Wake Up Call (packed with memes)

The ROI is no longer "in the valuations..."

“What the wise man does in the beginning the fool does in the end…”

—Philo, on the Microsoft breakup and subsequent Oracle deal with Open AI

Philo, September 12th (two months ago)

“At this stage, market expectations have diverged so much from actual economic reality that this tells me we are very, very close to the peak of the AI cycle…”

“I think the bust is near as markets and investors realise that the hype cannot be met by reality.”

This is how I concluded the video I made to discuss the infamous RPO announcement that caused a 43% spike in the share price of Oracle.

Since then, shares are down ~50% with Labubu Larry et al. finding out that hundreds of billons in market cap can be lost the same way they were gained.

Which brings me to Philo’s Third Law of Pump Motion.

“Every pump has an equal and opposite dump” —Philo

Last month we revised the current state of the AI cycle, and we didn’t like what we saw.. 👇

The NVDA Short

Our work on the AI Cycle starting with the Techno-Imperial Cycle piece — and subsequent mega-pieces, prepared us for a top in AI followed by a subsequent bust.

As all this was evolving, the stars lined up and we eyed a double top forming in NVDA — which was confirmed a few bucks above $200, see red arrow.

We started shorting on confirmation and remain structurally short (with a few trades here and there, all chronicled in the Philochat).

I have said for time that the FOMC from yesterday will not matter — rather what happens in AI is what matters to where markets are going.

The ROI is in the valuations

We isolated the ultimate driver of the AI cycle in the Summer of ‘24 — and formulated a Sorosian boom/bust cycle around that which, in my view, has been spot on in understanding and following the process.

Now, we have mounting and solid evidence that the cycle is turning.

In Sorosian market speak, the process is going through a test. Previous “tests” were passed and the cycle was reinforced mostly because of Nvidia working with other crazies like Mark and Larry, or teaming up with the White House to keep the pump alive.

But they front loaded too much of that pump in the past few months — and now the magic hat seems to be empty of pumps… 🪄🪄🫷🛑

THE AI GESTALT SWITCH — (𝟬 to 𝟏)

“A Gestalt switch(or Gestalt shift) is a sudden, involuntary perceptual change where your mind shifts from seeing one interpretation or configuration of an image or situation to another, without the actual stimulus changing, like seeing a duck then a rabbit in the same drawing, or moving from seeing “trees” to seeing the “forest”. Coined by philosopher Ludwig Wittgenstein, it illustrates how context and perspective dramatically alter our perception of a single, stable pattern.”

Recall how I intro’d this piece 👇

“What the wise man does in the beginning the fool does in the end…”

The wise man here is Microsoft, the fool is Oracle. As Microsoft was pulling back from Open AI for reasons we covered all over Philoinvestor, Labubu Larry was stepping in — in an attempt to get some of that magic AI dust too.

It seemed to be working for a few days but then things slowly started to unravel.

Yesterday’s earnings release put things from “first slowly” to the “then all at once” stage — in a hurry. The switch was hit.

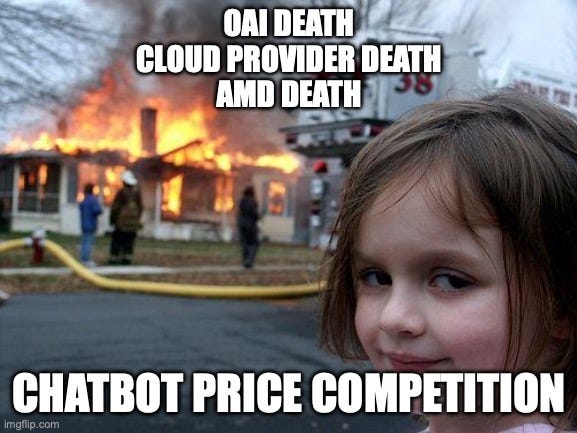

In meme talk — this is the market’s perception on Oracle ☝️

—> Burning cash and heavily indebted and ramping up a business which probably won’t make any money isn’t the way to go Mr. Labubu.

NVIDIA FINAL BOSS

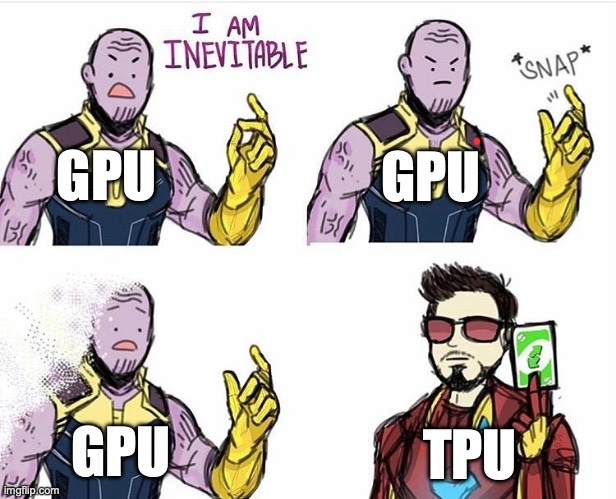

But even with the Neocloud trade taking a heavy beating and Google launching its TPU to much fanfare — Nvidia is still touching a valuation of $4.3 trillion (down 15% from peak)

So why hasn’t the Goliath of the AI trade still not gone down?

Keep reading for more memes and insights…

CHATBOT ATLAS

Open AI (and money-losing chatbots in general) are holding the sky from falling…

And even Open AI admits it — see below ⬇️

Oracle is spending billions to join the (money losing/race to the bottom) Data Center trade and is reliant on Open AI business.

AMD closed the deal of the century all resting on continued Open AI success —> AMD stock is now tied to the hip with OAI.

Open AI is basically giving work to every company in the AI space… but where is it getting all that capital from? And for how long will it be allowed to burn capital like this?

So OAI is sucking in billions in capital, burning it, all while waiting to hit break even (or IPO).

But recently there was a fork in the road: Open AI and NVDA are on high alert as Google finally launched their ASIC-based chip (called a TPU*)

—> Google managed to launch a more efficient AI Chip and a better Chatbot — this could shift perceptions against Open AI and make it difficult for them to continue to raise capital.

—> If Open AI loses momentum on the business side, losses could deepen, also impeding their chances of raising more capital.

—> All this as Chatbot price competition is in full swing.

So the whole process is reliant on Chatbot companies being able to raise capital from the likes of Masayoshi Son — AKA the worst market timer in the world..

And so, where is the ROI?

Nowhere to be seen yet.

One Last Meme

GPUs for AI are more flexible yet less efficient (more costly). The AI business is a cut throat business and can by described by the forces of creative destruction and a race to the bottom. This means the most cost-efficient player survives and wins.

Google launching and commercialising their ASIC-based TPU chip basically forces the hand of every player to incorporate it (or other ASIC-based chips) into their workflows. In fact, they started investing in Custom Silicon a long time ago. Read more here.

If you don’t — you lose and are forced to exit the business.

The implications for this are massive starting from NVDA (and others) losing business and being squeezed to lower their prices resulting in gross margin reductions for them.

To compute getting less costly for producers and cheaper for consumers, power consumption reducing etc.

Many seem to be extrapolating compute demands and power demands way down the line — but forget that their projections can miss by a lot with small changes in the variables down the chain.

Stack a 20% semiconductor efficiency gain on top of a 10% model efficiency boost and a 10% power-generation improvement from advancing nuclear tech and tell me what you get.

There’s your back of the envelope. Food for thought.

Philo 🦉