How Gold became the best performing asset

Macro Setup + Technical Execution = Caught the move on Gold

This is how Philoinvestor prepared for the move in Gold — from macro setup to technical breakouts.

First 10 get a discount here.

This is a short story on trading Gold successfully amidst this ~two-year bull market.

….all while not fostering any delusions about the (bad) history of the yellow metal as a long-term compounder.

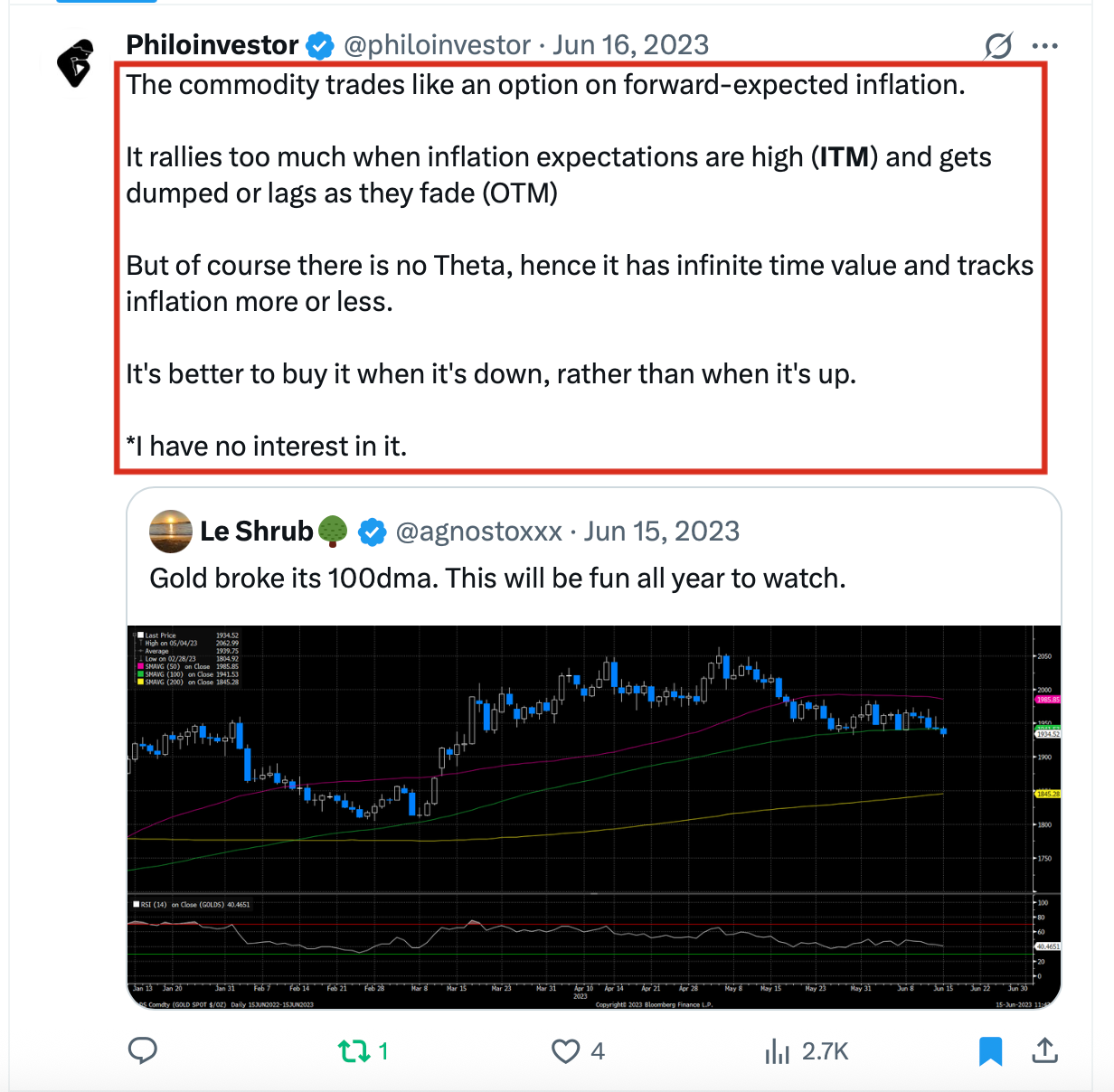

Exhibit A

In this quote tweet I said that I had no interest in Gold.

This was during a 4-year period where prices went sideways — until finally breaking $2,000 in March ‘24.

I explained that Gold trades like an option on forward-expected inflation…

Refer to the screenshot above if you want to get more technical on this — but the point is, inflation was coming down and Gold was moving sideways for a long time.

Meaning: It wasn’t the best setup to go all in on Gold.

Note that prices were at the same level they were in the summer of 2011 — that means they had gone nowhere for ~12 years.

Great job guys… Bonus and a Porsche for everyone! 😂

Exhibit B

Less than a month later I re-tweeted Le Shrub again!

My view then was that markets hadn’t caught up with the massive levels of currency debasement required to balance the Western fiscal side equation.

“All Western sovereigns are bankrupt.” —Philo

And so inflation would remain sticky — keeping real rates low, and eventually pushing Gold up.

The 30-Year Treasury Yield did move up ~1.3% from those levels, but that wasn’t the catalyst unleashing the price rally in Gold.

Exhibit C

One of Philoinvestor’s most-read pieces is Peak American Empire, published in early 2023. It opens with J.P. Morgan’s line:

“Gold is money; everything else is credit.”

This is mandatory reading for anyone interested in markets, economics and politics/geopolitics.

Holding this as a mental guide for what was to come — we then had the rise of Trump 2.0 and his ultimate election into office for a second time.

Exhibit D

You can chronologically see all Trump-related pieces in the post below.

I prepared Philoinvestors on the setup from multiple angles: financial, economical, political etc.

Both before the election and after, it as Trump and Bessent faltered and walked back on their commitments.

Exhibit E

In April of ‘25 we published a piece explaining that the US was moving from the Dollar Standard to the NO STANDARD as trust in the US was eroding, fast.

“But now even the Dollar Standard is breaking down as trust is eroding and the US is walking into insolvency territory. Their deficit is out of control and no one seems to care, in fact it’s accelerating.

This crisis of confidence is pushing us out of the Dollar Standard and towards the NO STANDARD territory — benefitting Gold in the process.”

Exhibit F

In FOMO MARKET we show the breakouts in Gold that we flagged in Breakout by Philo.

Conclusion

Remaining flexible over different scenaria, having a solid understanding of macro and how the world works so as to formulate hypotheses and test them, as the future unfolds — all while following markets from a technical-first unbiased perspective got us this result.

If you feel this is for you, you already know what to do.

P.S. Don’t forget that we keep in touch every day in the Philochat. This is an old thread talking about Gold’s breakout then.