What the hell is happening? August 2022

Recession obsession. Mythical market bounce. Energy security and the EU.

This is the fourth post in the WTHIH series. The previous one was sent July 7th.

In the previous WTHIH (What the hell is happening), we talked about the progress in taming inflation and the energy narrative burning out.

We also predicted Draghi would be out as Italian PM and that the ECB would indeed hike rates even if money markets and pundits stated otherwise.

In Mays’s WTHIH we said "Now is the time" for the long-term investor looking for bargains.

So what’s a recession? 🙄

Officially, the NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

Mostly everyone else defines a recession as two consecutive quarters of negative GDP - and we’ve had exactly that in the US.

But the definition isn’t the problem - it’s what it stands for… 👇 🇺🇸

In the political debate arena; It stands for a failure of Joe Biden to shield the American economy from geopolitical events. In fact, the definition of recession is so political a feud has broken out on the Recession article on Wikipedia!

Should you care?

Yes - if you are a politician or an economist. But this debate should not infect the minds of investors. Maybe if you could predict a recession before it happens with certainty. But an “after the fact” recession should not cause you to sell your holdings. If anything talks of recession should motivate the long-term investor looking for bargains to start looking harder as low prices create opportunity!

But all this recession obsession caused you to miss out on this dip and rally…that many call a bear market rally. 🐻

That’s what I have to say about that. Let me explain further:

You don’t KNOW if it’s just a bear market rally, we are all just making guesses. Some make educate ones, some make stupid ones. But if you think you can predict markets to buy the bottom and sell the top, it’s you who is the sucker on the poker table.

A few words on inflation and its effect on business

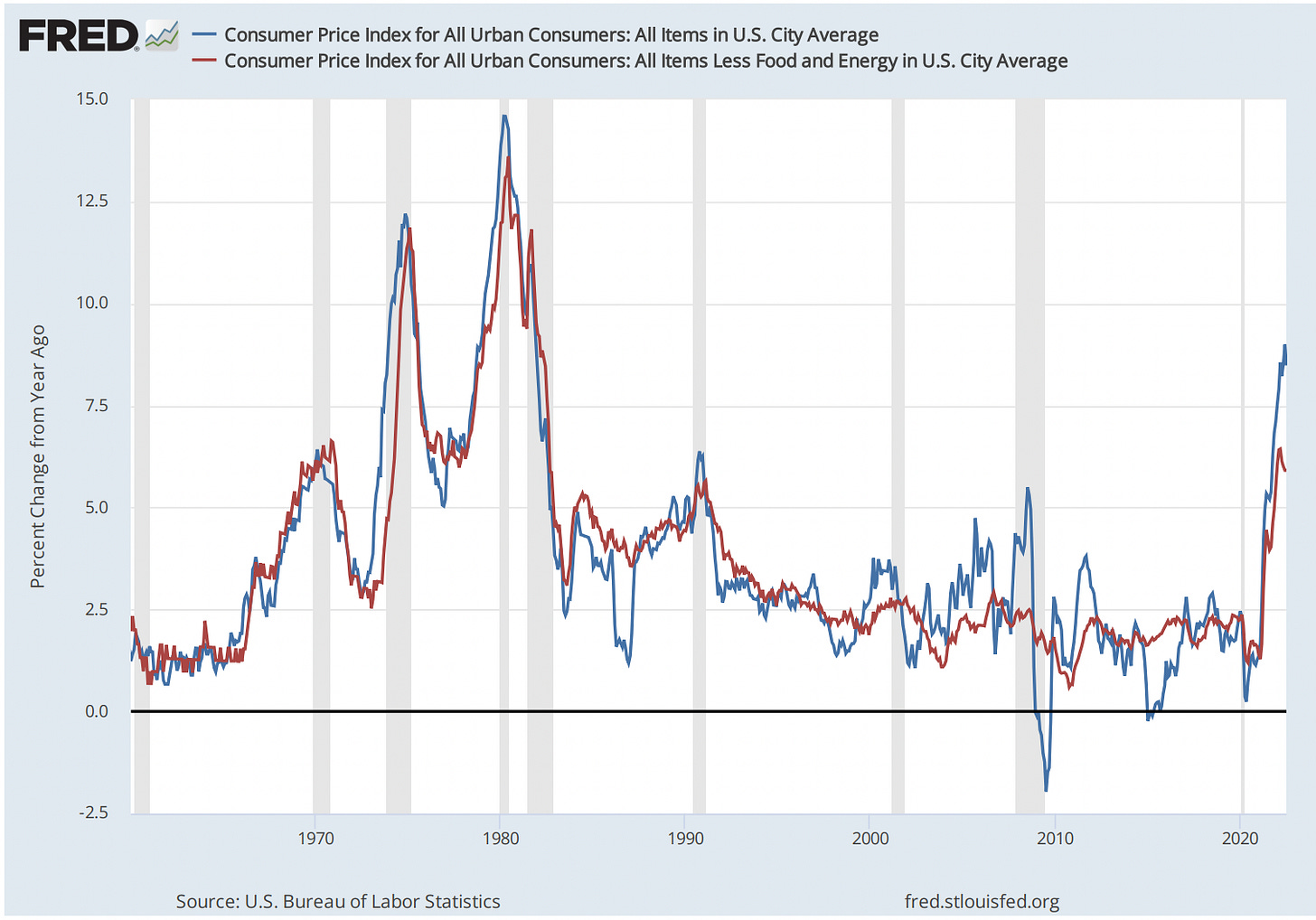

As per previous WTHIH pieces, inflation and inflation expectations have peaked and moving down. The post-Covid/post-War inflationary shock is losing steam as input cost prices are fading, rates moved up and economic contraction is taming the pressure.

But inflation is sticky, this means the majority of inflation will not reverse back to previous levels. To illustrate:

We had high inflation, lagging inflation, low inflation — but we never had negative inflation (except briefly).

The implication of this is that currencies lose value relative to goods and services consistently over time. Sometimes fast sometimes slow, but with near certainty they do.

Inflationary shocks are coexistent with material economic events, making navigating them even more difficult. But don’t be blindsided.

Economics and economies are complex and inherently unpredictable hence you cannot predict inflation. Do you need to? I say no.

As long as you can find assets with superior characteristics that will create value over time (regardless of inflation), and you can buy them at a good price — then you are good to go.

The effects of spiking or crashing inflation on the performance of companies is only short-lived. Do not mindlessly extrapolate the quarterly performance of a business that underperformed because of inflationary pressures to oblivion. The short-term is not the long-term and every case is different.

The Mythical Bounce

A debate has been heating up as to whether the Fed will pivot soon, arguing that if the Fed does not pivot then there’s no reason to buy equities. This pivot lies on inflation and whether it would come down consistently towards the 2% target.

The old adage “Don’t fight the Fed” was gaining followers and adopters, preaching to anyone that would listen that you should not buy equities because of the Fed and actually be short in case markets continue to crash from here.

The funny thing with these adages and commonly used phrases is that they are used and adopted much more when their advice has been working - than when it has not been. And by sheer mean reversion, when they have been working the most is when you should fear their reversal the most.

JUST Short Covering?!

Many seem to be cancelling off this rally for massive short covering across the board, insinuating that once the short covering is done markets will fall over once again. If only life were that simple…

Every market crash has an increase in short interest, and every subsequent rally has short covering. Trying to excuse away general market developments for just short covering is a trap.

And if you like adages I have another one for you.

“Bulls make money, bears make money, pigs get slaughtered.”

Is the EU going to end? 🇪🇺 💶

The crash in the Euro brought out many inflexible and “final destination” Euro bears jumping on the bandwagon of the European Union’s demise. It’s important to understand that currencies move in trends but they also mean-revert. You have to be flexible in your thinking.

I too have pointed out the shortcomings and failings of the EU many a time - here, here and here - but the Euro/USD wasn’t at parity then and Europeans are now forced to make better decisions as they find themselves at the brink. When the ECB signalled that it would hike rates, I started to look for clues for a reversal.

But don’t look for any straight answers, it’s tricky!

🇮🇹🇮🇹🇮🇹

A month ago the narrative was that Italy would/could be ejected from the Union. And together with fears of recession and the German energy issue, the Euro seemed to have no floor!

But now the leader of the FdI (Fratelli d’Italia), Giorgia Meloni together with a coalition backed by Salvini’s Lega and Berlusconi’s Forza Italia, says she is committed to structural reforms if elected PM. (Chances are she will be by the way)

This means no Greek-style episode for Italy and Europe this time around. And the infrastructure that the EMU (European Monetary Union) has created since the Greek debacle 10 years ago has made it much stronger to react to any market-related dominos.

Italy does not want to enter an ESM programme so it will do what is needed to calm the markets and make its €2.75 trillion government debt (>150% of GDP) sustainable again.

Now on to the next problem 🇩🇪

🇷🇺🇩🇪🇫🇷 The blame game is gaining momentum. After sanctioning Russia and announcing plans to completely turn away from Russian energy resources, Europe is complaining that Russia is weaponising energy and threatening them with gas flow cuts…This kind of posturing breeds uncertainty for Europeans.

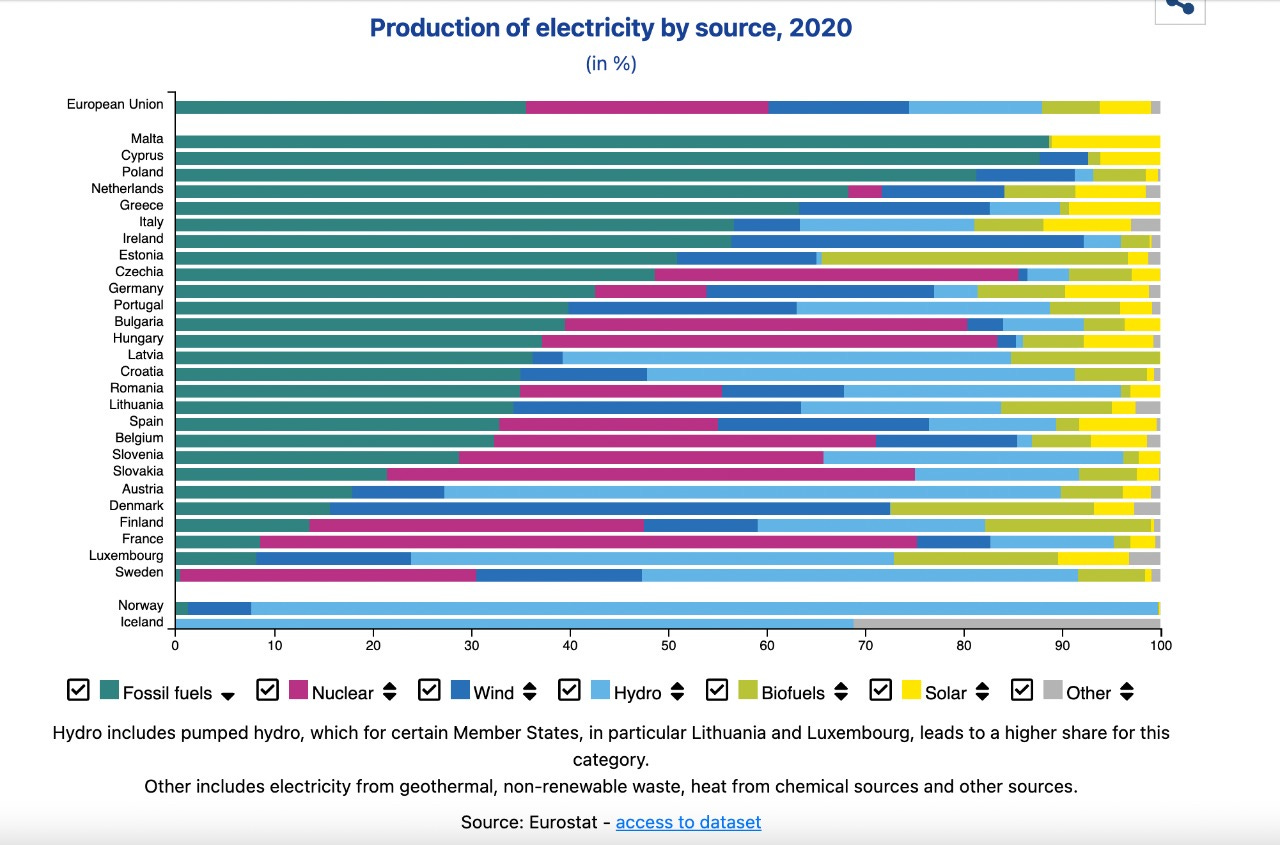

All this energy insecurity is sparking debate about Germany’s plans to shutdown nuclear energy plants by the end of 2022, putting the country in an even more insecure position: Electricity Production by Source1

Meanwhile Germany’s economy is taking the pain as the cost of energy has skyrocketed, putting German industry in a very tough spot.

Many have predicted Russia would completely turn off the gas and destroy Europe, but I don’t believe that was ever Putin’s plan. Russia just wants to send the message to Europeans that, “You can’t do without us.”

Now if this ends up toppling Scholz I don’t know, but in times of crisis the range of political outcomes is wide.

The current German coalition is made up of the Socialists (SPD), the Greens and the Free Democratic Party (FDP). These parties have historically committed to a nuclear energy exit, putting Germany in an even more precarious position right now.

The historical context of European and German politics is too long to analyse here but the gist is that this idealism and politics by the German government is breeding energy uncertainty — and the squeeze is hard.

Since the invasion, the SPD is weakening while the Greens are strengthening considerably. Let’s see how things will change as Germany is increasingly faced with energy rationing, plummeting business confidence and a recession.

Something’s gotta give - and the coalition reneging on its prior energy related commitments could be it.

A few more words on the stock market rally…

I see many being annoyed from this rally. “Nothing has changed!”, they cry out.

Nothing has changed from what exactly? Why do you think the economy is equal to the stock market with a 100% relationship?

When people look to economic figures or the general macro picture - they think they can use all that to make predictions on the stock market’s direction. We also like to use historical analogies to prove our predictions or expectations…

But reality is elusive, what happened before is something else, what is happening now is something different.

And looking to economic data to tell you what will happen in the stock market is like looking to shadows to try and understand objects.2

Sincerely,

Philo 🦉

Picks from the archive

📺 Netflix surprised in last month’s earnings when it lost less subscribers than expected. It bottomed at $160 in May and is now at $250. Pretty soon Ackman’s call to dump his holding will start to look like a mistake. My thoughts on his move at the time. My thread on the company. And my actionable research piece on Netflix here.

🛢Germany and Europe may be backed into a corner but companies with European gas assets are printing money. The last Philoinvestor actionable research piece was on Vermilion Energy a company with considerable European gas production.

🚀 If you wanted to buy stocks in this last dip but didn’t and beating yourself up for it, this Mindset piece may broaden your mental model toolbox.

💥 Are you into crypto by the way? Read my Dump Your Crypto piece from last October. And my tweet which called this recent bottom. I explained my thinking process briefly with this meme.

Image explaining Plato’s Allegory of the Cave.