Zooming out on AI: Part 1

Let the AI-Complex Wars begin.

“Zooming out, zooming in — it matters not. The bubble will always whisper in to your ear with complete, unabashed honesty every time you take a look.”

—Philo, modifying a line from his favourite movie A Good Year.

A Few Good Years

And it’s been a few very good years for AI, and Tech in general.

Valuations have grown massively as multiples have expanded — and with them revenues and capex too. The indices are performing very well and everyone feels like a genius.

The question now is — how much of that is real and how much is not.

Up to now, this didn’t matter. Valuations were moving up, and whoever said and did the right things — got handsomely rewarded.

But as the market adopts another thesis, where will it reprice to?

On December 11th, we published Wake Up Call! to talk about the generational Oracle blunder — and how that would affect the broader AI theme.

The piece has now been released from paywall 👇

“At this stage, market expectations have diverged so much from actual economic reality that this tells me we are very, very close to the peak of the AI cycle…”

“I think the bust is near as markets and investors realise that the hype cannot be met by reality.”

—Philo, September 12th

For ORCL, it was the weak balance sheet and the leverage that did the damage. The stock is down 50% since the OAI deal was announced.

Oracle is already unwinding with bondholders suing, and the company tapping markets for funding up to $50bln to continue with its AI capex program.

But NVDA doesn’t have leverage — so what could be the pretext for a broader AI re-pricing?

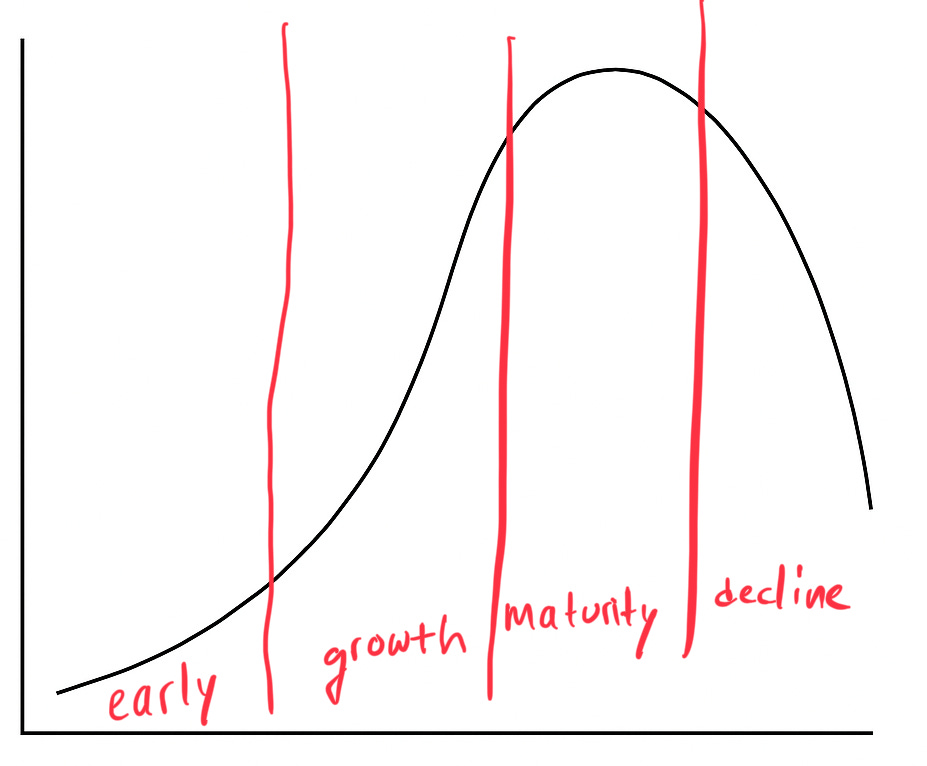

Evolution of the Cycle 🔄

The pace of development is slowing, and consumer behaviour is shifting. That means lower AI capex ahead and a change in how people use the technology.

Many power users that previously paid for 2-3 chatbots will slowly consolidate their usage to 1 — as the space matures and progress slows down. Chatbots themselves are also maturing as battling compute waste takes major importance for the survival of these compute merchants.

Chatbots aren’t even profitable now, what will happen if the Chatbot goes in the way of a bundled, commoditised offering?

To be sure, OpenAI (“OAI”) has bigger plans than remaining a cash-losing compute merchant needing the perpetual good graces (i.e. funding) of everyone in the Tech Complex to stay afloat. Now this is key.

At a high level, the complication is that Big Tech is competing with each other — but also that each individual player needs to carve alliances to compete with the others forging alliances against THEM.

Without this lens, we cannot form hypotheses on strategic alliances, common interests and map out our expectations of how the space will evolve.

Some recent developments and moves catalysing the future

Google’s TPU launch

And the rise of ASIC chips (TPU is ASIC)

Google’s Gemini Bundle (Something OAI cannot do)

NVDA <> GROQ deal

NVDA still can’t sell to China (we forewarned)

Ads on ChatGPT in the making (I made a video on this here)

Another funding round by OAI

OAI is in deep losses and one of the biggest consumers of compute

1-Year Performance

With Amazon, Microsoft, META and Oracle almost flat — Google boasts a stellar ~70% performance. From the lows of April ‘25, the stock is up ~130%.

But why this sudden re-rating in Google shares?

Well, besides antitrust wins and overall business progress — Google is no longer seen as an AI loser.

Its Gemini Chatbot has benefitted from great product improvements and user testimonials. With users dumping a tired ChatGPT for a fresher Gemini.

Google announced their own ASIC chip called TPU (Tensor Processing Unit) that it uses to power its own AI.

Google is also commercialising this technology and selling TPUs directly to others, like META. In other words, Google is now a chip company as well.

Basically, Google came out from under the AI race and took everyone by storm.

For reference, Google’s market cap is sitting at $4.15 trillion, and selling for ~30X 2025 EBIT.

OAI is currently raising a funding round of up to $100bln, in my view, to create a fortress balance sheet and buy several years of runway in case doubts creep up about its business.

This fortress balance sheet will also give it space to test out and implement ads on-Chatbot, allowing them to monetise free users as well.

This puts OAI and Google as direct competitors. In fact, one could divide the AI complex in two sides: the Google side and the OpenAI side.

Behind the Scenes

The Anti-Google side is funding OAI in an attempt to:

contain Google and their AI rise

strengthen themselves

and make a killing on IPO day

While NVDA may still be Kingmaker on the hardware side of things, Apple is Kingmaker on the distribution and interface side, as we discussed here 👇

Now let’s look at things from a game theory angle and what that means for the stocks of these major AI players. Not only at the high-level Complex Vs Complex — but also at a lower level intra-Complex.

That is, how does co-operation need to evolve between the players of a given Complex — for them to grow to a robust full stack, battle ready to face the others.

And more importantly, how can this affect their stocks?

Let’s start with game theory.