its politics getting in the way

German/Merz and the EU losing the narrative

The Takaichi Trade amidst uncertainty and chaos

Past trades and trades that are setting up

The Fed Cutting Cycle

Gold Miners

The Nuclear Thematic and Power Demands

And going low level in some of the themes.

Markets Undercurrents & Notables 📝

The Google VS Open AI chart

This chart has been doing the rounds showing how the Google Complex has been over performing while the Open AI complex has been under performing since Google came out with their TPU chip and Gemini 3.

Not only doubts on Open AI’s future have been creeping up for some time — but Google has managed to flip the narrative to their favour. We warned and discussed this previously on Philoinvestor in a number of posts.

I revised this and touched on the ongoing TPU story here — as we ramp up to send out a bigger piece on the theme.

Chatbot Competizione and the AI Tech Stack

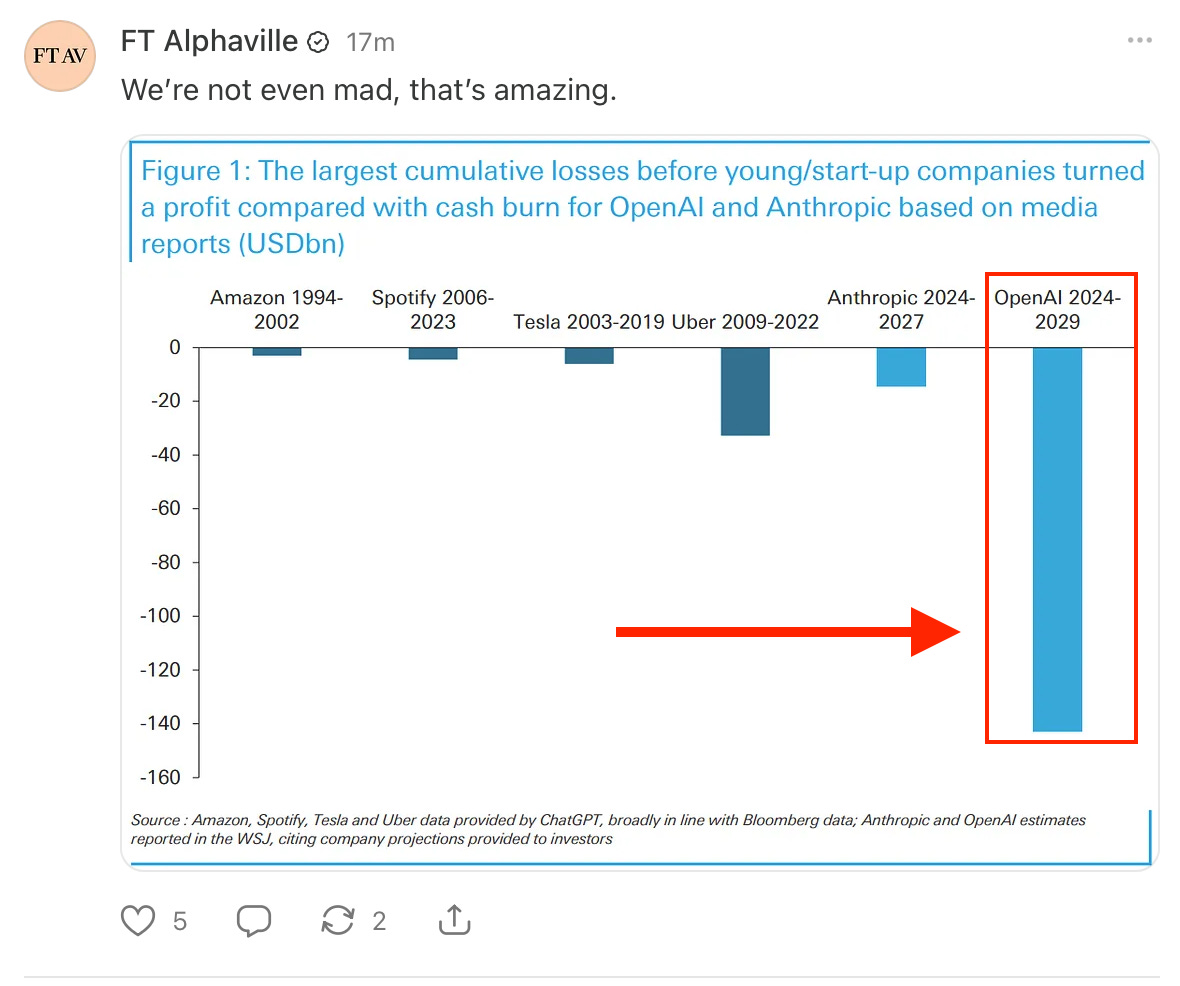

Amazon, Spotify and Uber racked up billions in losses before turning a profit — but Chatbots are dwarfing those losses with Anthropic losing almost $20billion while Open AI touching a staggering $160bln in expected cumulative losses for the period 2024 up to 2029..

Refer to the relevant time periods, both historical and expected, in the chart above.

Now, large is fragile and small is beautiful. One turn of the narrative, one fork in the road and Open AI could fail in raising its next funding round — especially after parting ways with its willing suitor, Microsoft Inc.

Some thoughts and facts on Chatbots on my X here.

The narrative now seems to be that Google is winning the war because people are turning from Chat GPT to Gemini. I have yet to use Gemini and only use Chat GPT and Claude currently, I am especially pleased with the latter and mostly use Chat GPT to generate images for the courses in Philo’s Academy.

But the point is this: the Chatbot Race will not stop for years and they will all end up being very close in terms of performance and capabilities.

And therefore, the “ultimate differentiator” in this race (marathon rather) will be financial. That is to say, who can endure the most before going bankrupt and being forced to sellout to someone else or leave the race.

The race is one of scale, finances and of keeping up with the required R&D to fund technological advancements in the form of training better models.

We expanded on each layer in the stack below and outlines the problem that both Nvidia and Chatbot makers would run into.

The Brazilian Bull hits a wall 🇧🇷🐂

From prison, right-wing Jair Bolsonaro backed his son to run for president in next year’s elections. Flavio Bolsonaro is a senator, is 44 years old and is the easiest opponent for left-wing incumbent Lula.

We wrote in Bom Dia, Philo! that Jair Bolsonaro was being pressured to name a successor to his political career as he serves a 27-year sentence in Brazil for plotting a coup.

The implication here is that markets want Tarcisio de Freitas and not any Bolsonarista to become president next year — and they especially don’t want Lula to remain.

The “Brazilian ETF” also known as iShares MSCI Brazil ETF (Ticker: EWZ) dropped 6% on the day. The Real dropped 2.5% against the Dollar.

It seems, markets did not want Flavio and preferred Jair to give Freitas his blessing — apparently that’s not the way it’s going down.

Is Takaichi = Harakiri? 🗡️🇯🇵

Japanese markets revolting against the Takaichi Trade as yields on JGBs make new multi-decade highs and the Yen crashes down.

We analyse this setup and offer more context in the second part of the piece.

If you’re not familiar with the Philochat or our trades on the Yen, these two short promo pieces should solve that!

Ok let’s finally begin part deux…

Nasdaq 100

Nasdaq sold off on negative Open AI and NVDA related catalysts but found support and was later aided by positive Google catalysts related to the Google Gemini release, Cloud growth and their in-house Custom Silicon (i.e. TPU).

I won’t say too much here as we will individually look into Google and Nvidia later on in the piece.

Russel 2000

Continues to be probably the most boring market we cover in Breakout.

Nikkei 225

Taichi becoming PM gave the Nikkei a continuation rally as doubts grow on the Japanese fiscal side. If you’ve been living under a rock for 2-3 decades — Japan is *the most* bankrupt country in the whole (Western) world and has been desperately applying Hyper-Keynesian Monetary policies to try and pump their failing system.

Spoiler: It hasn’t worked out.

And now Takaichi is trying to repeat the Abenomics playbook with the market responding mostly the same way. Yen down, stonks up. The problem now however is spiking yields on JGBs making their Godzilla-sized sovereign debt unsustainabruuuuu!!!

[I would insert the meme of the Japanese man but Cloudflare is down again]

Gold

Expanded views on the broader Gold/Debasement/Reserve FX trade here.

Gold did not seem as interesting to us as it approached the $4,000 level in a parabolic fashion as we called out beautiful trades on it years in advance (refer to older Breakouts).

The Debasement trade remains significant going into 2026 but fragile to small changes in the narrative.

Many have been burned trying to trade economics. Global macro trading is not economics. Moves in global macro instruments like commodities, FX and even the broader stock market are the shadows of economics (and a bunch of other things).

Don’t get burned conflating the two. Learn to use technicals to structure your trades more intelligently.

We continue to cover markets like Gold in the Philochat.

Silver

Up 100% since the breakout of early June — Silver has always been the play for those that feel they were 1) too late on Gold or 2) that Gold can’t move up enough to make them precious metal rich!

But recently there has been something else brewing in the Silver market with big chunks of COMEX Silver being withdrawn from the exchange. This strains and squeezes the supply of physical Silver as supply-side issues persist and China curbs exports..

This invites fears of impending short squeezes and scares the whole market. The mechanics of futures exchanges are complicated and I won’t go into the details here — but the point is, if you are (naked) short say 100,000oz of Silver and the counterparty (the longs) are asking for physical delivery in a market that is spiking up because of a short squeeze —> then you could go bankrupt trying to cover that short.

It’s all about leverage and sudden price spikes..

But zooming out for historical context, here’s how Silver behaves and tells the picture of how many got burned on this market (don’t forget to include opportunity and carrying costs!)

New Age Gold (Bitcoin)

A 36% drop peak to trough from the highs of October to the lows of November — “Digital Gold” is losing its shine as the narrative is slowly being lost. ETFs are seeing outflows and Trump is too busy with other things to pump Crypto 24/7.

Saylor is feeling the pain. Our most recent Crypto-themed piece.

Ethereum

Similar story with ETH which failed perfectly at the level. The last highs labelled below goes far back as November ‘21. If you refer to previous Breakouts you will see we faded expectations that ETH had the power to break through. Sorry Tom Lee.

MSTR

MicroStrategy (or Strategy 🤮) is the Bitcoin Treasury Company of possibly one of the most disgusting men in Finance.

This snake oil salesman and grifter is one of the Top 5 people responsible for the (possible/future) demise of Bitcoin and broader Crypto, at least in its current form.

For now, Michael Saylor and his “team” have launched a charm offensive to try and get the market to switch on the idea that they are about to blow up.

Refer to Crypto Winter above for more colour and my thoughts.

For those of you that missed it: last December we published Dump Your Crypto 2.0 after nailing the top in October of 2021. The cover of this post was

It’s only been a year and look how far we’ve come! 🦉🙏

The Dollar Index

DXY finding resistance at the bottom of the range as the Euro remains strong-ish and the Yen nears new lows.

Dollar / Yen

USD/JPY could not move above the level as the pair approaches April ‘24 levels — i.e. the last time a carry unwind started.

Authorities have (once again) come out to talk up the Yen (down the USD/JPY) while they lose the narrative: On the one hand they talk about Takaichi Trade things, on the other they don’t want they Yen to fall further lest they piss off their people…

So confused, so confused..

We traded the long side perfectly and went flat at 156.2 — and remain flat. Market is finding support around the MA50 as Yen holders *remain* reluctant in holding the world’s second most hated currency (Turkish Lira #1, lol)

Meanwhile bond markets are protesting as the JGB market (Japanese Government Bonds) are revolting and dumping Japanese paper..

JGBs and the Takaichi Trade

Yields on 10-year Japanese paper have spiked 30bps since Takaichi won the LDP elections and the rubber band seems to be breaking. We touched on the Takaichi Trade under Nikkei above, and discuss Japanese macro almost daily in the Philochat.

For context, see below the chart in Monthly. The Japanese MoF could previously borrow in negative rates (nominal) but now must pay 2% (nominal). Of course this also connects to inflation which went from negative to almost a CPI of 3%.

And so in real terms, the Japanese MoF still gets to borrow money at -1% (real terms). Note: 30-Year Japanese Yield is at 3.36% right now.

I believe yields could continue to reset higher after a long period of artificially suppressed yields *and* an environment of benign inflation globally. Now the BOJ is losing the narrative and we are well into a *harsh* environment of inflation.

Further Reading: https://www.ft.com/content/72ec2377-c7ae-4469-b2ef-0784c5cbae51

The Euro

A lost Brussels and an EU with no strategic direction, a war in Ukraine that does not want to end and Merz in Germany losing the narrative less than one year into his premiership — how far do we expect the Euro to go?

The most important thing in this market is actually the confidence differential between Trump’s US and the EU. And the Euro has benefitted mostly from the Trump side of the equation fading rather than the European side making new highs..

Sterling

Putting politics and macro volatility aside — this pair has been in this range for 10 years now! Talk about consistency! And if you adjust for Brexit things, it has been in this range for *twenty* years!

Crazy if you think about it — or not so crazy if you consider that both trading blocs have been declining together. And Political and sociocultural inertia isn’t about to let that reverse any time soon.

On a more dramatic side note: We could see broader revolutions both in the UK and the EU as soon as next year.

Brazil!

The Brazil ETF: EWZ — has gone nowhere (to down) in 15 years. But note it’s dollar denominated. The actual Brazilian stock market has been rallying simple because the Real (their local currency) has been inflating massively.

The Selic Rate (Brazilian Fed Funds) is at 15% right now, and Q1 ‘26 expects it at 12.5%. The high Selic rate means Brazilians could benefit from that simply buying their Government bonds — and so stocks seemed less lucrative.

With a falling Selic rate now, more money could move into stocks.

USD/BRL up more than 3X in 15 years — but the market hit a wall next year. We elaborate on the Brazil setup here 👇

The AI Trade

We gave a lot of context on the AI goings on in the first part of the piece — let’s focus on a few charts now.

GPUs are peaking while Custom Silicon and ASIC technology (i.e. TPUs etc.) are ramping up with Nvidia feeling the heat.

With Google, META and even Anthropic starting the shift to less flexible, more efficient AI chips I expect NVDA shares to feel the pressure.

We shorted this as the technicals (double top!) confirmed our fundamental thesis and currently remain short. The Weekly MA50 isn’t far and if shares lose that…. ouch.

Google shares benefitting from good results and the narrative on the stock switching from AI-loser to AI-winner! Don’t expect much more upside on the stock from these levels, sorry.

Broadcom is a leader Custom Silicon and its share price shows it. The company is close to hitting a $2trillion market cap — and FY25 revenue is expected at less than $70 billion. That’s almost 30X Sales…

Energy

Crude still not going anywhere but there are two charts that are interesting: Eurogas and US Natural Gas.

Why is Eurogas crashing while US Natural Gas (Henry Hub) is spiking up?

Eurogas is dropping because the spread between the two is crashing as US gas inventories flood the European continent.

Historically, US gas — priced at the Henry Hub facility — trades at a discount to the European TTF due to abundant domestic production in North America.

However, that spread has shrunk dramatically in 2025, falling from about $12 per million British thermal units (MMBtu) at the start of the year to just $4.8, the lowest since May 2021.

Currently, TTF gas trades at just under $10/MMBtu, only twice the price of Henry Hub gas, which averaged $5.045 this week.

Enough for today 😮💨e

Philo 🦉