Schrodinger's USD // When Gold & Bonds Collide

Issue #13. The (tariff) brink and back? Nasdaq hit the level and is bouncing. Gold overdone etc.

In the previous Breakout we talked about how the Nasdaq 100 was finally breaking down from its long-term ascending channel (covered in Breakout issues for time).

In Issue #11 we gave the support levels on the Nasdaq 100 that we were eyeing. Excerpt below.

Yes, you read that right. We expected the Nasdaq 100 (viewed as a proxy for all major equity indices) to break down and find support at around the 17,000 level — which it did.

By the way, we also follow these moves in the Philochat — I screenshot the April 8th one below👇

This is an excerpt from the April 7th Philochat 👇

But trading a thesis is not linear, right?

--> Chart below of Naz futures, Daily/Hourly. We can see the Naz is for now respecting our yellow level of importance, I am not betting on a further drop from here without some sort of bounce.

Pods have blown up, people mostly sold what they wanted by this morning - the VIX moved high enough.

In short, shorting here will be a very tough ride.

The setup here is that markets are overextended (technically I mean) to the downside and a minor retreat of the rhetoric (a negotiation or something) means markets will snap back higher, killing shorts.

—> Markets are playing out just as we expected them to — first by breaking the channel and dropping sharply and then with a strong bounce off the lows.

Now on to the next issue…

Issue #13

In today’s issue we will look into all major markets, including FX, Commodities, Bonds, Stocks etc.

But in this issue, we will do something different: We will offer inter-market commentary where it is fitting.

For example, Gold and Treasurys don’t make sense right now — there is a divergence and bifurcation here, and I will formulate a thesis that reconciles it.

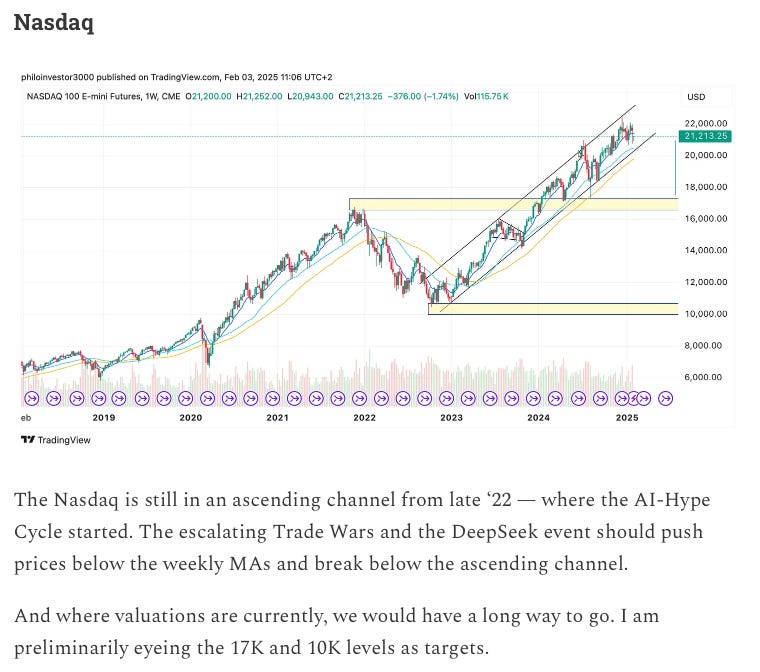

NASDAQ 100

The Nasdaq broke down from the weekly ascending channel (black ascending trend lines) and sold off — then it bounced and sold off some more. The driver behind the move was the escalating US — China rhetoric and a tariff tit-for-tat...

It seemed that the US would not back down —> we actually faded that eventuality all over Philoinvestor.

Then magically the Administration started to back track and change its rhetoric. The Nasdaq bottomed on April 7th and has been rallying since.

On the Weekly, prices are just below the EMA10 — a critical level of resistance.

Bessent keeps talking about a “deal” between the US and China, and it seems there is some behind-the-scenes discussion. Markets are digesting the news positively.

As I have said in the last WTHIH — GDP for the 1st quarter is coming out this week on April 30th. Investors will be trying to decipher where the economy is going — especially after Trump’s antics. Expect volatility.

Now let’s look at how the Dollar has behaved since Trump.

The Dollar Index

The light red lines show the 7% trading range that we have been observing in Breakout for months. The Dollar broke out of the range post-Trump election but did not hold.

Our views on Trump 2.0 (pieces listed here) coupled with this technical confirmation caused us to lean bearish on the Dollar.

The tariff tantrum and Trumpspeak caused a fast sell-off in the dollar, taking the index to the lower boundary of its range, and slightly below it before it bounced back to the neckline. (Yes, it could be a retest! 😱)

If the Administration manages to contain the fallout and effects of their lunacy, we could see the USD stage a recovery. But to be honest, with Trump 2.0 things could change on a dime.

And so I will keep this chart as a blueprint — but be ready for pivots along the way. That is to say, if things cool down and we see a broader bounce, the dollar should rally. If thorns remain on the horizon, things could get tougher for the dollar.

Since the index is mostly driven by the Yen and the Euro, let’s dive right into them.

The Euro

The Euro benefited firstly from progress on the Ukrainian front and then from problems with the US economy — as Trumptalk caused a sell off in the Dollar. We talked about this under Dollar Index.

Zee Germans managed to pass their budget and break the “debt brake” — unleashing animal spirits…

Philo’s Take: GOOD LUCK, you’re going to need it.. What’s good luck in German? Anyway, this is what we are working with now — basically, if you don’t have a strong bearish USD thesis or setup, be careful going long the Euro right now.

The Yen

Arigato Japanese Yen! Best performing major FX YTD!

Same vibes as the Dollar Index + Carry Trade Unwinds took the USD/JPY back down to 140. Some were betting on the reverse carry trade, others on Bessent flying to Tokyo and pushing them on a “too weak” Yen.. 🤦🏻♂️

Bessent later admitted there are no FX-related talks under the broader tariff discussion. The rate differential between the USD and the JPY is still 4%, a major positive carry.

Now if the confidence differential drops back down, we could see a lot of USD/JPY buying, taking the pair to the target area ⬆️

Now that we are done with our FX of importance (sorry GBP, nothing to say about you) — let’s go to Crude Oil.

Crude Oil

FINALLY some movement from Crude.. It has been doing nothing for years! In Issue #12 I wrote that:

“This market needs a major event to get it out of its rut…”

And I was right. Crude broke down first due to the Liberation Day and second from OPEC unexpectedly front-loading its supply cut unwinds.

OK OK, I mean they increased production faster than expected. Naturally Crude sold off. I wrote a bigger piece on that here.

Crude is now recovering, as expected here.

Now let’s talk about the bifurcation

Gold

On the one hand we have Gold — it broke out in January ‘24 at around $2,100 and hit $3,500 last week. 75% on Gold is no joke!

But the move has gone parabolic with fears of further currency debasement, escalating trade wars etc. Is now the time to buy? I doubt it. Technically this move is overextended and the Americans have already started walking back their rhetoric.

I wouldn’t touch this without another formation — I explained as much in my last podcast interview here.

Gold is pricing in high inflation and worries about the fiscal position of the US — with worries about the Dollar by extension.

But the bond market isn’t pricing in all these fears.

US 10-YEAR

The 10-Year is still below the 5% level. Maybe progress on the inflation front is keeping holders long this? Maybe there is no alternative on the horizon?

Maybe — but I argue that one day price discovery on this could be sudden and abrupt. For now the market is at relative peace — with a break above 5% we will see moves.. We will keep an eye on this.

The Bifurcation & Schrodinger’s USD

Do you know the experiment with Schrodinger’s Cat? Dead and alive at the same time? Anyway, that’s how the Dollar feels right now — the global reserve currency and NOT the global reserve currency at the same time 😂

Maybe a perverse version of this effect explains the fact that Gold demand is insatiable while the treasury market hasn’t cracked yet.

The USD today is like Schrodinger's Cat - call it Schrodinger's Reserve FX if you want.

To the world, it’s both alive and dead at the same time: It’s still the reserve currency, still liquid and still used to trade.

But underneath, it’s rotting: unsustainable debt, uncontrollable deficits - and hence uncontrollable interest costs. A weakening of the US in the halls of global power, fading unipolarity, a general loss of direction leading to an erosion in trust etc.

This paradox is reflected in two markets: #1, the US 10-Year is trading at 4.3% - hardly bankruptcy territory. There is talk of foreign sovereigns dumping their treasury positions but nothing material as of yet. Inflation is above average, but hasn't spike "death of money" style, yet.

#2, While at the same time Gold is at >$3,300, up almost 50% in a year. Indicates that loss of trust in the US is on the rise and capital is preparing for problems down the line: Solvency. Fast Currency Debasement. Asset Seizures.

The New Reserve Currency

And so, capital is flowing into Gold as a hedge against the USD. Everyone knows the USD is losing its reserve currency status expect some big FinTwit accounts!

Bitcoin

But Gold is not the only asset that’s benefiting from USD troubles, there’s another asset (?) benefitting — this time a digital one.

Bitcoin found support on the Weekly MA50, and rallied above a prior level after Trump walked back on his tariff and firing Powell rhetoric.

Risk On or Reserve Asset — I don’t know. I gave my views on this in Dump Your Crypto 2.0, when BTC was at $105,000.

I think this is enough to digest for now, more in the Philochat

Philo 🦉