What the hell is happening? November 2022

Red wave incoming. Trump 2024? Elon finally buys Twitter, panic ensues. BIG TECH problems are passive investing problems! Tech layoffs across the board. U.S. debt is staggering.

This is the sixth post in the WTHIH series. The previous one was sent September 24th.

In the previous WTHIH we talked about Japan trashing the yen. We also talked about the Fed’s strategy to tackle this wave of inflation and how that brings us to another Fed Put.

A few words on this pivot obsession and how to always choose simplicity over complexity. Excerpt from the previous WTHIH piece:

“But don’t confuse business and capitalism with the proclamations of pseudo-intellectual myopic central bankers that have never got anything right.”

You can’t buy the bottom and you can’t sell the peak. Better go with intelligent risk/reward.”

In this issue we talk about:

Fed Policy: Higher for longer.

The Midterm Elections on November 9th.

Will Trump announce he is running after the midterms?

Elon buying Twitter, and politics.

Big tech valuations diverge, I smell trouble for passive investing.

Massive tech firings across the board - what’s the story?

Biden kicks back against OPEC+

The fragility of U.S. debt.

Higher for Longer

"It's premature to discuss pausing. It's not something that we're thinking about. That's really not a conversation to be had now. We have a way to go…"

Jerome Powell made it clear that the pivot is not around the corner, and the Fed will continue to tighten and/or leave rates high until they get inflation down to 2% sustainably. J-Pow hinted that achieving that would require a “sustained period of below trend growth and some softening of labor market conditions”

“..and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher, than previously expected..”

The Midterms 😱🇺🇸

Jerome uttered those words one week before the U.S. midterm elections, where Democrats need all the help they can get. The Biden presidency has been associated/coincided with global geopolitical turmoil as well as an inflationary spike not seen for decades.

The Democrats have held control of the House and the Senate for the past two years, but things are getting harder for them. The elections in two days will show where the balance of power lies and just how much Americans have had enough of this administration.

Meanwhile Democrats are getting desperate… 👇👇👇

TRUMP 2024

After being elected POTUS in 2016, something many considered to be impossible - the Donald is planning to run again? So it seems.

But there are some other important “techno-political” developments brewing under the surface that must be said…

Elon finally buys Twitter!

Elon closed on the deal to buy Twitter for $44 billion. Whether he ultimately intended to close, or was forced to close - the result is the same.

I mentioned in my April 2022 Twitter piece, that the company would only make a profit if it got serious about its overhead - and specifically its staff costs:

“BUT FIRST! Twitter has to reduce its head count. They have to shrink, trim the fat and rationalise costs. Increasing sales is not an excuse to keep increasing costs and not making any money. They are no longer a startup.”

And it seems Elon came out of the gate running…⬇

Twitter fired ~50% of its workforce seemingly overnight and announced a number of new product features to increase monetisation and try to rebalance the ship. Elon said Twitter is losing millions a day and so there is no alternative.

Meanwhile advertises are pulling out from the platform due to worries of “censorship” and Biden is trying to trash Twitter’s reputation.

“And now what are we all worried about: Elon Musk goes out and buys an outfit that sends – that spews lies all across the world… There’s no editors anymore in America. There’s no editors. How do we expect kids to be able to understand what is at stake?”

Sure Joe, sure….🙄

Which brings us to the (potential) politics behind Elon’s acquisition of Twitter.

Elon pulled his expressed support of the Democratic party earlier this May, making himself an easy target for Biden et al. to go against him.

And now that he’s acquired Twitter - it has begun ⬇️

Free speech this, censorship that. Even AOC came out on Twitter bashing on Musk and his announcement that the blue check-mark will require an $8 per month fee.

AOC also retweeted the tweet below.

They seem to care a lot about free speech and censorship these days!….I mean now that they don’t have their “own people” within Twitter to do their dirty deeds for them:

Dorsey says blocking the Washington Post’s Hunter Biden laptop story was “mistake”

Twitter also censored a number of medical professionals warning against vaccine mandates, lockdowns etc. What about *that* free speech?

Big Tech and the Nasdaq

The Nasdaq 100 is down ~35% year to date, as titan after titan announces layoffs, restructurings, and problems. I first touched upon passive investing and Big Tech in July 2021 in the first ever WTHIH piece - you should read it. By the way, it’s short.

I laid out 4 hypotheses that the market seemed to be adopting at the time, and tested them with my own thought process. I then offered my conclusion. The hypotheses were:

Inflation is back so buy quality mega caps to protect your cash.

Equities will be hurt from the Fed tapering and the increase in interest rates.

Protection from inflation can be achieved by buying treasuries.

Investing in an index fund does not carry the risks that investing in individual stocks does.

Tech layoffs across the board - what’s the story?

After a decade of economic expansion, calm global waters, a booming economy and stock market, venture capital money sloshing around and overall smooth sailing - one after one, tech company either big or small is bringing out the axe and starting to cut costs.

🪓🪓🪓🪓🪓

And when your headcount is bloated, the lowest hanging fruit to start with is headcount reductions.

In May, Carvana came out firing 2,500 employees. Carvana has ~20,0000 staff today and it’s stock price is down ~98% from ATH. Ouch.

Then Stitch Fix fired 330 employees in June. Redfin fired another ~500 and Coinbase 1,100 on the same day. Unity, the famous gaming company fired 200. Enjoy Technology fired 400. I am just focusing on well-known companies and big numbers here, for a more comprehensive list visit Crunchbase Tech Layoffs 2022.

Shopify fired 1,000 in July, and Rivian another 840. Robinhood another 1,000 in August and Groupon 500, Snap also fired 1,280 and Wayfair 870 in August after bad quarters.

Twilio fired 900 in September and Netflix another 480. In October, Peloton fired 4,084 after previously laying off 3,584 in February.

For November, up to now - Lyft, Stripe and Twitter have fired 760, 1050 and 3700 respectively.

This week, the WSJ has published that Meta Platforms (i.e. Facebook) is getting ready for massive layoffs as Zuckerberg’s Metaverse pie-in-the-sky dream isn't working out, causing his stonk to sell off 75% from last year's high. Dreams and ideas are good in capitalism, but not if you don’t make money.

So you see, the tech sector was experiencing booming growth - and these companies aggressively invested for more, competing for resources (e.g. talent, real estate etc.) in the meantime.

But then dark clouds were starting to form, and revenue projections started to move the other way (i.e. south). What does management do? Start to cut.

Now that these highly-paid workers are forced to cut personal costs, expect disinflationary pressures in many areas - and many companies that cater to them to be negatively affected. This is what I had to say in May about this chain reaction..

ARK and ARK-y type stocks peaked and crashed much earlier than Big Tech, but it seems it’s time for Big Tech to enter a prolonged period of difficulty.

Note: At the moment I am not looking into any big tech names for investment opportunities, but continue to follow closely “small tech” and other interesting setups. These are the names that have the most growth ahead of them and are adapting to the environment. I will continue to write about them here on Philoinvestor.

Biden Vs OPEC+

And while this is all happening, the Biden Administration is desperately trying to fight inflation (or be seen to fight inflation), in order to not be ruined in the Midterms. How?

Empty the SPR (Strategic Petroleum Reserve) to keep a lid on oil prices. No comment 🙄

Try and do a deal with Saudi Arabia and OPEC+ so the latter two would increase production to keep oil prices low and fight inflation.

Then, go all out against Saudi Arabia and threaten “consequences” when Saudi doesn’t do what you want.

Accuse Saudi Arabia that they are siding with Russia.

And make things worse.

Under this administration, the U.S. is alienating more and more foreign countries, making things increasingly more difficult for itself. I fear that these behaviours will boomerang - either soon or later.

Note: The Biden Administration is also trying to cripple the Chinese semiconductor industry with further protectionist measures — a scary development with repercussions to follow. CNN Business article.

The fragility of US debt.

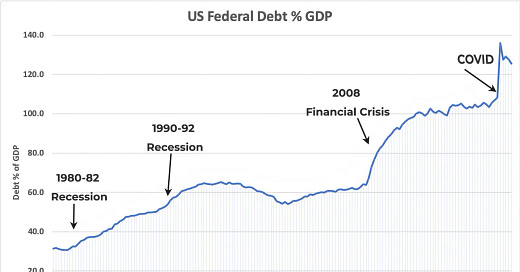

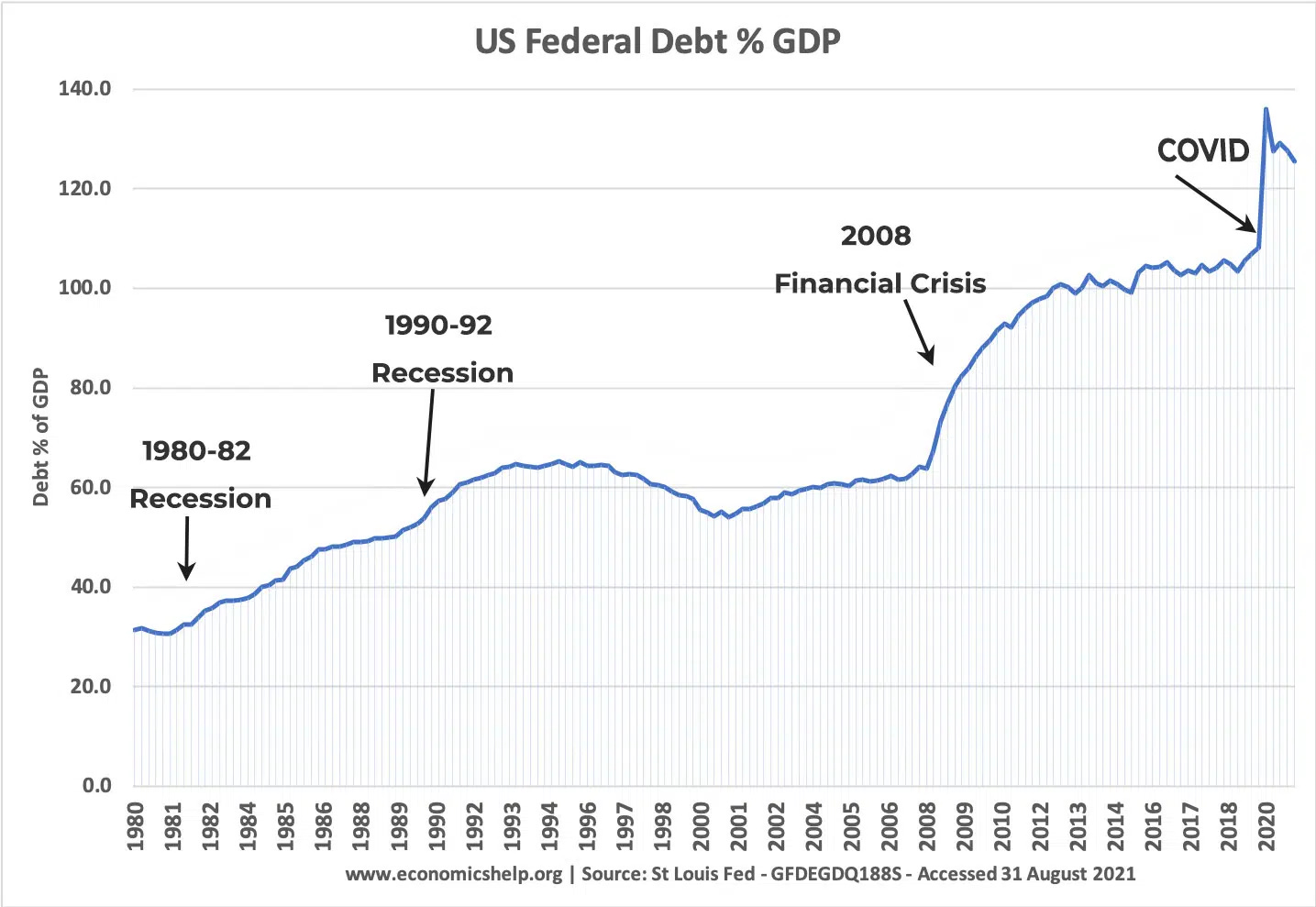

As of Q2 2022:

U.S. Federal Debt was at a staggering $30.5 trillion.

GDP was at $25 trillion.

Bringing Debt to GDP at 122%.

—> From previous piece: How did we get here?

One could argue that a Debt to GDP ratio of 122% is OK - not tragic, the U.S. will pull through. “Yes Debt is going up but so is GDP!” they respond.

Well yes, but the debt is fixed, the GDP isn’t. And therein lies the problem - that the risks are to the upside. See below what happens to debt levels in recessions or material negative events like global conflicts, wars or pandemics.

The debt will continue to climb as long as the U.S. are in budget deficit territory - it’s simple math. The U.S. is very far from balancing the budget, and spending tax revenues willy-nilly with no side of the political spectrum willing to recognise that spending must be reined in is not gonna balance the budget.

But how can the budget ever be balanced when annual interest payments on the debt are ~$600 billion (~2.6% of total GDP) and military expenditure is $900 billion annually (~4% of total GDP).

And if that were not enough, the U.S. economy has been flying high on the tailwinds of cheap money, low inflation and a booming tech sector (as explained above). All these trends are reversing - now what?..

Possibly that GDP will stay stagnant, but debt will continue to rise..

Conclusion

The U.S. as well as most Western countries will need to engage in a number of material policy changes and structural reforms in order to stay afloat going forward. Don’t expect the future to unfold like the past, it won’t.

I will continue to observe these trends and developments, and seek to inform you of my findings right here on Philoinvestor.

If you liked this piece please share it, I would be grateful.

Sincerely,

Philo 🦉