Education & Mindset

Ready to walk the path of the Master-Investor?

ZERO TO HERO: Investing for Beginners and Professionals Rediscovering their Edge.

Visit philomastery.com to find out more.

Philo’s Academy hosted on Whop, link here.

The idea for Philoinvestor started from the investment philosophy and mindset pieces that I started writing in early 2020 during the Covid lockdowns.

The lack of quality investment education was what pushed me to first start writing and subsequently launch Philoinvestor in late 2021.

The buzz words and buzz terminology, the oversimplification, the false generalisations. The dogmatic views and all the things that become risky and dangerous if they are understood only superficially. I couldn’t stand them - and every time a person mentioned them I felt an increasing need to try and educate them.

It then became clear it would be more efficient (for them and me) to start writing about these things, rather than educating people on a 1 to 1 basis every time.

In this space you will find an archive of all these mindset pieces to read and study.

I write these pieces with the intention of making them timeless — and so the content you read here will always be relevant.

Philo 🦉

The first piece I wrote for (what was to be) Philoinvestor was a piece on the Efficient Market Hypothesis (EMH) and how institutional investors hijacked it and made it even less true than it was before their involvement. The idea for passive investing gained prominence on the back of the EMH.

Deconstructing Efficient Markets and constructing optimal investment portfolios

The Efficient Market Hypothesis is an academic theory which postulates that all publicly available information is priced in the markets, and that no one can over-perform the markets or beat the indices. According to this hypothesis, stocks always trade at their “fair value” and that it’s impossible to buy cheap and sell dear. We disagree.

Then I wrote a piece on real estate investing because people always came to me with the cliché, “Isn’t property always the best place to invest in?” - I had to tackle that question too.

Why gentlemen prefer real estate.

Anecdotally, one could easily argue that the average wealthy individual has created a disproportionate amount of his wealth via property investments. There are of course, stories of average investors that made millions on single-stock investments, but they are few and far between.

In an autobiography, one writes his own biography. Here I will interview myself as an investor in order to express my views and share my mindset. I will start with general questions and move to more particular ones as the interview progresses.

Philoinvestor: an autointerview

In an autobiography, one writes his own biography. Here I will interview myself as an investor in order to express my views and share my mindset. I will start with general questions and move to more particular ones as the interview progresses.

People have a very flawed view of the stock market as it relates to risk. They think the “stock market” is one unified thing, but that notion breeds a lot of confusion.

What's your risk?

🗣🗣🗣 Investors speak of the “stock market” as if all securities trading on it are one and the same. What is more, their opinions of the “stock market” change together with its recent history, falling prey to the recency effect. “Invest in the stock market, you could make a lot of money.”

The dimension of time has many meanings as it relates to investing in general. In this piece I aimed to explain how financial markets change gear and value assets differently. This is a reality you cannot hide from, and so better to use it to your advantage rather than get ruined from it.

The dimension of time in financial markets

In this letter we will try to distinguish the dimension of time from financial markets, and discuss its power and influence in the financial arena. In economics and finance the concept of time is captured in “time discounting” or “time preference”, which is defined as the current relative valuation placed on receiving a reward sooner rather than later.

This is a concept very few understand. The piece explains why a great business keeps its value and actually continues creating value while non-real assets destroy it.

Why are stocks not dropping?

In this essay I will compare the 10-year treasury with a very strong cash-flow generative company. I’ll go for the most profitable company in the history of capitalism, Apple Inc.

There exists an idea strong in the minds of investors that equities are inherently risky, while bonds or real estate are inherently safe. This false notion has been written on the tombstone of many a failed investor. Don’t be that guy.

Investing with a conservative mindset

A great number of investors self-proclaim to have a conservative investment mindset. When you ask them what they mean by that – they say it means that they only make safe investments. Some examples of assets that a conservative investor generally considers to be safe could be: 1) Prime real estate in international cities like London or Paris 2) Real esta…

Drawing parallels with difficult to understand concepts is always helpful to simplify things and make them easier to grasp.

One such parallel that I would like to draw is the similarities of stock market investing to an endless game of poker.

Investing = Endless Poker

Drawing parallels with difficult to understand concepts is always helpful to simplify things and make them easier to grasp. One such parallel that I would like to draw is the similarities of stock market investing to an endless game of poker. What do I mean endless? Cards keep on dropping on the table. As long as a company …

My personal experiences made me write about the differences between money with skill and money without skill. The latter has proven to be extremely dangerous, financially.

Money Vs Skill

It’s 2021 and you have $10 million in cash. You sold your business, you sold real estate, you inherited the money – it doesn’t matter. You only have $10 million in cash. You think you’re rich, but you’re probably not. You did not devote your life to investing and financial markets, so you are having a hard time deciding what to do with the money. Besides…

I saw that investors were overly focused on prices and where they would go in the short-term, and not focus in the actual securities that they were investing in. Market agnosticism is the way to make a good “bet” - but without having a view as to where prices are going in the immediate.

The Power of Market Agnosticism

Investors tend to preoccupy themselves with the general level of the stock market much more than reason would expect. If their preoccupation was simply on an intangible level that had no bearing on their actual decision making, then that would be acceptable. However, most make their decisions solely based on these market-centric factors.

It’s important to believe and understand that capitalism is democratic. By and large, no one can force you to take a deal that is not to your benefit. The tools are at your disposal to research, analyse and make the correct moves to benefit financially. There are no excuses.

The Democracy of Capitalism

I won’t say life and business are a level-playing field, they are anything but. However, you always have a choice. For those that have access to the financial markets and have a starting amount of capital, the world is your oyster. Many will tell you that you can’t beat the markets – so why bother? They will tell you that individual stock picking is like …

This is a note to all passive evangelists from me. I wrote this in November 2021, two months before the peak of the last stock market cycle. The S&P 500 is down >20% since then, and passive investors are not happy.

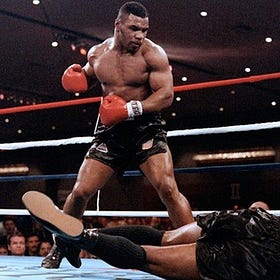

You can't beat me 👊

Individual stock picking is considered to be too risky for the "passive investing" crowd. Let's call them that. This passive investing crowd seeks to mitigate that risk by buying the index (e.g. S&P 500) and holding for the longer term. They also expect to make a handsome profit by doing so.

I wrote this in October 2021, trying to explain how present-day decisions create the future for economic actors. Wrong choices create bad outcomes. You need at least some understanding of macroeconomics (and politics) to gauge future results.

Austrian economics and the good son, bad son story.

After finishing their education, a rich man’s sons started working in the private sector. They were both chugging along without the financial help of their rich father and all was good. At some point, an economic recession struck and they both had to pay for their previous bad choices. Some of the bad things that happened were through no fault of their o…

And last but not least, the Rufus pieces. I created the character of Rufus, to depict the quintessential anti-investor. The investor that isn’t really an investor. You need to be learn about Rufus, so you won’t be that guy.

The first Rufus piece.

Rufus: Portrait of an anti-investor.

Investors nowadays aim to achieve investment success by trying to jump on the next hot trend that the markets may throw at them, without really doing the work to assess whether it’s an opportunity or a trap. The primary motivator of their investment interest seems to be price action and not fundamentals.

The second Rufus piece, warning about Big Tech and potential future fragilities that could cause issues for many of these loved Mega Cap technology stocks, and cause losses for investors. In their attempt to go for the safe bet, investors sometimes make risky bets.

Rufus: Quest for the safe stock

Philoinvestor is an investment and lifestyle newsletter. Most of the content is free. Rufus needs a safe stock to invest and make profits. People are making so much money, why can’t he? Life is getting expensive, prices are going up. His lifestyle needs cash to sustain itself.

And the third Rufus piece, in which I tried to explain multi-level thinking and how thinking too much on the first-level could destroy you as an investor.

Rufus: The first-level thinker

This is another Philosophy & Mindset piece, written to be timeless and to serve both retail and professional investors alike. This is the third piece in the Rufus series. Rufus is the typical anti-investor and he makes all the mistakes in the book.

I wrote about piece ~10 years ago on the business of shipping, but which can be applied to other sectors too. The piece makes the analogy of shipping as trading options.

Shipping as options trading

I wrote this small piece 7-8 years ago after thinking about the shipping industry and studying it for years.

A great track record never comes in a straight line. You need mental fortitude to get it.

Double Standards & Great Expectations

Everyone wants an amazing track record. But the problem with great track records is that people know they are great only after they have happened. It’s not as easy to recognise them while they are still happening. We look at 30 or 50 year track records and stand in awe of the amazing, flawless and easy ride that someone enriched himself on. Fund managers…

It seems to me that the discipline of value investing has been highly misunderstood. So I wrote a piece to set the record straight.

On Value Investing - Part One

Value investing is a well regarded and highly adopted practice of investing, however, it can be misunderstood and wrongly applied. The skills needed to succeed in it are: Buy companies at a price that you consider to be undervalued Hold them long enough to extract the bulk of the upside.

Investing is easy. Staying invested is hard. You think it’s easy being an investor? Read this.

So you wanna be an investor?

Being an investor is not as easy as it seems. Sometimes it feels like the weight of the world is on your shoulders. Like you are an athlete training for the olympics. In fact that is the best way to think about the life of an investor, like that of a professional athlete.

Don’t get it twisted - you want stocks to go down. This is why.

Why you want stocks to go down

💥It still amazes me that investors are more focused on day-to-day stock prices than actual business progress.💥 No, I am not talking about amateur investors or the retail crowd. I am talking about professionals running big money. If this subject interests you, read on…

Drawing analogies between Plato’s Allegory of the Cave and the practice of investing.

Shadows & Traps

Investors are like prisoners in Plato’s Allegory of the Cave. They are chained and cannot see reality — only shadows of reality. What are the shadows in investing? An obsession with the Fed and monetary policy Macroeconomic analyses and reliance on economic figures

You never graduate as a master-investor, the path goes on forever. True Zen never stops and that is the mindset you need to cultivate to walk that path. Here are the main skills you need to constantly work on to become that person.

Value traps are the road to investing misery. Avoid bad companies & value traps at all costs. There is a way, focus on layers that I write about in the piece below.

Bad Companies & Value Traps

Major losses come from investments made with good intentions but unsupported by good fundamentals. Avoid bad companies and value traps — but how can you recognise them in the first place? Signs of Bad Companies On a high-level: a company is good if it creates value and bad when it destroys it.

This is the only letter in the section that isn’t written by me. I however asked the writer to sit down and write it. Read below.

Πως έμαθα το χρηματιστήριο, και κέρδισα πολλά λεφτά

The letter below was written by a friend of mine, after I asked him to sit and write down his emotions and memories on his investing journey. This happened shortly after he capitalised on a massive investment success, just this summer.

Lesson from Greek Mythology — applied to investing and life.

Investing like a Greek God

Markets are chaos, but chaos leaves clues. The Greeks knew it, their myths weren’t just stories — they were survival guides.

Discussing the importance of life cycles in investing — an often forgotten angle when analysis companies and picking stocks.

Life Cycles are Life

Most investors obsess over earnings multiples (banal shadows of real value), macro narratives and themes.

Sincerely,

Philo 🦉