Access the last Breakout issue (FOMO MARKETS) here.

The theory of reflexivity was developed by George Soros and it is a framework for understanding far-from-equilibrium conditions in financial markets. Far-from-equilibrium conditions arise when positive feedback loops exist between prices and the fundamentals (that they are supposed to passively reflect).

We first published on the reflexive bubble in Tech/AI mega caps here.

Issue #16

What stage? This stage:

Why Breakout by Philo?

Breakout by Philo gives readers an unbiased and unemotional look into markets from a technical-first perspective. After the technical part is complete — we then layer on context.

I have found this approach 1) incredibly fruitful 2) and the source of a persistent and consistent edge in markets, partially because it’s very hard to do.

I have been doing this for ~20 years in one form or another. Consider this the highly developed version of blending technical analysis and macro into understanding markets and generating actionable intelligence.

THE BACKDROP

These are some of the themes unfolding concurrently in markets — and we will tackle them all in this issue:

“I’m the reserve currency now” — Gold and precious metals filling in for the gap left by the almighty buck.

Derivatives to the Gold trade.

Tech/AI leading the indices all by themselves

But the process is turning into Bust

How this affects FX and why everyone will get this part wrong (just trust me).

Nasdaq 100

The Nasdaq broke through previous highs and continued moving up, we are now at ?>24,000 points.

Narrative violations are accumulating on the Mag 7, but the baton has been passed to companies like Broadcom (>5% weight) which is up 120% since last year. Nvidia in China article here.

Now, the problem isn’t that it’s up 120% — it’s that it’s selling for 100x earnings…

The indices are held up by the Tech/AI narrative, and the whole thing is interconnected. When one shoe drops, they will all drop together.

Besides our bigger picture pieces, we track shorter-term narrative changes in the Philochat.

Russel 2000

Free from major AI and Big Tech influences, the Russell 2000 has gone nowhere for >4 years — while its older brothers have been going from strength to strength.

Maybe the R2K reflects the real economy more aptly? Probably.

GOLD

Blue arrows indicate where we previously flagged breakouts right here on Breakout by Philo.

“Prices are now hovering below the last top and setting up for another upside breakout — yes, really!”

—> The quote above is from the last Breakout — we now see Gold decisively broke that pattern and blasted higher.

GOLD to USD: “I’m the new reserve currency now!”

The backdrop for this move was Trump’s attack on Fed independence and the prospect for another rate cut cycle in the US.

Capital just doesn’t know where to flee, and safe havens just aren’t what they used to be.

Not to mention the ever-so-slow realisation by the market that Western sovereigns are bankrupt. Really, how many times do I have to say this? 🦉🥹

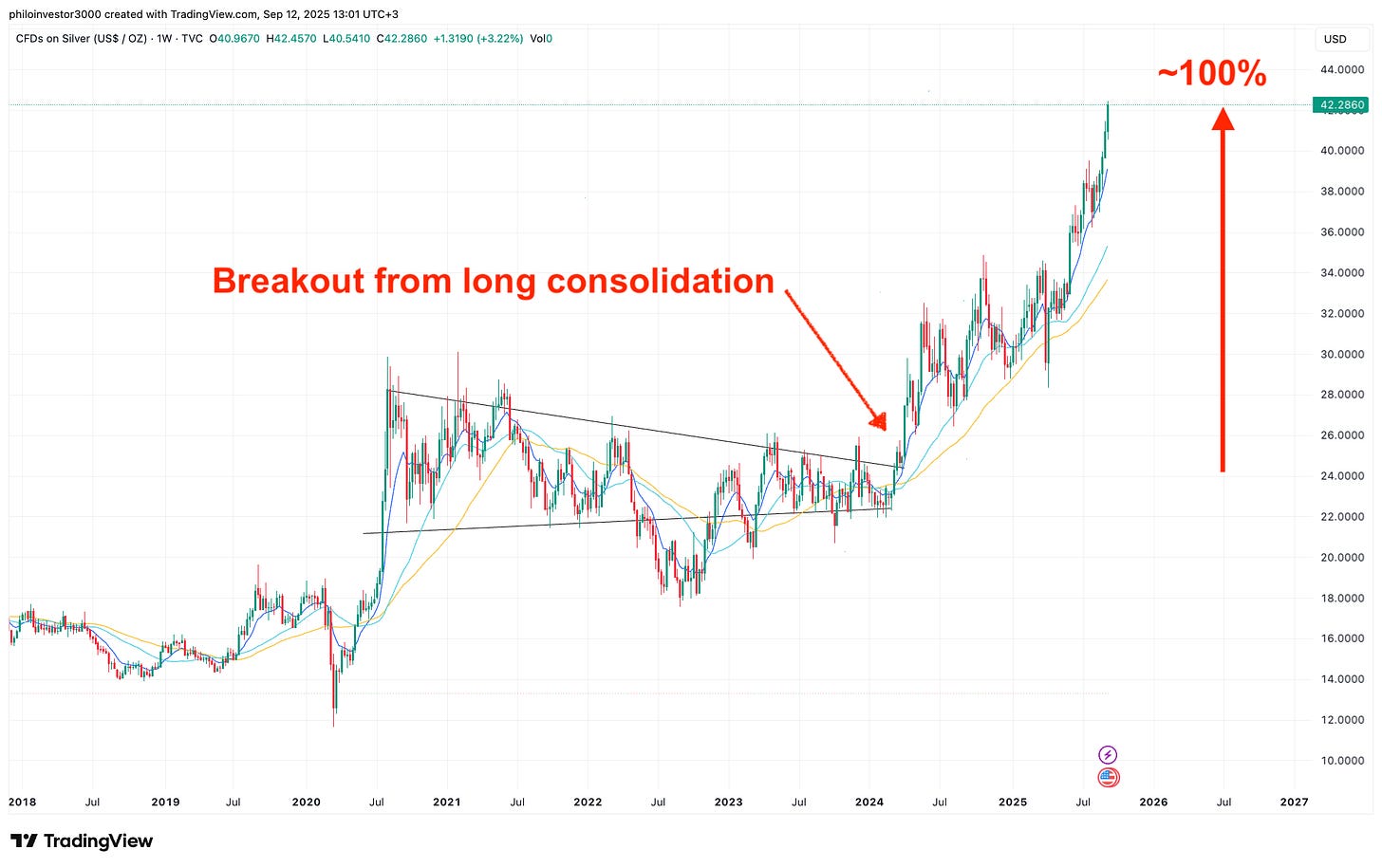

SILVER

(A gold trade derivative)

Up almost 100% since it broke out from the pattern shown below. Gold and Silver can both go way higher as demand spikes and supply becomes harder — both at the same time.

Note that Silver is more illiquid and hence more prone to violent spikes.

This doesn’t mean I would go out now and buy any of the two — long-time readers know I prefer to allocate on technical signals.

—> The point is, you could discuss any thesis on how currency is being debased, how Western sovereigns are bankrupt, how deficits are uncontrollable, how wars are only increasing etc. but if the market wants to go down — it’s going to go down.

Don’t become Jim Rogers 😂 Be better than the Gap.

New Age Gold (Bitcoin)

(A gold trade derivative)

The tariff tantrum caused it to crash to $70K and then it just bounced together with markets. Not as uncorrelated as we think, right?!

We flagged a double top in BTC from the first days of its formation. It then broke down and is now staging a minor recovery.

Again, this is a tricky market as the treasury companies seem to have access to stupid money and they can BTFD whenever they like.

Remember: This holds for as long as the rubber band is in one piece. When it breaks, expect a flush.

I discussed my thoughts on the broader Crypto cycle here.

Ethereum

I think the chart says it all!

ETH was dying with even Vitalik and his gang nowhere to be found, the Ethereum blockchain was just not adopted as fast as people expected…

I called it an “existential crisis” for ETH — and now a few months later we have Tom Lee trying to pump this 10X harder than a drunken Saylor pumping Bitcoin.

Oracle x Open AI

Oracle announced a spike in their Cloud revenue backlog in this week’s ok-ish earnings release. The stock spiked ~40% adding a quarter of a trillion dollars in market cap..

But as we can see the market quickly faded the move and seems to be not buying it.

I made a short video explaining how that move by ORCL connects to the broader Tech/AI cycle here.

The Macro Stuff

The Dollar Index

The Dollar is in its Trump 2.0 era.. and having a hard time.

The DXY could not move back into our 7% range (the red lines) and is hovering below.

The problem is not only economic uncertainty as we see economic data weakening day by day — but political uncertainty as the market doesn’t know what Trump will do next.

And yes, the political and the economic reinforce each other! 🔄

Dollar / Yen

I made one major mistake in trading this in the past few weeks — but the silver lining is that I can now use it to get better:

DOING LESS OF WHAT DOESN’T WORK

DOING MORE OF WHAT DOES WORK

ADAPTING TO THE MARKET REGIME

The first two were from a previous Breakout, I added the third one now. Why?

Because I ignored how this pair has been moving the past few weeks, and instead just sat there waiting for a breakout from the range.

Yes, that can still work but working *with* the market is also a skill in trading.

This pair has been in a range for two months: selling rallies and buying dips would have made me a killing!

So having realised this, I added to the CT3000 road map a “market regime” tool which tells the user what kind of setups are most likely to work, considering that market regime.

Trending, mean-reversion/range, parabolic moves and flux, you name it.

Sign up to the waitlist at cotraderapp.com to try it for free when it launches.

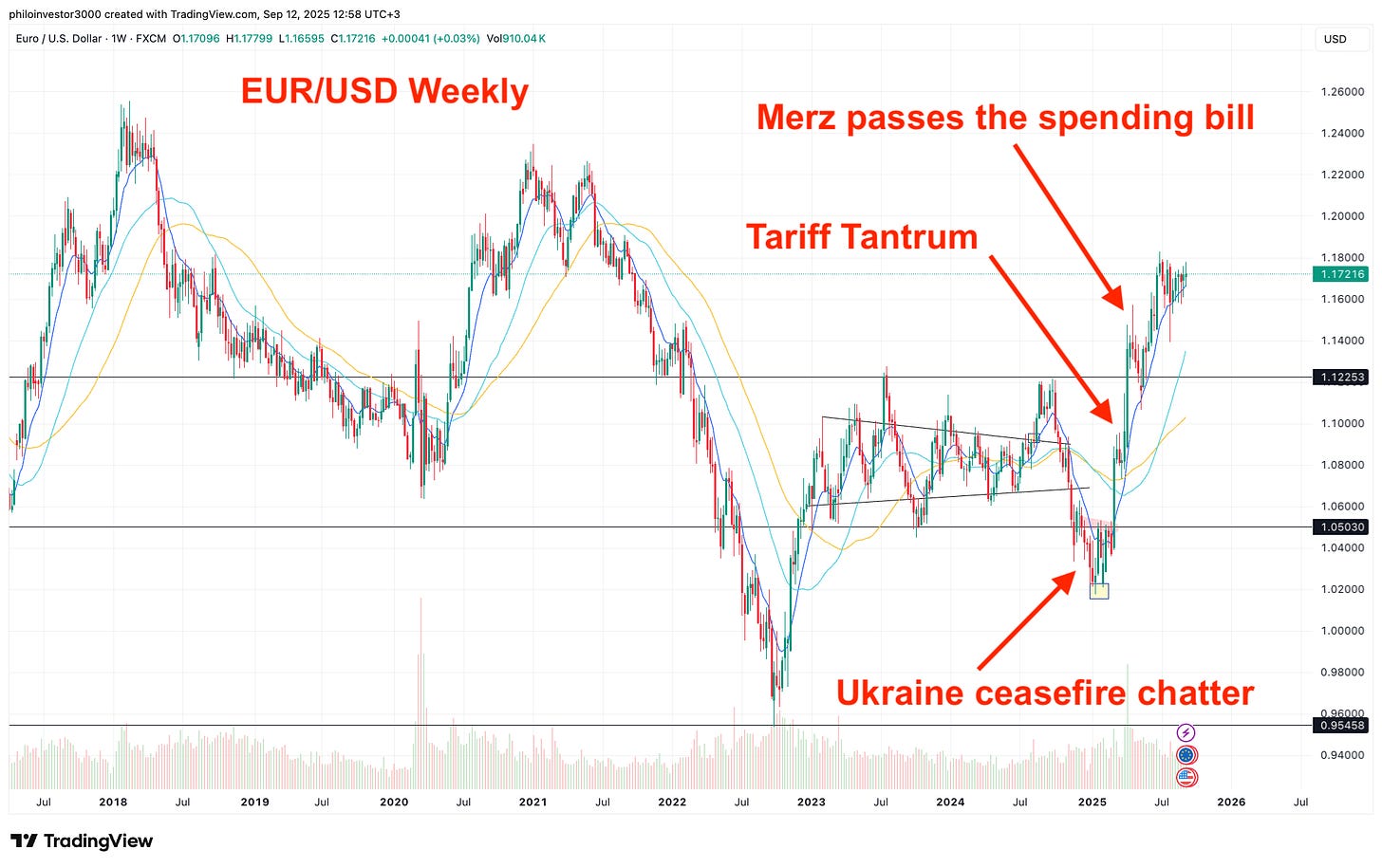

Euro/USD

We bought this as Trump in the WH started the ceasefire chatter and the not-so-common currency started to move up from 1.04 and 1.05.

The thing is, the market didn’t reverse when talks failed — probably because it was held up a new Europe with Merz’s Germany on the wheel and a pivot towards self-defence etc.

Not so sure about that but if you ask me, the Euro is mostly up because European capital is leaving the US because of Donald.

US 10-Year Yield

Dollar Maximalists rejoiced once again in popular finance forums on how the US bond is being bought and that those who called for a 10-Year >5% were wrong.. Ok mate..

US sovereign bonds are being bought post weak jobs reports and signs that the economy is cracking. Went into depth on this here.

But at the same time markets need to price in forward inflation and solvency.

So capital isn’t flowing to this because of its fundamentals — it’s flowing into this because it feels it has nowhere else to go, and as that dynamic is blowing off steam (pressure cooker style) — Gold is moving up.

Not very sustainable for the falling American empire to be funding its ever increasing financial demands with such fragility, right?!? 🤦🏻♂️

In any case, even with the 10-Year where it is — the US is still bankrupt. We warned on this as Bessent talked a big game pre and post-Trump election.

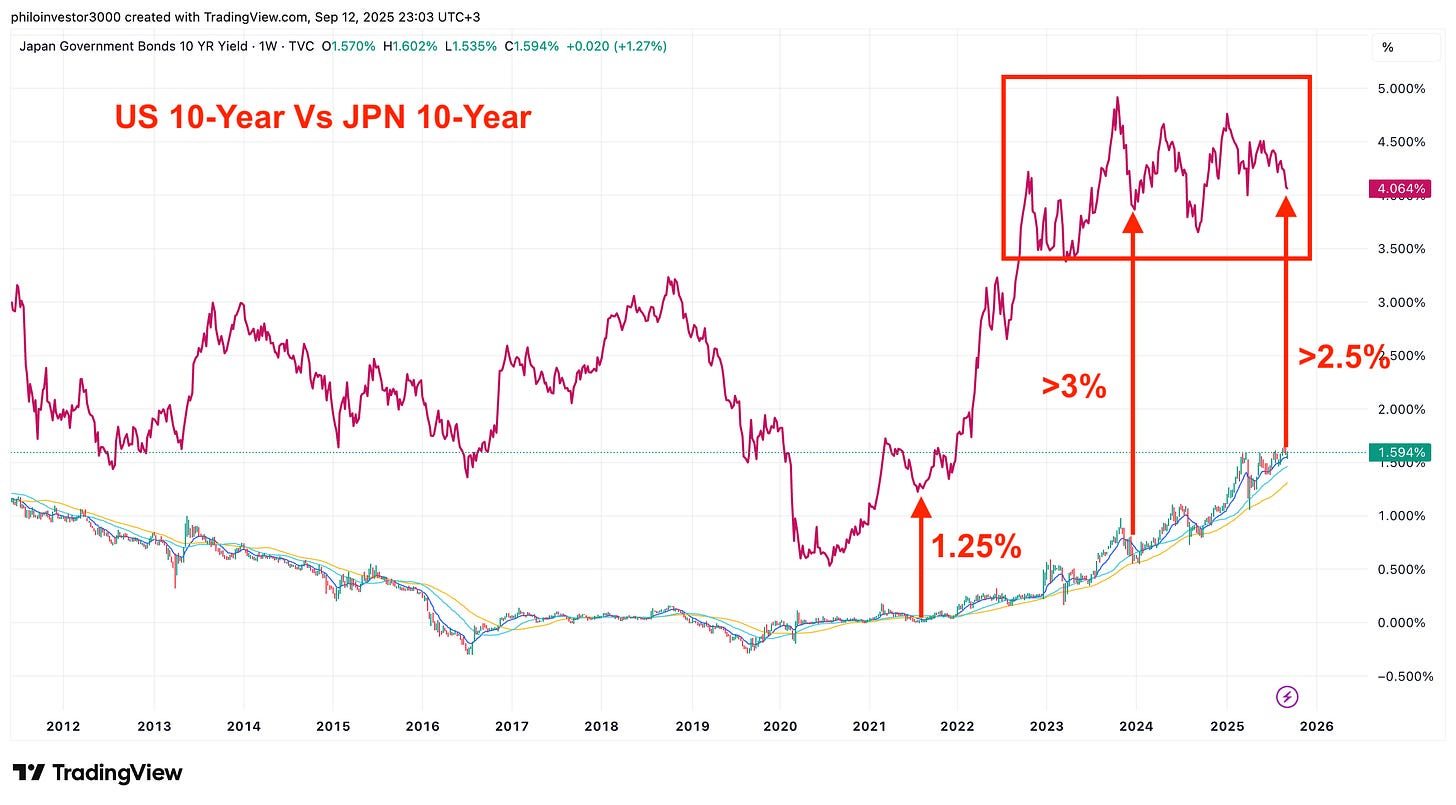

US Vs Japan

The Japanese 10-year yield is moving up as Japan unwinds zero-ish interest rates, but the US 10-year is also moving up.

End of the day, everything is relative. Long USD/JPY carries a super positive carry — especially if you can trade it well and make money on the appreciation too!

What’s a Japanese bank to do after decades of financial repression from the BOJ?

This will remain super volatile and tricky — I have been obsessed with this pair for a very long time, and I discuss my thoughts like a maniac in the Philochat almost on a daily basis (for subscribers!).

Conclusive Thoughts

The point is, markets are moving much faster than reality — even if the latter is moving faster than it was. The world is changing too fast for markets to catch up, so they adopt and un-adopt narratives as they go along.

If you do not have some form of technical analysis in your arsenal you run the risk of falling into major traps.

And where markets are now (far-from-equilibrium territory) trying to invest conventionally will probably get you hurt.

Enough said, be careful out there.

Philo 🦉

P.S. Learn Investing. Better.

—> Click here.