The Trump Bounce & IPO Trading

Issue #14. CRWV, CRCL and IPO Trading. Gold & Reserve Assets.

Today we will pick up where we left off in the last issue — Stocks, Indices, FX, Commodities and the broader Macro setup. On top of that, we will also comment on two recent IPOs — CoreWeave (CRWV) and Circle Internet (CRCL).

Philoinvestors that follow the Philochat know we traded them both — CoreWeave on the short side last week and CRCL on the short side yesterday.

See below the Philochats 🔻 Note that they are usually behind a paywall.

In the last issue we touched on the parabolic action in Gold and how it wasn’t the best time to buy that overextended move — after more than a month, the technical picture seems to be changing.

On the stocks side, the Nasdaq 100 bounced from our first support level and is now nearing its recent highs. All that with a lot of pumping by Trump 2.0 as they try to repair the damage they have caused.

But just because they are pumping things does not mean things will get pumped…

This reminds me of BTC right now. We published DyC 2.0 in mid-December when BTC was in a major hype phase where even the President was pumping it..

Where is BTC now? Barely up 5% after a drawdown of 30%.

Where is ETH now? Down 32% after a 65% drawdown.

The market will do what it will do — no matter what the players around it say about it.

Which brings us to stocks and the broader equity indices — after which we will follow on with our traditional Breakout chart-bucket, plus a discussion/lesson on trading CRCL and CRWV (both recent IPOs).

Next Piece on Philoinvestor:

Before we proceed, note that Philo’s Academy is launching soon with Zero to Hero in Investing: Investing for Beginners and Professionals re-Discovering their Edge. Find out more at philomastery.com or message me for more details.

Issue #14

Nasdaq 100

As we’ve repeatedly said, Trump 2.0 rhetoric changed swiftly when they realised the ground beneath our feet was collapsing. Markets bounced violently and are now faced with the 22,000 point level. Trump is calling for rate cuts (LOL) and Fed will probably not deliver. The (global) economy is confused and the only theme that is still chugging along is AI etc.

That doesn’t mean valuations are of any interest to me — it just means the wheels of the economy are still turning, with some help from the broader AI theme.

Chances are we will face resistance at the ~22,000 level indicated by the yellow range in the chart above. In other words, this was purely a technical move resulting from Trump retreating from their prior rhetoric AND then trying to pump the markets after realising…. that markets are actually important.

Brink & Back Dynamics as we’ve talked about many times.

GOLD

In the last issue we touch upon Gold’s over-extended parabolic move — underpinned by a loss in trust in the US. The overextended move is now finding support on the Weekly EMA10 and consolidating in a tight range. This probably means another move up, unless the picture changes and we see the technical picture breaking down.

$4,000 is a possibility here, especially if Trump/the US get back to their antics.

The loss in trust we are talking about? See below 🔻

Dollar Index

The DXY lost our “7% Range” weeks ago and has still not managed to get back in. Even with Trump pivoting the rhetoric, the USD is still not recovering… That probably has something to do with the Yen and the Euro rallying (obviously).

The Yen

The USD/JPY hasn’t managed to stage a serious come back after selling off violently in the start of the year. We traded that very well (chronicled in the Philochat) but recently stopped looking for trades in the pair until it finds its way again.

The Euro

The move in the Euro is what’s keeping the DXY down (40% weighting). Renewed European hopes and a new German government that went all in on growth and militarisation has been well-digested by markets. Laugh now cry later, I guess…

10-Year Yield

Half the Trump 2.0 plan was to reduce the cost of the monstrous debt — and start to make it sustainable again.. But it was all empty rhetoric. Luckily for the Treasury, the yield is still below 5%.. For now. Deficit this year expected to be $2 trillion..

At this stage they are just numbers, until they aren’t — and things start to happen. this chart breaking up could be the next catalyst for the next market sell off.

Crude Oil

Crude not moving.. An escalating broader conflict in the Middle East, OPEC increasing supply, Trump 2.0, tariffs this, tariffs that — and Crude is still there. Not much more to say about its technical picture for the time being.

CRYPTO

BTC

BTC sold off after our Dump your Crypto 2.0 piece, but then bounced back as Trump retreated from the rhetoric and “risk assets” rallied together..

BTC is back to its previous level and trying to break above — those who know my work though know I don’t really see it. The theme this time isn’t strong and it relies on Saylor and his clique buying more BTC, as of late their purchases have been weak.

It’s near all-time highs yes but so is the Nasdaq. If I see the technical picture changing — i.e. any notable technical formations I will inform in the Philochat. For now, I see nothing special.

Ethereum on the other hand…

ETH

ETH dropped by 70% since our 2.0 piece. On the fundamental side, I think ETH is going through an existential crisis, it’s bouncing now but so do companies that are about to go bankrupt 😂

Anyway jokes aside, from discussions I have with Crypto bois — things aren’t great under the hood.

(IPO) TRADING

CRWV

The thesis here to go short is simply weakness after an overextended/parabolic move. This is why the setup is called a “Parabolic Short”. You can see from the Daily chart how the move accelerated towards the upside with a big up day, another smaller up day and then a gap down.

I waited for the open to give me confirmation of weakness and I smacked it. This setup isn’t for crazy home runs so you start to take profits as prices approach areas of resistance.

In hindsight, I should have looked for areas to go long previously! That’s the take-away lesson from all this, learn to go with the move. You don’t need to fade everything to make money — You can make money by going with the move.

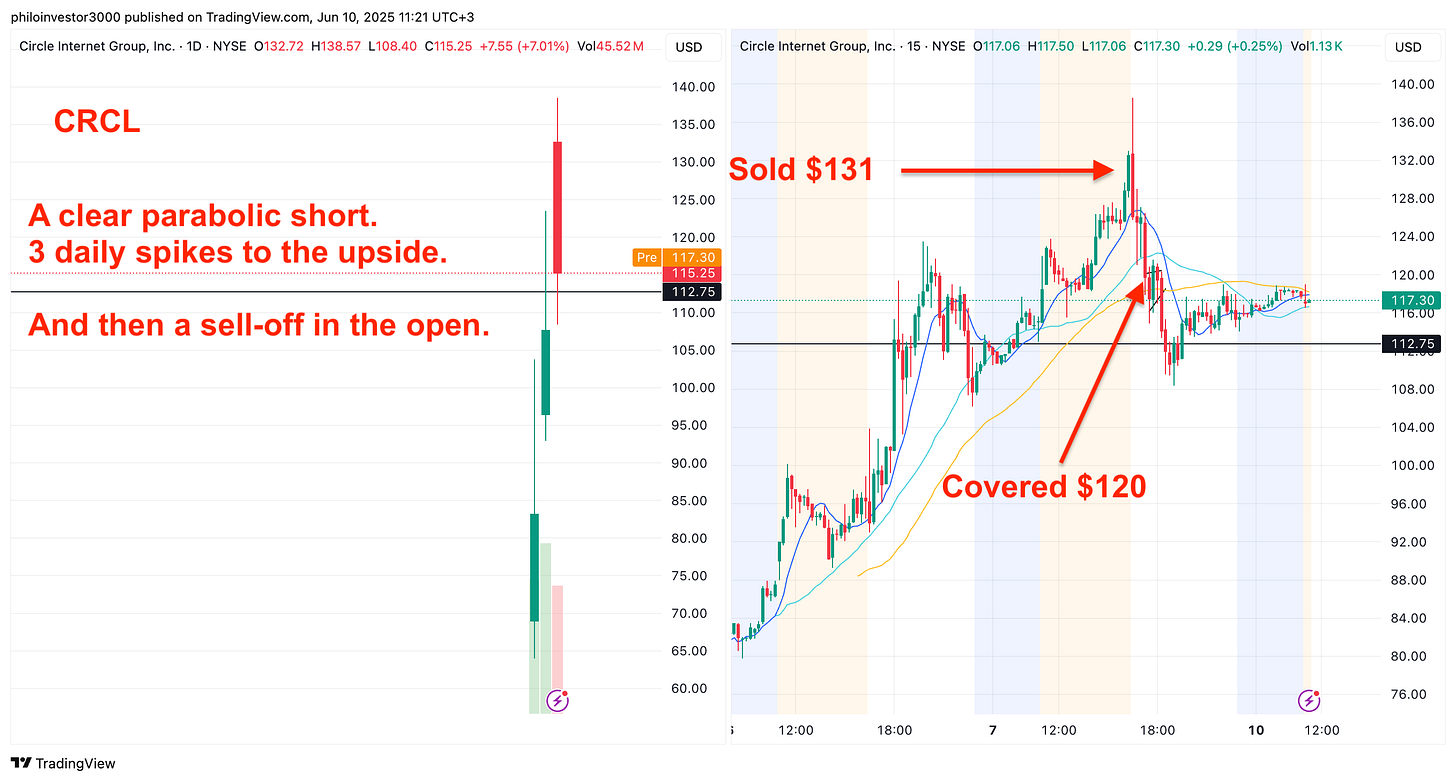

CRCL

This stock only started trading 3 days ago (when looking at the chart) it opened up massively and continued to move higher. Trading at the open was erratic, I was just looking at it. It moved up the next day as well and the third day it gapped up and started to sell-off.

That’s where I shorted with stop highs of day. I called my trade live in the Philochat.

I covered too soon at $120, and after finding support at those levels the market cracked again falling another $10. It is what it is.

If you feel someone could learn from this and Philoinvestor, gift them a subscription using the button below.

Philo 🦉