Riding the AI Tech Stack

Infrastructure - Models - Applications - Interface. Where is the money going to be in AI?..

After publishing Downside at AI in October of 2024 — where we focused on the economics-under-the-hood (margins, capex etc.) of Cloud companies, we saw MSFT drop by ~20%.

This drop happened on the back of:

1) The market picking up on the things we touched on in the research piece. We were literally several months in advance of FinTwit and the market in touching on business economics/quality of earnings for MSFT and the Big Cloud bunch.

By the way, if you want to learn how to do this analysis yourself— have a look at Philo’s Academy at philomastery.com. The course launches this month!

2) Satya’s interview with the Dwarkesh Podcast where he basically admitted to many of those things (i.e. AI Commoditisation, Limited Value etc.)

3) The Trump election and subsequent tariff-craze sell-off.

Now, as we discuss and analyse in The Trump Bounce — the Administration realised the grave mistakes they were making and reversed course from breaking things —> to pumping things.

But just because Trump 2.0 is now pumping things does not mean everything is great. In The Trump bounce (a Breakout by Philo) piece we looked into the technicals in Stocks and mentioned that the Nasdaq 100 is faced with the ATH (all-time high) level — a difficult level to just breakout of for no reason….

But back to the reason for my email to you.

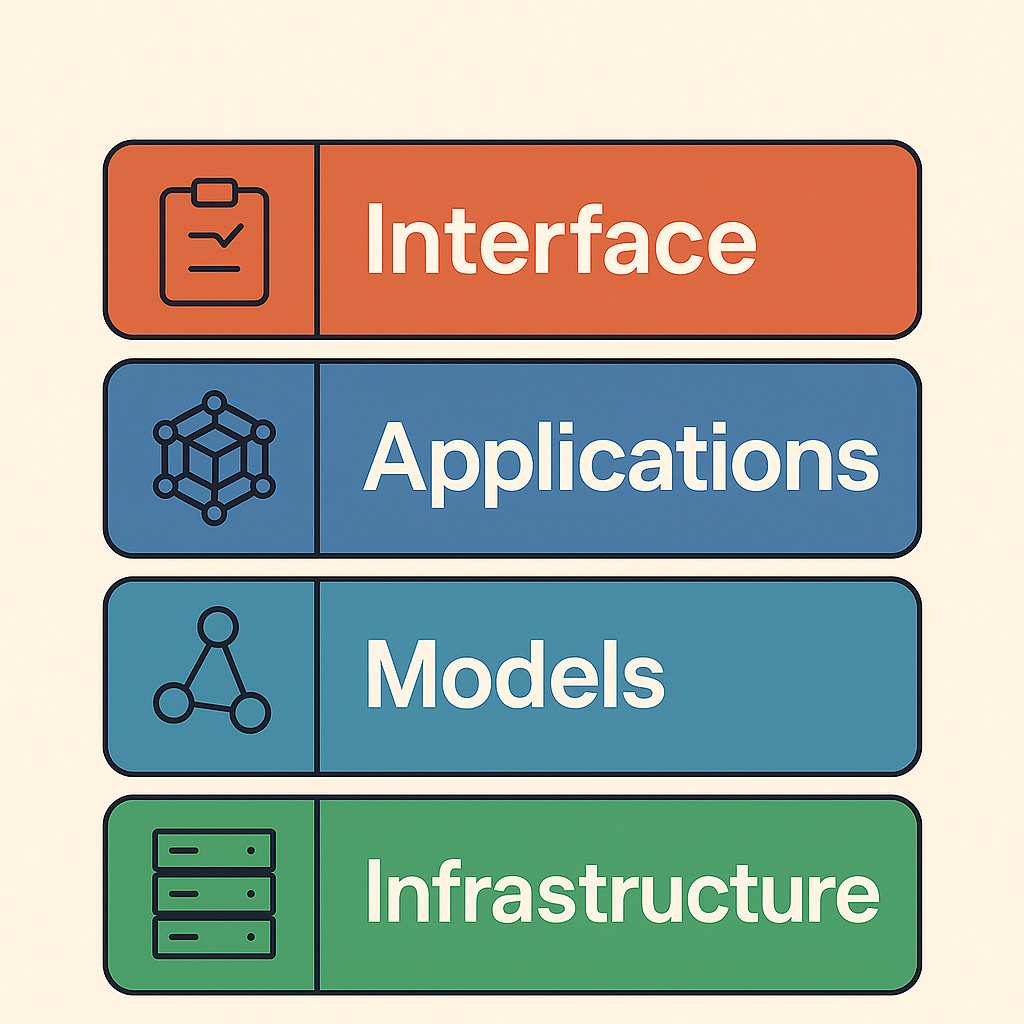

Riding the AI Tech Stack

The image above explains the AI Tech Stack simplistically — it may show four stable blocks on top of each other, giving us the illusion that things are easy to understand…

But underneath the surface there is chaos (and panic).

On the infrastructure, incumbents are fighting to survive and stay ahead. Meanwhile models (LLMs) are trying to proliferate while getting better — and stay alive.

The App layer is where the money is at, but competition is fierce. Those using second-level thinking then say: “Well if competition is fierce, why don’t I go for the picks and shovels trades?”

Which takes us back to the Infrastructure layer — but the devil is in the details.

Is NVDA selling to China and evading sanctions?

Does the valuation make sense or is the r/r abysmal?

Is QC and Custom Silicon going to take their launch?

And if so, are TSMC the ASML the only real intelligent plays left?

Having said all this, there are app layer plays that are dominant and getting better with time. One stock we wrote about on Philoinvestor was Duolingo, the globally-known language learning app — and now just for languages!

It’s now up >5X since we wrote about it. PIECE.

INTERFACE?

Which leaves us with the Interface Layer — what’s happening here?

Elon bought X for his own agenda, he is now signalling that he will merge it with xAI (his AI company). Their LLM, Grok, is already integrated with X.. and it works just fine.

Now they seem to be in the process of striking a deal with Telegram and their vast user base. (X and Telegram are the Interfaces here)

Meanwhile Apple is still finding its way with Apple Intelligence and how they intend to go about AI things.

The Interface Layer is about who controls the relationship with the user. There will be a lot of shifts and movements here — as players below the Interface Layer try to get a leg up, and Interface Layer companies measure their own risk and benefits about who they will side with.

All this dynamic is further complicated by politics and geopolitics.

—> The above just in brief…

I think I have said enough for a promo piece — read more in the full piece when it’s sent out to paid subscribers shortly.

Philo 🦉