This is a Netflix world, and we are all living in it. Part #1

Trends, themes and dynamics in the media space. Disney's woes, Netflix gains? Survival or reckoning for legacy media? Will the DTC pivot ever work? Big Tech lurking..

Don’t just stare - SHARE! 🦉

I see you there just lurking and not sharing… 😤

The Philoinvestor referral program has been launched. Start referring your friends and get complimentary subscriptions now.

See what others had to say about Philoinvestor here and access research pieces that were previously paywalled.

Find Philo on Twitter here.

In May of 2022, I sent out a Netflix-focused research piece entitled “Content is King, but Distribution is God.” After Netflix returned 100% since I wrote it, I removed the paywall for everyone to read.

~20 days earlier, Ackman’s Pershing Square dumped their whole Netflix position on Q1 results after-hours. Ackman came out with a whole letter on his rationale, trying to explain to his investors why he lost >$1 billion on this move.

I was clearly annoyed by Ackman’s short-termism and his audacity to excuse his move as some sort of long-term thinking, so I wrote this short thread on Twitter (now, X). THREAD.

Content is King, but Distribution is God

In the piece I touched upon the Netflix story, how it evolved to be the biggest distributor/content-creator in the world, and how it has certain advantages that its competitors just do not have right now — or can never get. The general idea is that path dependency matters.

I talked about Legacy Media and how their pivot to a DTC model could nearly kill them and warned against investing in those companies.

16 months later and this is the performance of Netflix Vs the Legacy Media Cos.

Netflix +120%

Legacy Media Companies

Disney -23%

Warner Bros Discovery -37%

Paramount -53%

📺 This is a Netflix world, and we are all living in it. 📺

In the past ~20 years, the media space has been quickly morphing into a sort of beast that went through radioactivity-induced gene mutation. But by the time you put your finger on it — it changes to something else.

So, to give you context about the space and make it more understandable, I will break it into themes and trends — and will expand on them here.

Who are the major players in the space?

Streaming-Only

Netflix

Legacy Media

Disney

Warner Bros Discovery (WBD)

Paramount

Peacock

Big-Tech

Apple

Amazon Prime

Youtube TV (owned by Google)

The Big Picture

The big-big picture is that Netflix is thriving and leading the herd, Legacy Media is being squeezed from all sides while Big Tech is sitting put and basically (more on that later) has all the time in the world. Let’s drill down into the details.

Netflix is the only Streaming contender that doesn’t have a Linear TV segment, while Legacy players are being tacked down by it. Profits from Linear is still the only game in town for these Legacy Media behemoths (with the exception of Theme Parks).

Trends & Themes

A pivot to DTC.

Big Tech.

Cord Cutting.

An economic indifference for Video from Cable companies.

An increasing “value focus” from Cable companies.

Price competition between Legacy and Cable.

Legacy surrendering to Cable.

Cost Cutting.

Asset Sales & Delevering.

Wokeism and intervention into culture and politics.

Weak TV Advertising Revenues.

Secular decline in Linear TV.

SVOD transitioning to AVOD.

The Weaponisation of content & exclusivity.

Weak balance sheets and big losses.

However, the MAJOR themes and trends are 1) Cord cutting 2) The pivot to DTC 3) Secular decline in Linear TV and 4) Weak balance sheets.

Let’s start from the top.

Direct to Consumer — a false prophet.

With the example of Netflix, and the massive growth in subs and decent ARPU (Average Revenue per User) — Legacy Media Players (“Legacy”) became energised to jump in the ring too. But they forgot to count a few things. First, Netflix was a Streaming-first and Streaming-only company. Legacy was tacked down with their declining Linear TV segment, large and inflexible business structures, massive debt loads and most importantly their lack of scale.

They got carried away with their sizeable content libraries and thought content and franchises was the name of the game. Well, it turns out content may be King, but distribution is God.

Legacy launched with cheaply priced DTC offerings to attract buyers, and by the time they realised they have to manage for revenue (obviously, paid subs * ARPU) they lost billions and their equity values (and balance sheets) took a hit.

As an example, for the 9 months ended 2023, Disney lost $2.2 billion in “Direct-to-Consumer” and $2.5 billion for 2022. Annualised, that runs at >$3 billion losses a year. Now, you can’t argue that Disney is making losses on DTC because it hasn’t reached scale. It is the second largest Streaming service after Netflix, with offerings such as Disney+ and ESPN+..

So now Disney realised that it’s far from scale and started raising prices for Disney+ to put some wind under their revenues. Right now their ARPU isn’t looking good while their paid sub growth has stalled. CHART. They are 20 mln paid subs down (to 147mln) from their peak 3 quarters ago.

Every streaming name ex-Netflix is still fighting for break even on their DTC segments. More on the specifics of each name later.

BIG TECH — the sledgehammer.

A major disruption force, big tech entering the media space has caused a cascade of effects — but mostly negative!

Big tech has seemingly infinite cash, trillion dollar valuations, captive ecosystems with hundreds of millions of subscribers and basically their distribution networks already in place!

It is a tragedy that legacy media is forced to compete with these behemoths. I think one could argue that their DTC offering pricing is “predatory pricing” and hence non-competitive.

Apple arguably has the most fire power to make a massive foray deeper into media by purchasing IP or forming a major partnership with a Legacy company.

But for the moment it’s lurking in the background with not much content or oush for growth, as Apple+ is not its priority.

Amazon’s offering APV (Amazon Prime Video), is one of the first entrants in the streaming space. The company has Amazon Studio and also bought their own Hollywood Studio 2 years ago — MGM, for $8.5 billion.

Amazon uses their owned studios to produce original content and also license content to beef up their libraries for their subscribers. By the way, Amazon Prime users get Video for free, which is included in the Amazon Prime bundle.

I point this out because the profit motive may not be their only incentive to offer streaming. While in the case of Legacy media — a pure profit motive drives their decisions. This has other consequences that we will discus later. (Unfair Competition)

Google launched Youtube TV in early 2017. Youtube TV is a vMVPD (think Charter Spectrum, but “virtual) and it aggregates a selection of Linear TV channels, on-demand content and over-the-top (OTT) content from companies such as Paramount and WBD.

Google doesn’t create its own content but its been active in obtaining sports-related programming, e.g. offering NFL games.

Cord Cutting & focusing on value.

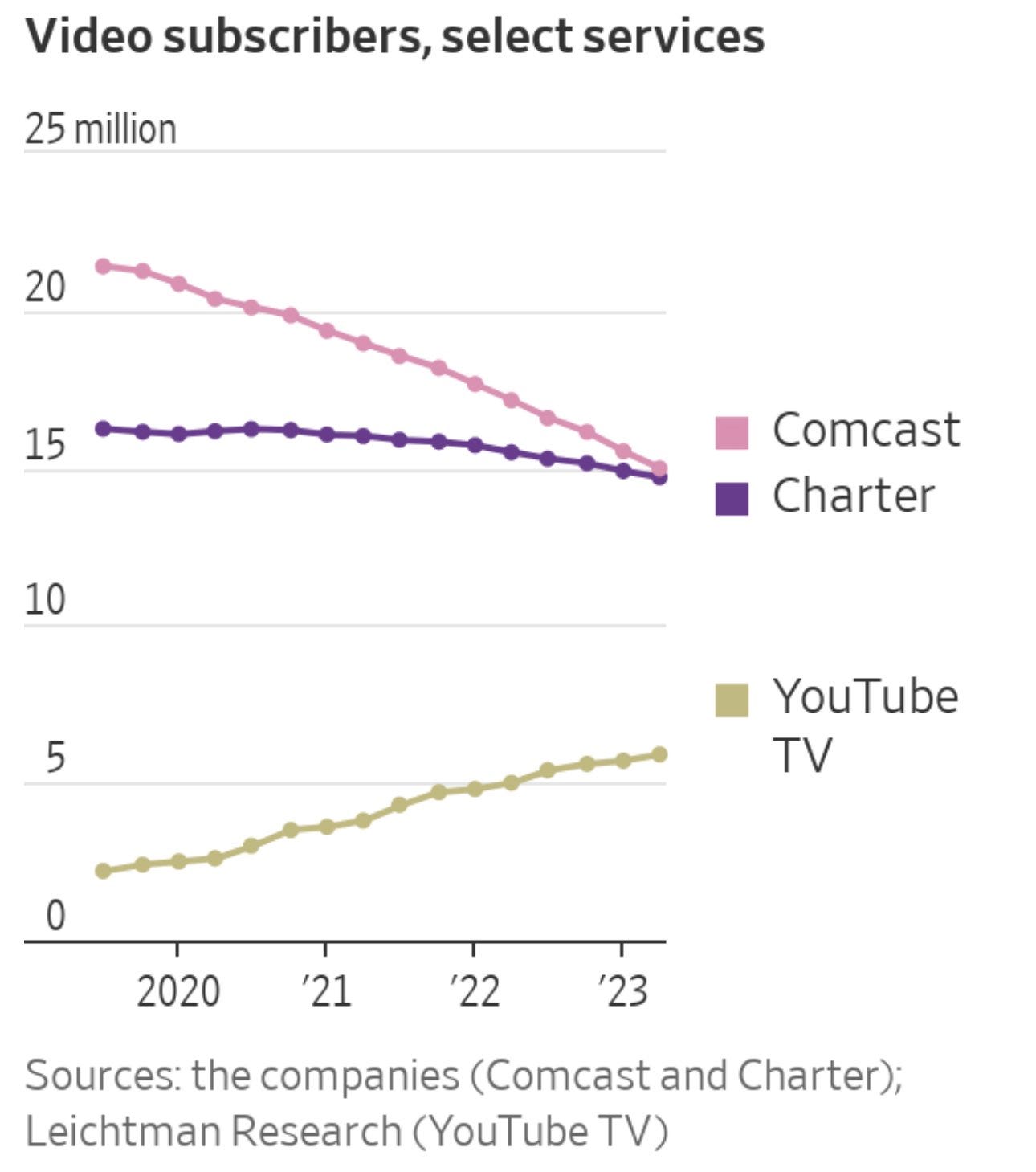

Cable Companies like Comcast, Charter and Verizon are seeing a fast reduction in their video subscribers. Video content is simply moving from cable and satellite to the internet. This is shifting economics under the hood for these cable companies and forcing them to adjust to a new business model — one that centres around broadband internet as the sole source of profitability.

It’s this trend that resulted in the recent showdown between Disney and Charter — where Disney wanted to proceed with the old model and just increase their prices, while Charter wanted a brand new model of cooperation or nothing!

Charter even published a presentation explaining their rationale. The discussions went for many days but in the end a deal was struck. In short, Charter made the following points:

You are using our networks and overcharging our customers to achieve your DTC ambitions — while we are losing customers and worsening our value proposition.

We want more flexibility in what we bundle and want to forget about “tying” agreements. We can’t charge our customers things they don’t consume.

We are either moving into a Hybrid model or we are dropping our video partnership and come whatever may.

Besides, we are “economically indifferent” to Video at the moment because we only make money from Broadband.

We are throwing you a lifeline and giving you an extra distribution network for your DTC offerings, but we will pay you a wholesale price for it.

Up to you.

Legacy surrendering to Cable

In the end, Disney conceded to exactly that and a deal was struck. Charter has made it clear that this is the new model that they intend to follow for all their new programming agreements coming up. This new state of affairs is transformational for Legacy as well as Cable — the latter now stands a fighting chance to beef up their value propositions and reduce the pace of cord cutting…

…And Broader Implications.

I think there will be a number of cascade effects from this. It shows that Disney is pulling back from the pure-DTC model, because they need to prioritize staying alive..

This deal is a realisation that you can’t go pure-DTC when you rely on Linear TV revenues to bridge the gap between losses in DTC and enough scale to become wildly profitable! Note: Disney DTC is still loss making while being the second biggest Streamer in paid subs after Netflix.

This is because their ARPU (Average Revenue Per User) is very weak. Disney+ Core ARPU stands at $6.58 while Netflix achieves twice that. I believe Disney made the mistake of launching Disney+ too cheaply thinking it would kill Netflix (lol!) and get it out of the way.

In turn what is happening is that Disney can’t achieve escape velocity for DTC while setting fires in its Linear TV programming arrangements because affiliates (that pay Disney all those fees), feel that they are being cannibalised. Which they are.

Disney still doesn’t have a clear strategy to where it wants to go, and this is another reason why the share price will continue to fade and linger. This confusion and squeezing of Legacy Media is causing them to react by cutting costs and selling assets to 1) reduce overheads and 2) robustify their balance sheets.

Remember: It’s not enough that Legacy is facing existential issues, they also carry a lot of debt which will increasingly be a problem down the line. In Part #2 of this thematic series we will continue looking into the trends & themes that shape the industry until we have enough context to start drilling into specific companies one by one.

"Skate to where the puck is going to be, not where it has been."

-Wayne Gretzky