Issue #16 here.

Issue #17

Why Breakout by Philo?

First, don’t be this guy 👇

Breakout by Philo gives readers an unbiased and unemotional look into markets from a technical-first perspective. After the technical part — we then layer on context.

I have found this approach 1) incredibly fruitful 2) and the source of a persistent and consistent edge in markets, partially because it’s very hard to do.

I have been doing this for ~20 years in one form or another. Consider this the highly developed version of blending technical analysis and macro into understanding markets and generating actionable intelligence.

Sometimes there’s nothing much to say, sometimes there’s a lot. But you have to be here for the turns, or else you miss them.

The Backdrop

“I’m the reserve currency now” — Gold and precious metals filling in for the Dollar

Tech/AI leading the indices all by themselves

AI Supremacy via Trump 2.0

Moves in Global Macro

Risk: Is the process is turning into Bust?

Catalyst: Trump 2.0 trying to redeem himself with The Brink and Back trade.

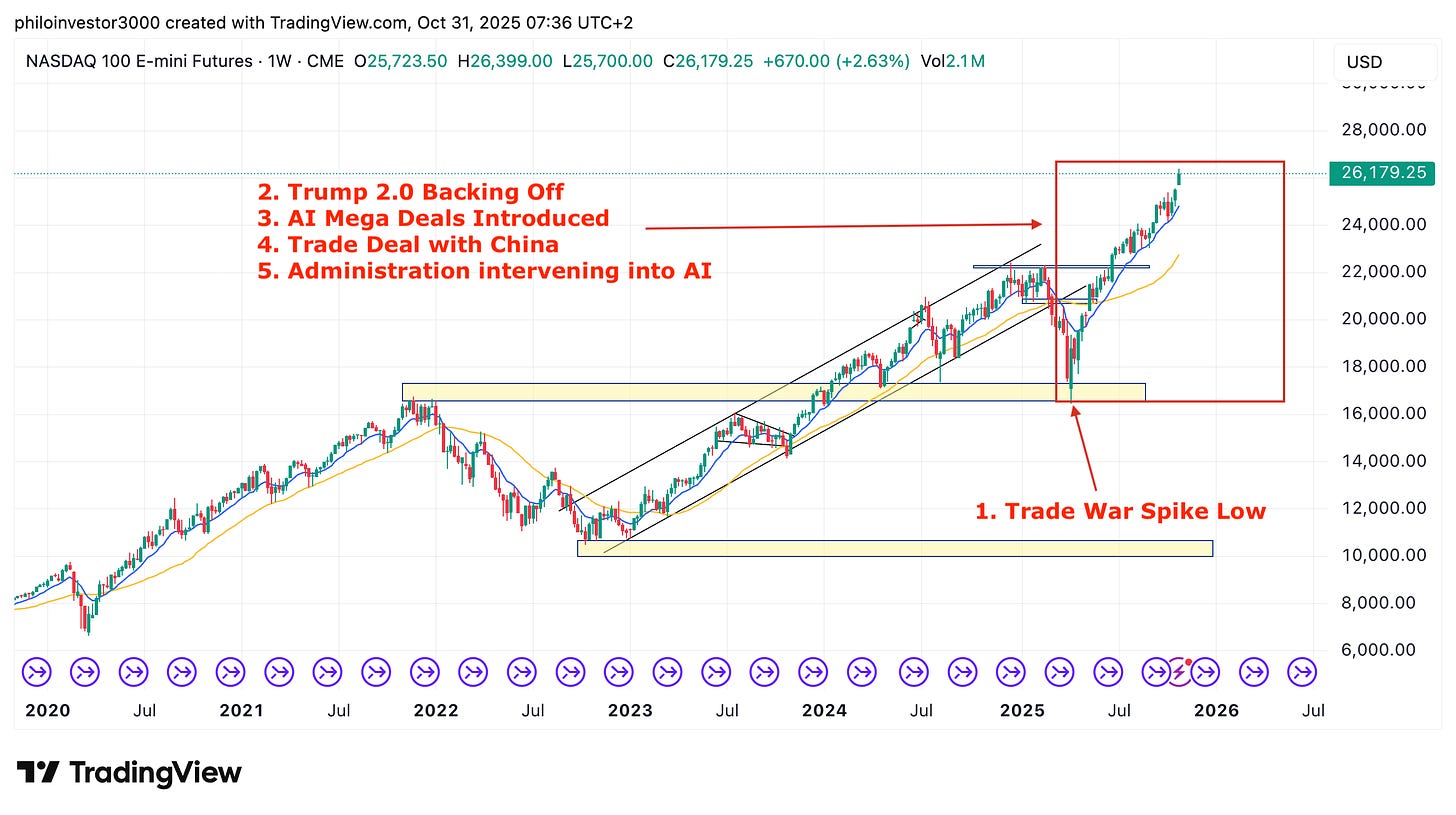

Nasdaq 100

We are 10,000 points higher since the spike low of the US Vs China trade war.

Since then we’ve had Trump retreat from the rhetoric, manage to get the Fed to cut rates, facilitate super deals at the upper echelons of the AI/Tech space and get the state into the AI ring. One of the craziest markets that I can recall.

Russel 2000

Similar forces that pushed up the Nasdaq supported poor Russel. But if you zoom out, there aren’t any major trends here — just a mean reversion trade if you ask me.

So, technically the picture is weak and fundamentally I don’t see much that can push this higher.

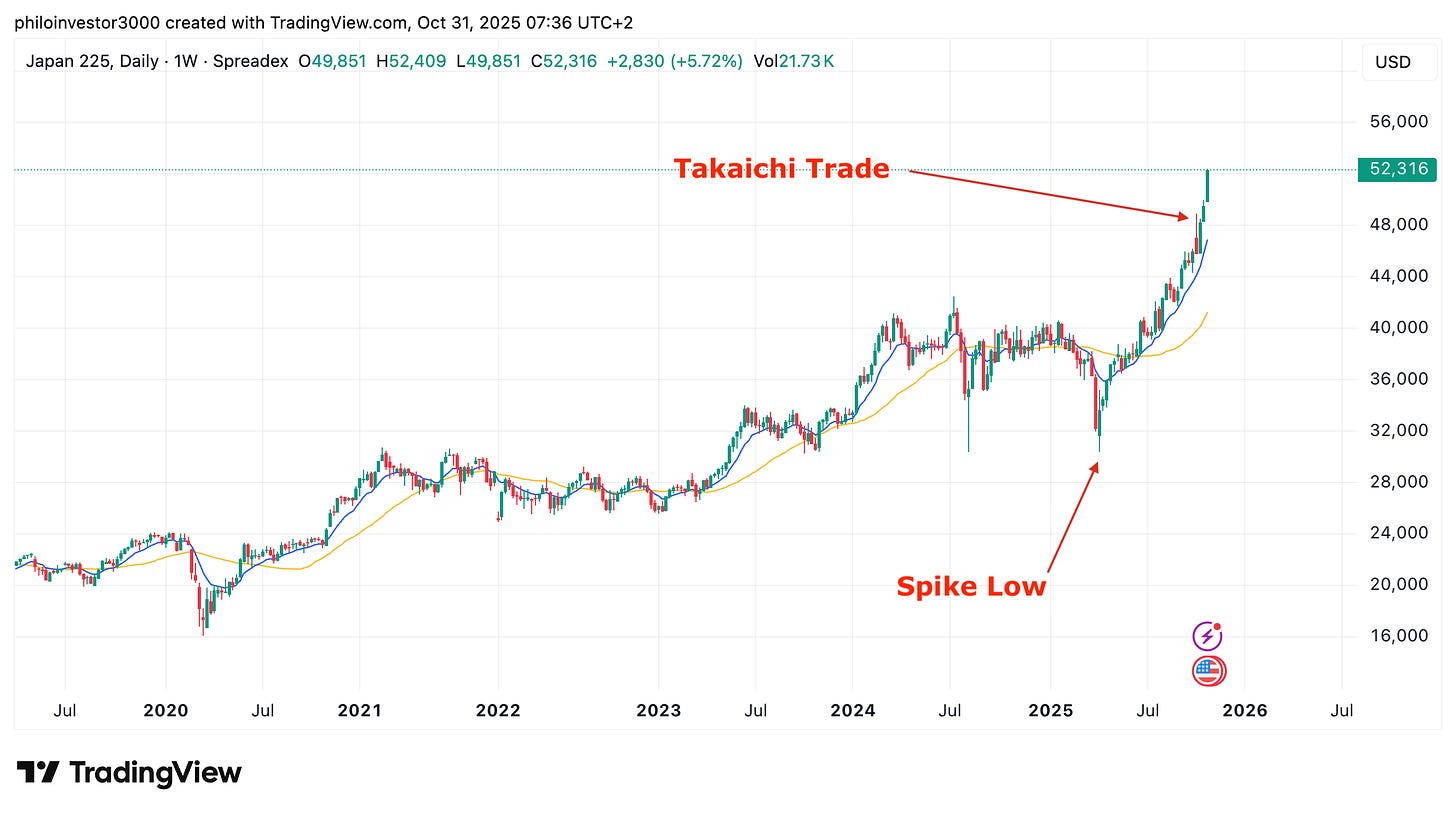

Nikkei 225

Not much technicals to discuss besides the obvious parabolic move post-Takaichi election. More thoughts on the Takaichi/Abenomics trade on this Philochat.

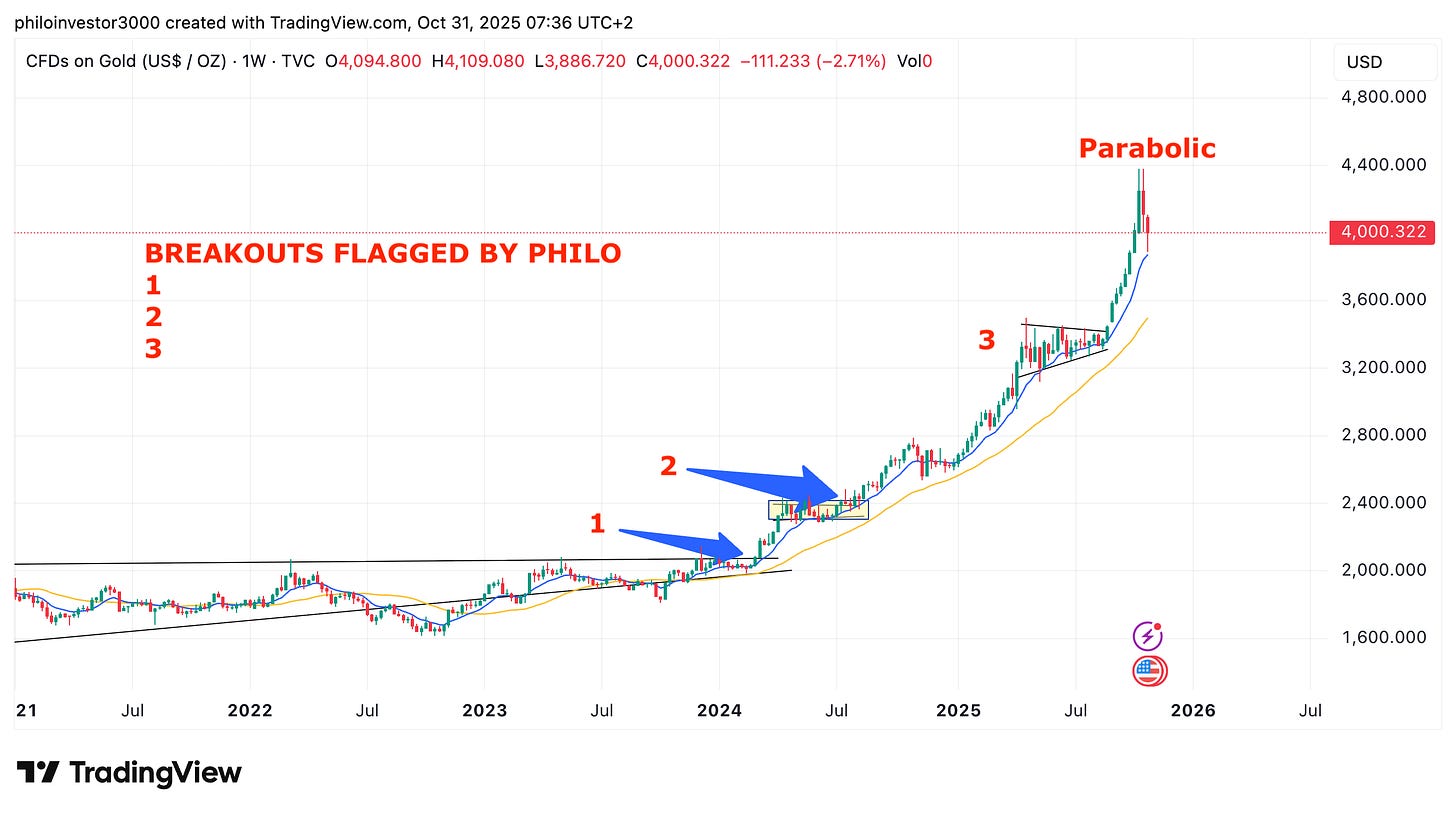

Gold

We lost interest in Gold after the third breakout as the move went parabolic and everyone who wasn’t already on was trying to get on. You don’t really buy these things on parabolic moves unless you’re a great trader.

👇This is how we prepared readers for the trade in Gold from the early days. Refer to this piece for a chronological order of macro pieces and the final technical execution.

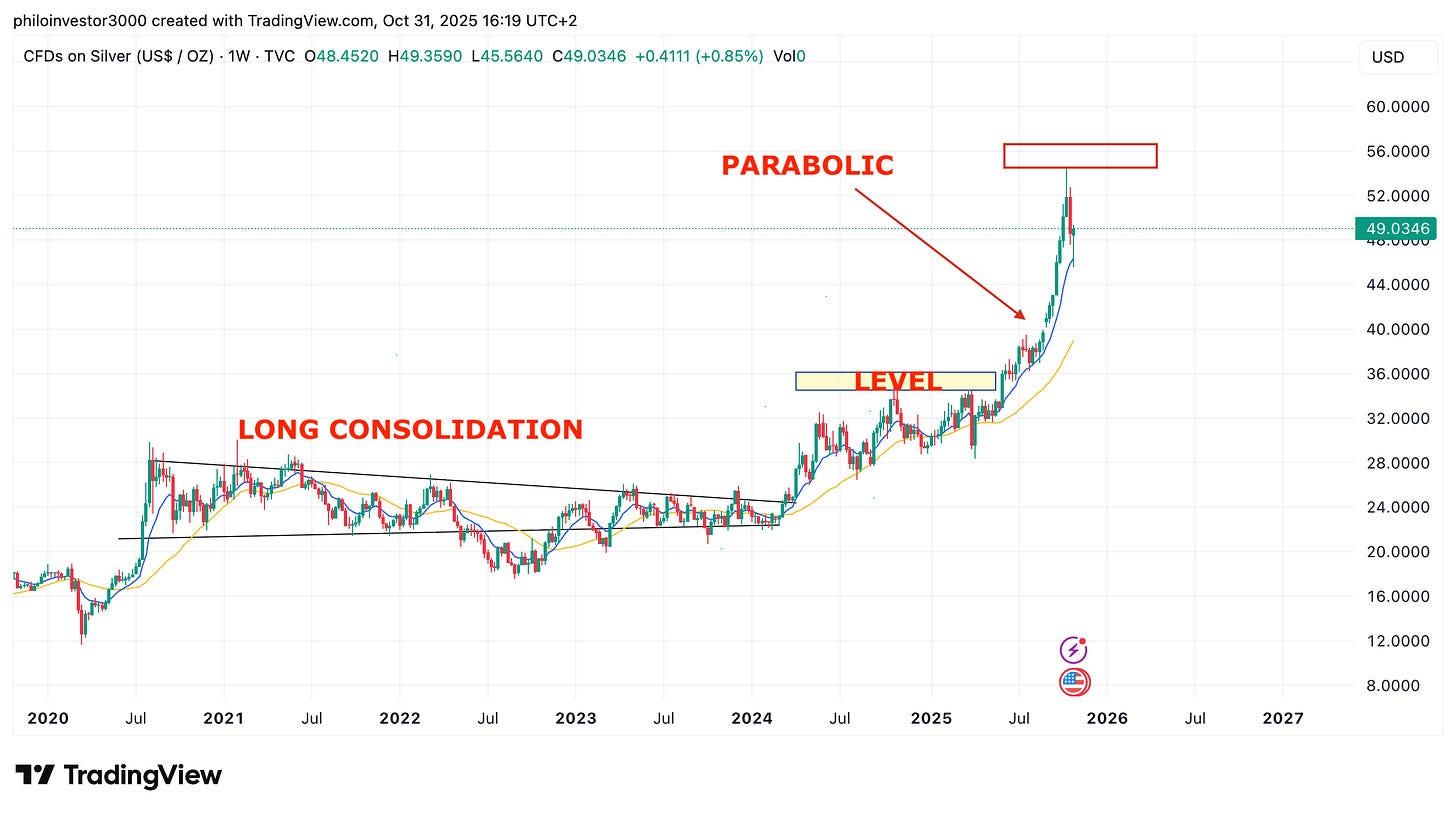

Silver

The signal was the breakout of the long consolidation pattern that we flagged here. After that you could have bought the breakout of the LEVEL (triple resistance) shown below, but after that it got harder to find a good setup.

I give an 80% change that both Gold and Silver will move sideways/down from these levels until the market decides their next move.

New Age Gold (Bitcoin)

Weak, super weak. We flagged the double top as it was forming and prices are still weak since then. Notice how prices are finding support on the Weekly MA50 and forming wicks on the line.

All this market needs right now is one negative catalyst to push it under — that would take it to $90K next. After that, we see.

Ethereum

Ethereum Treasury Companies weren’t enough to help push this higher. Tom Lee can say what he wants about crazy targets on ETH, but this is losing steam.

For the fundamental setup, we published this piece 👇

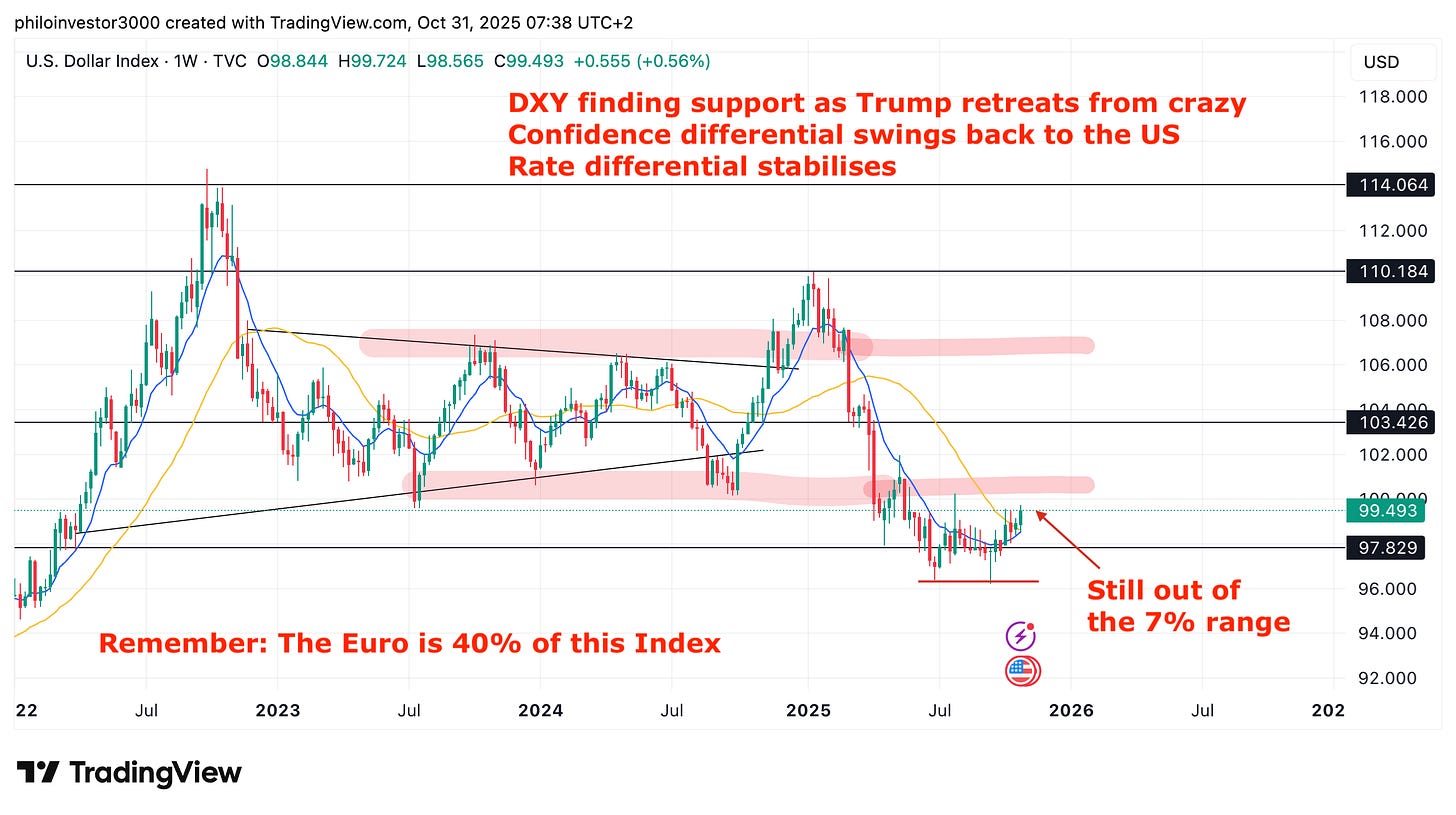

The Dollar Index

The Euro slightly peaking and the Yen fading back down allowed the DXY to find support. Still below the bottom range of our 7% range, but I see this easily moving back in as the Europeans hit a wall going forward.

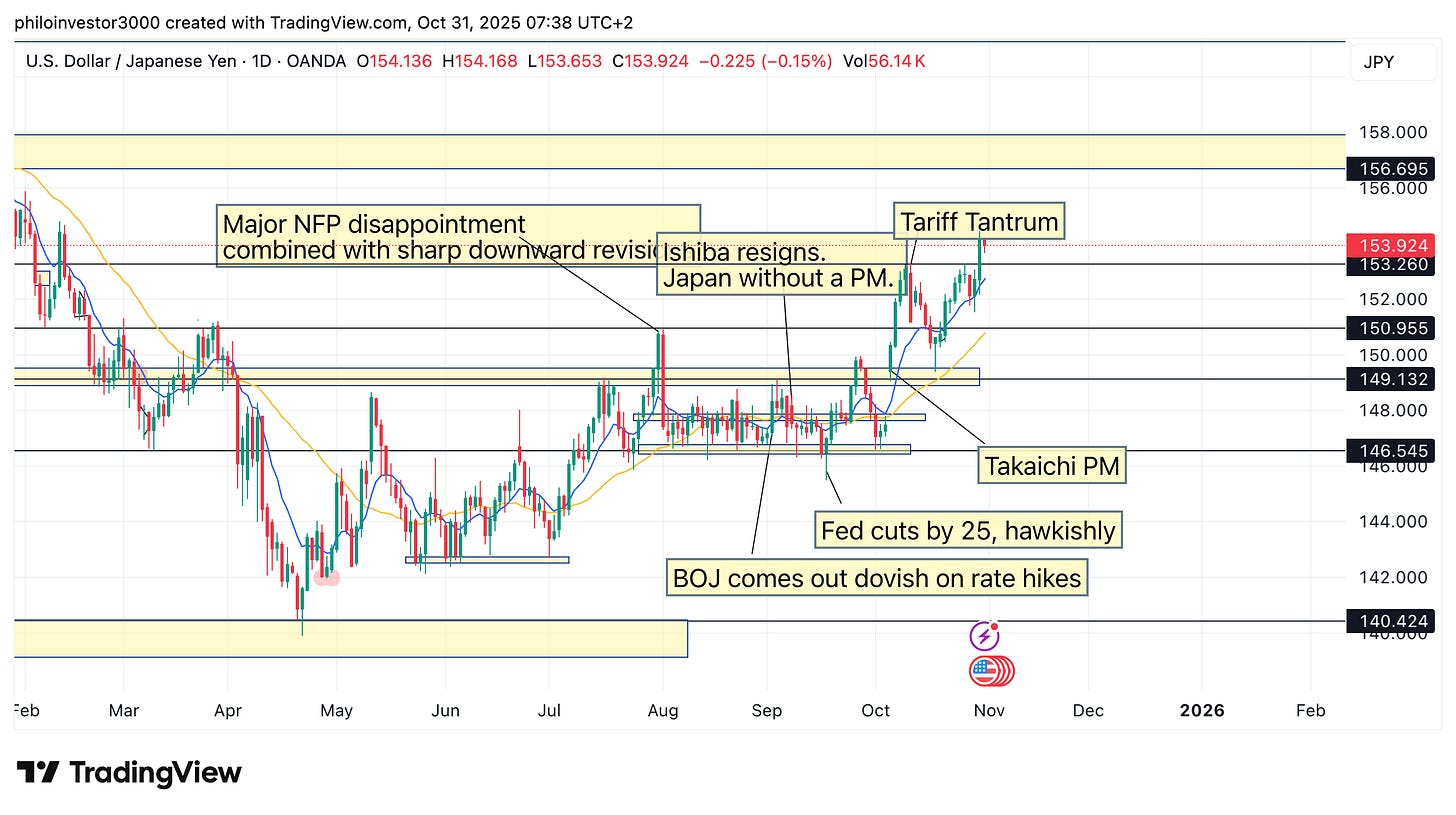

Dollar / Yen

In the last issue I discussed the importance of adapting to the market regime to catch great trades. The Yen was a in a range and I made a few mistakes trying to catch trending trades — but sure enough prices snapped back in the range.

This is what I said in the last issue, mentioning the importance of the Co-Trader 3000 cotraderapp.com in this process 👇

I made one major mistake in trading this in the past few weeks — but the silver lining is that I can now use it to get better:

DOING LESS OF WHAT DOESN’T WORK

DOING MORE OF WHAT DOES WORK

ADAPTING TO THE MARKET REGIME

This piece breaks down our two last trades on the Yen breaking down the plan and thesis for both. If I could do this manually, imagine what I can do with the CT3000.

Trade #2 is still on as we are targeting 157 - 160 on the USD. We follow up on these trades daily in the Philochat.

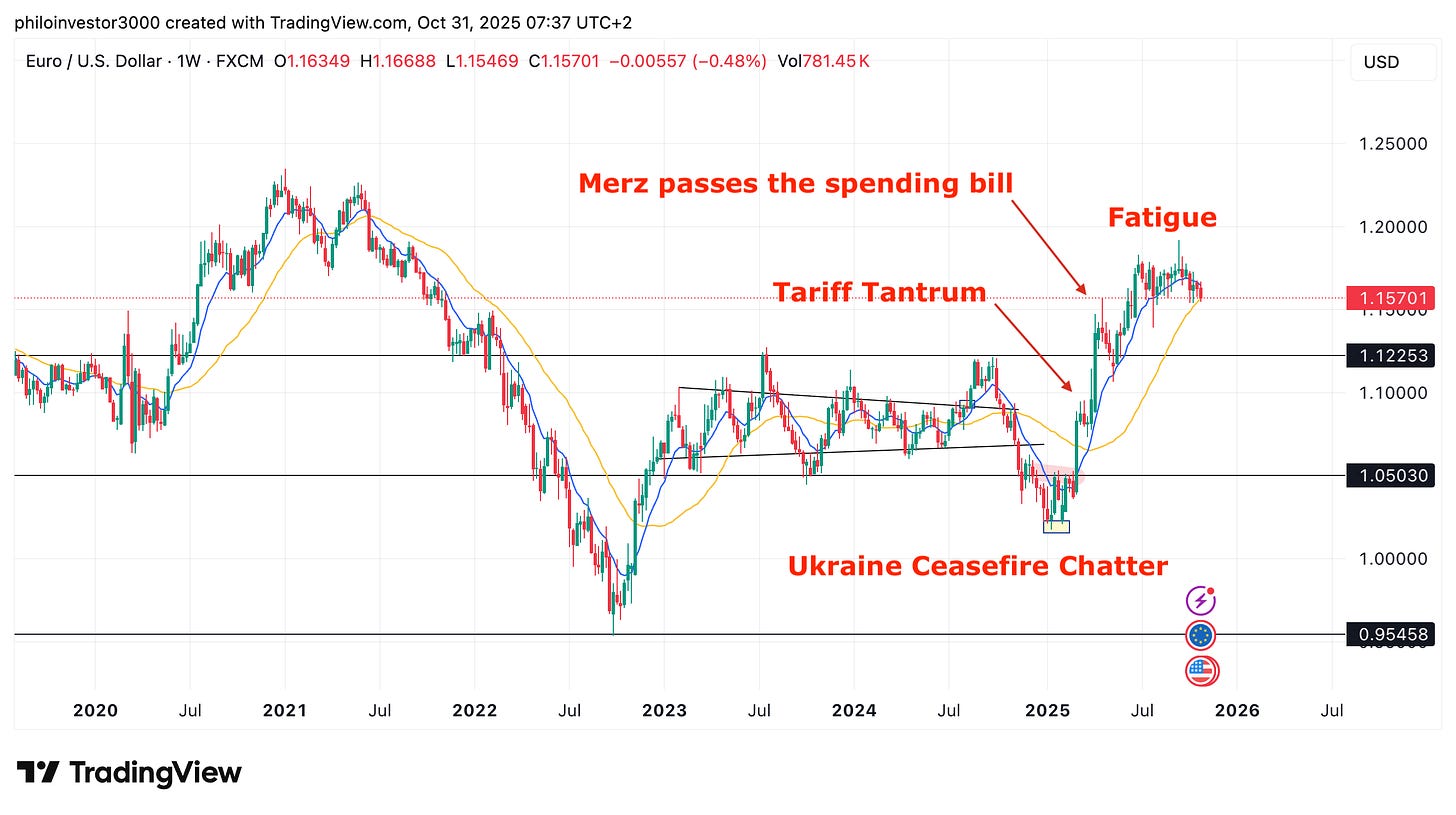

The Euro

Momentum in the Euro fading as European/German plans to MEGA seem to be hitting a wall and Trump 2.0 flips the script. Europe is going to need some serious green shoots to push this higher. Not interested.

Philo 🦉

CT3000 launching January 2026, join the waitlist here.