Life Cycles are Life

Life Cycle > Hype Cycle

Most investors obsess over earnings multiples (banal shadows of real value), macro narratives and themes.

But how many consider life cycles when they pick stocks?

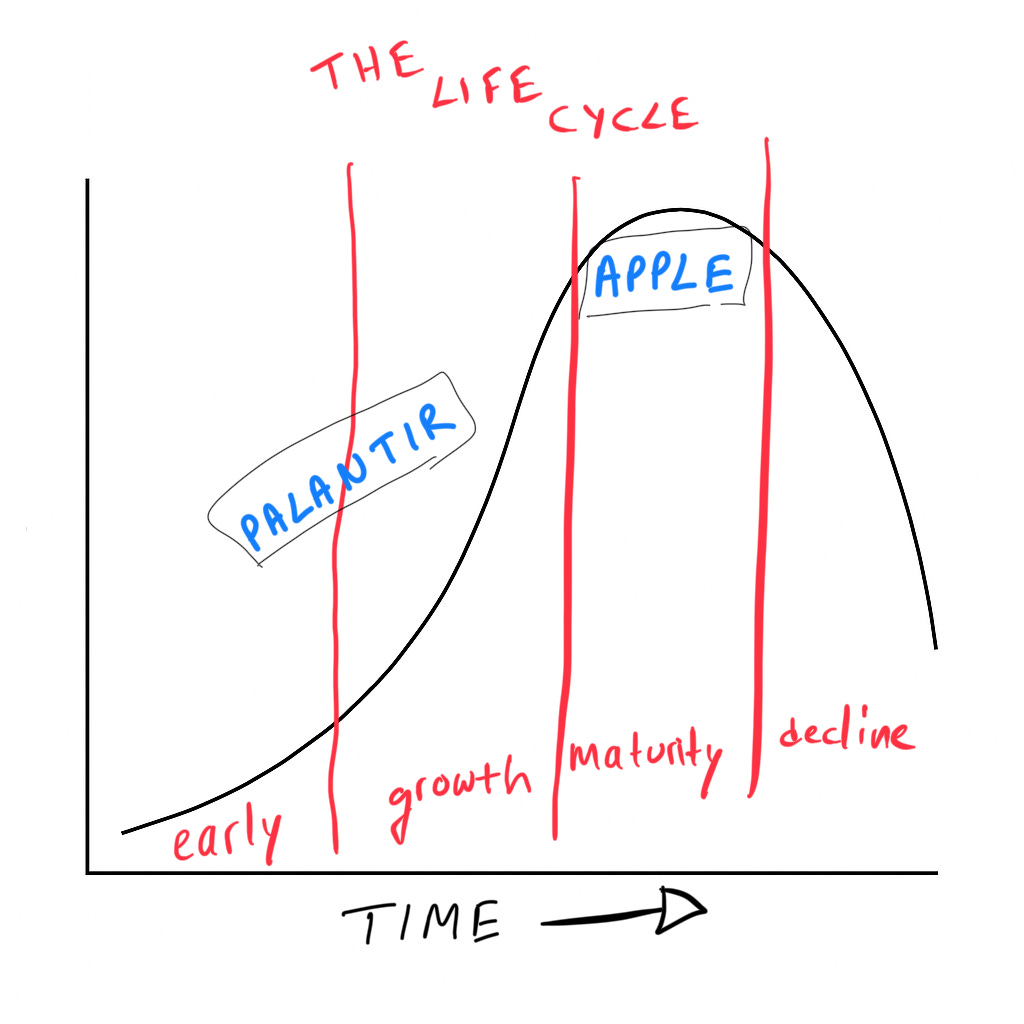

As we can see from the diagram above — the typical life cycle has four stages.

Early Stage

Growth Stage

Maturity

Decline

Each stage can be described by a general set of characteristics — let’s look into them.

Early Stage

In the early stages the concept is unproven, and so business risk is higher. This means more uncertainty and a wider range of outcomes. The business could literally fail, or take over the world.

Growth Stage

In the growth stage the concept has had time to prove itself, this reduces risk and uncertainty. The range of outcomes now starts to reduce on the downside, but the upside remains open. The business is growing fast.

This does not mean risk is now inexistent — competition could be fierce or an event could happen that changes the whole trajectory of the business. The moat could be strengthening or eroding.

Late Stage (Maturity)

The business is now maturing. Uncertainty is diminished further, but so are growth rates. This means the range of outcomes start to close both to the downside and the upside.

But business decline could be just around the corner. The business could move sideways for a long time or start to die slowly. Management competence and competitive dynamics are key here.

Decline Stage

The business starts to slow and threats to appear. By now, management is rich and happy. They have no real reason to be proactive and their sectors start to get ahead of them. They stay behind. The risk-taking mindset is long gone, and so is the founder. The moat is eroding.

What does this mean for investors?

Each stage carries its own dynamics — which makes the payoff, ceteris paribus, a function of life cycles.

In other words, risk-reward shifts with a company’s life cycle. If you ignore that, you’re setting yourself up for failure.

But ceteris are rarely paribus — all things are rarely the same.

And so for each stage, investors must also weigh for the specific company they are analysing:

Range of Outcomes

Optionality & Risk/Reward

Valuation & Expected Value

Business Model —> of which business risks & economics stem from

Competitive Environment / Moat

Module 17 of the Zero to Hero in Investing course is all about Life Cycles in Investing. Access the course by joining Philo’s Academy here.

Real-World Examples

Let’s use this framework to look into Palantir and Apple. The former is positioned at the left-hand of the chart while the latter more towards the right. Two very distinct examples.

Early/Growth Stage: Palantir

Palantir was founded just 22 years ago and operates in the data industry. It has strong roots in military and intelligence circles and started out by catering to them. Today, it has expanded its offerings to corporates and governments as well.

The company will barely make $5bln in Sales for FY2025, but with 80% Gross Margin on those Sales. As they are a service business, overheads are massive, which meant they were barely breaking even not long ago.

Palantir has been a major beneficiary of the AI-adoption wave and keeps winning contracts as the world adopts AI technology.

But it’s now selling for almost $300bln — even if it makes $1bln in net income for 2025, that’s 300X earnings… And if that were not enough, one must understand the business environment extremely well to assess where this business will be in 5 years — not to mention 10 years plus. Where is the margin of safety?

On top of all this, you must assess regulatory and general risks pertaining to the business model. And so, very briefly, risk/reward is skewed to the downside for this one.

Maturity Stage: Apple

Apple was founded 50 years ago and is a household name worldwide, unlike Palantir. Of course, that’s because Apple is possibly the most aspirational brand on the planet, at least for the mass-market. But it is well into its maturity stage.

iPhone units sold per year peaked many years ago — everyone owns an iPhone by now! The iPhone segment carries more than 50% of the company’s revenue, while 25% comes from Services — which is mostly tied to the iOS ecosystem.

The remainder of the business is from iPad, Mac and Wearables & Accessories. Basically the business is reliant on the iPhone and the iOS ecosystem. A decline in the iPhone would equal to a decline in the company.

Product Life Cycle = Company Life Cycle

For 2024 the company generated $400bln in Sales at a a 32% EBIT, but sells for a market cap of $3trln — 7.5X Sales!

~24X EBIT for a company in maturity with

increasing global competition in smartphones

serious regulatory/legal issues (e.g. AppStore take rate issue)

and in risk of losing the $20bln a year it gets from Google as the latter faces the DOJ lawsuit

It’s already expensive, imagine if it loses another $20bln from the bottom line. Again, summing it all up, the risks are heavily to the downside on this one.

Philo 🦉

Philo’s Academy

For much more on life cycles and how to think about them in stock selection and portfolio management, join Philo’s Academy here.

Nice article. imho, a simple view that you may consider, or not: PLTR vs APPLE or AMZN, TSLA, etc for the matter, is not fully understandable, hence it's potential, compared to the other giants, limited. It lacks a key characteristic, you(the investor) do not see its products. Sold at 120, started re-averaging at 100 and waiting under, really under.

Understanding cycles is pivotal for investors, regardless of the markets, strategies, and even instruments.

Lassonde Curve, Gartner Cycle, Everett Cycle, and even the distressed debt cycle.

As you pointed out, knowing where we are in the cycle predetermines our game: range of scenarios, odds, and payoffs.