Crypto Winter, just in time.

This is an existential crisis for the space.

“The volatility comes with the territory.” —Michael Saylor, 2 days ago

With Bitcoin down 30% and ETH down 40% in the same period — FinTwit is blowing up with Crypto-related tweets, and Crypto bois are getting worried..

Meanwhile, Saylor’s MSTR is down a whopping ~60% since mid July…

And in typical Saylor fashion, he went on CNBC talking about how bullish they are on BTC and how much they are buying.

As we’ve said during 2025 — Saylor (i.e. MSTR) is the only buyer left for BTC.

Everyone is following them in the market trying to make a buck off their back — there is no natural buyer of BTC here, especially now that the ETFs are exhausted.

Note: they did this to themselves.

There are indications that long-term holders are selling and retreating from the space — and I have personally spoken to a number of them that have echoed similar sentiments.

Almost a year ago, in December ‘24 we published Dump Your Crypto 2.0 — again calling the top in Crypto after the success of Dump Your Crypto of October ‘21..

💥DUMP YOUR CRYPTO 2.0💥

Bitcoin’s Superman is Michael Saylor. Superman’s greatest weakness was Kryptonite, Saylor’s greatest weakness is Cryptonite.

Notice the cover art on this piece — that’s the Superman of BTC, Michael Saylor, and his greatest weakness is Cryptonite… It’s a long-form piece focusing on the current cycle, the dynamics around it and gets technical with MSTR’s financial engineering.

It ends off by listing the ways in which Saylor could perish (Saylor’s Cryptonite)

11 months later and with MSTR down >50% since then, the market has started to catch up to the setup. (But clearly a year after us!)

Leaving this tweet here for now.

Now let’s analyse notable events since our last piece and consider where the space is going.

We will reason using a holistic view and taking into consideration the Trump 2.0 pump, the Store of Value narrative, the ETF flows dynamic and the Forces of Crypto Treasury Companies.

The Drivers

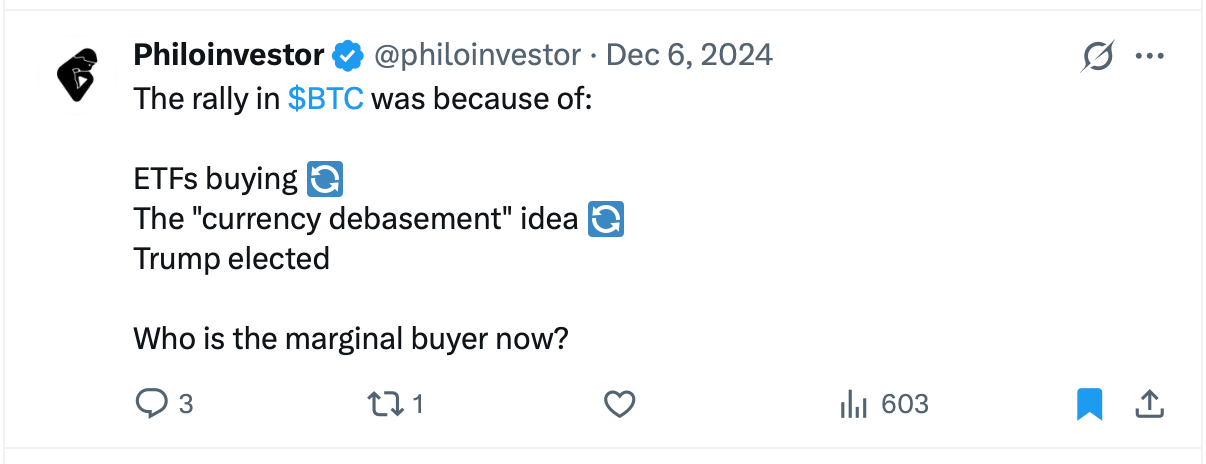

Last year I called out 3 major drivers underpinning the rally in BTC and Crypto.

ETFs getting launched and approved — and then buying Crypto in the open market as buyers bought shares in said ETFs.

The “Store of Value” idea that we covered in DYC (Dump Your Crypto) 2.0.

Trump 2.0 was ultra bullish and promotional on Crypto, his election obviously helped.

I then asked who was the marginal buyer that would take BTC higher?

Everyone had already bought and waiting for the wave to take them higher..

And sure enough, BTC barely moved up from there — even with all the pumping and hyping.

Consider this: even the White House was pumping Crypto! This was a space energised and empowered by early-stage adopters, technologists and believers.

It was community led and based with higher ideals — then cycle by cycle things started to change.

Bitcoin National Reserve & The Big Idea

The Bitcoin National/Strategic Reserve was never enacted into law, and faded just like most of Trump 2.0’s big ideas. Refer to our comments from DYC 2.0 on this.

The things is: simply the idea of this ever happening attracted flows into BTC and sort of vindicated the hypothesis that BTC is going higher. Narrative follows price 🔄

There was a view being shared that the US was going to get out of its monumental sovereign debt load by accumulating BT. It didn’t matter if the idea was anchored into absolutely nothing, the President and thousands others talking about made it a reality in their minds.

Put it in the list of things that pumped the price. And the more the price went up, the more bullish the market became..

But at some point reality catches up to you — and you need to prove yourself: Bitcoin hasn’t managed to do that.

The Microstrategy Force

The whale in the market was Saylor via MSTR — he had a strong rhetoric and a stronger stock valuation.

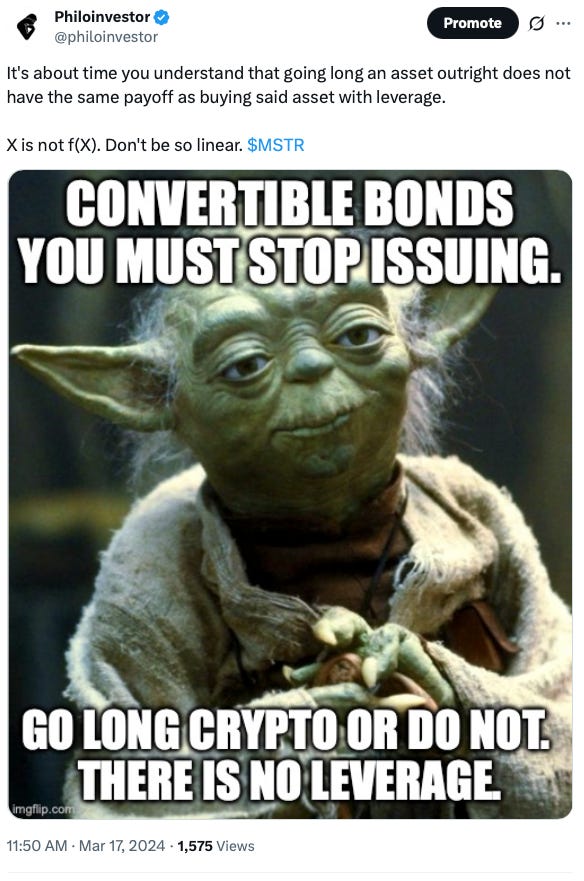

As MSTR stock was moving higher, that enabled it to raise capital. They used convertible debt, preferred equity and any way they could — reinforcing the narrative.

Again, we covered the MSTR layer ad nauseam in DYC 2.0, no reason to repeat myself here.

But it turns out that:

flows into Crypto via ETFs

“institutional” buying

the Trump 2.0 pump

Retail Mania

and even Microstrategy raising fiat capital and throwing it into BTC..

—> Was not enough to break $125K and push BTC higher. Calls for $250K or $400K by the likes of Cathie Woods, Tom Lee or whomever were just stabs in the dark.

It’s easy to set higher targets on something that’s moving up and up. But was there a basis in their predictions? Doubtful…

And now with BTC at $90K, MSTR is in shambles (refer to the chart above).

The Volatility

We explained in DYC 2.0 that Saylor’s “infinite money glitch” was basically the result of an arbitrage handed over to their convertible debt buyers. 1) They had security of capital because they owned a bond but 2) open upside because they owned a bond convertible to shares on certain conditions.

In simpler words, they had upside optionality in case BTC/MSTR went parabolic-er.

But what did MSTR get? Them buying that convertible bond meant MSTR got cheap money to buy BTC. And as long as BTC was moving up in price it was good for them.

But now that MSTR is in the gutter those convertible bonds are way out of the money — and the appetite for new buyers to buy any potential new convertible bond issuances could be inexistent. That means MSTR can’t raise money easily and cheaply to buy more BTC.

Debt Covenants, you say..

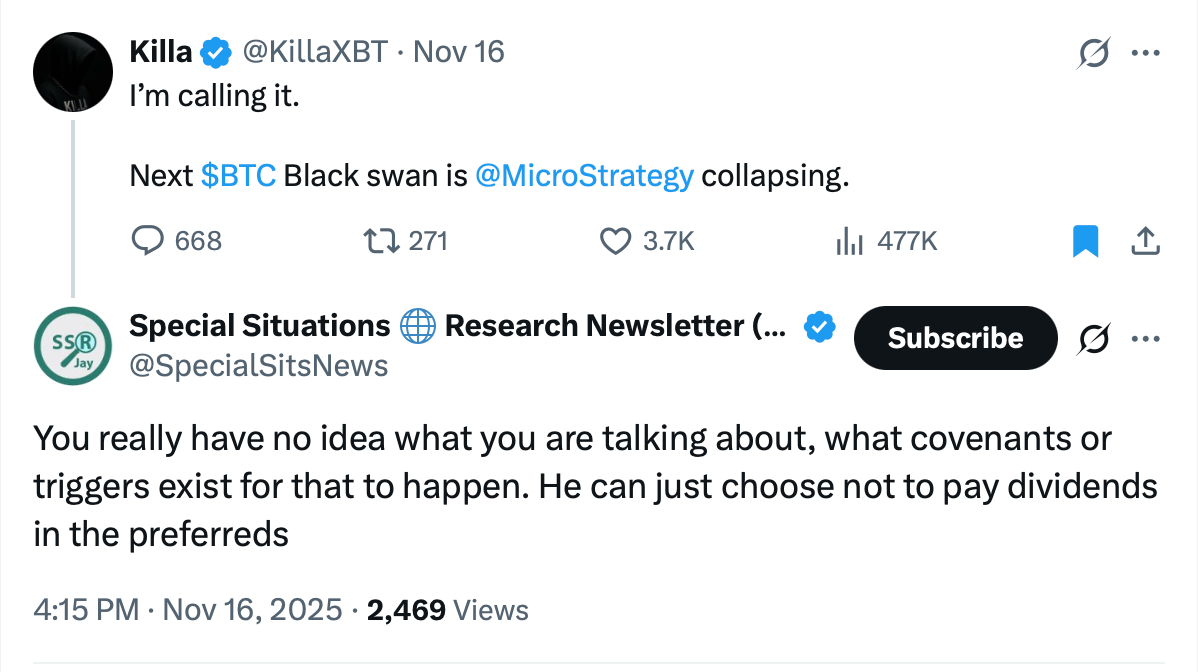

Here we have “Killa” — a Crypto account that has 40K followers calls the collapse of MicroStrategy. So we note the massive reversal in sentiment from Crypto-centric accounts.

Second, we see Special Situations attacking him and explaining that MSTR can’t collapse because of covenants, or triggers or whatevers. The thing is, Special Sits here is a special situations guy — he is very technical and legalese, and he relies on things like debt covenants in his research.

This makes him believe that MSTR *cannot* collapse because the company has a lot of wiggle room to move in case BTC does indeed collapse in price.

The Asymmetry

Debt covenants are not everything. The devil is in the details.

MSTR’s BTC stash has been known to act as an anchor to the BTC price. Basically, the MSTR “overhang” on the BTC price would result in the price dropping without stop simply because of the idea that MSTR could soon either sell or become a forced seller — forcibly liquidating their position.

The idea of this “overhang” would mean practically no one would want to hold it. Saylor and many (like Special Situations above) may say that MSTR “can just choose” to do this or not do that — but the reality is somewhat different.

You’ll need to focus here…

The reality is that MSTR built a BTC stash and got a crazy valuation on the back of the arbitrage and asymmetry we explained above. But do you think that the convertible debt buyers are willing to see their principal perish to zero simply on Saylor’s whims and huge weak ego?

MSTR may say that they have strong covenants and massive staying power, and that they can see BTC go to $50K or $40K — but in practice they don’t. The investors in MSTR (and MSTR instruments) would tear them to pieces — at a time when BTC is being torn to pieces. Lawsuits, fraud accusations, mismanagement you name it.

At that point, the idea that MSTR destroyed Bitcoin would take hold and people will start to say it and believe it.

People will start to ask: Why hold this?

They will start to jump ship from BTC, and alternatives will emerge and gain momentum.

Conclusion

This is not the end for Crypto as an idea or technology stack (Blockchain etc.).

But this may very well be the end of a paradigm in Crypto — as this configuration and power hierarchy becomes purged and burned to the ground, allowing for a reset.

The fundamentals in the space have been eroding for years now, cycle by cycle. First adopters and innovators entered the space energised and ready for self sacrifice — the profit motive was not very high up the list.

Then as the space matured — opportunists and fraudsters amassed more power and found ways to exert control over the space. Real adoption went to near zero while the space became predominantly a ground for financial engineering and empty profiteering.

Besides the rise of Treasury Companies like MSTR and BMNR — the events of this October sealed the fate for the space. The increasing use of perpetual futures caused an increase in leverage in the space — making it easy if a higher power wanted to liquidate everyone.

I don’t know with certainty what happened but this tweet provides a good summary for those interested. The point is many holders got liquidated suddenly after a Trump announcement that things with China aren’t going well on the trading front caused a small first drop.

Then liquidity from the market vanished and valuations dropped suddenly, in some cases even by 60% or 80% overnight. Even very moderate leverage would have wiped anyone out with those numbers.

The space is filled with false prophets and fake gurus — and people with a real moral compass are getting tired and fed up.

X user Marc De Mesel does real fundamental work on Privacy Coins and has grown to a large following on the platform. If you have a real interest in the space you should follow his work.

As the dominance of BTC perishes, others will definitely rise and gain ground. There could be fresh opportunities setting up in the space.

Philo 🦉