The Spell of Donald

A gedanken on market efficiency and themes in play. Deregulation and Tariffs. Fading the narrative.

“Countries are going to pay us back for all that we’ve done for the world.” —DJT

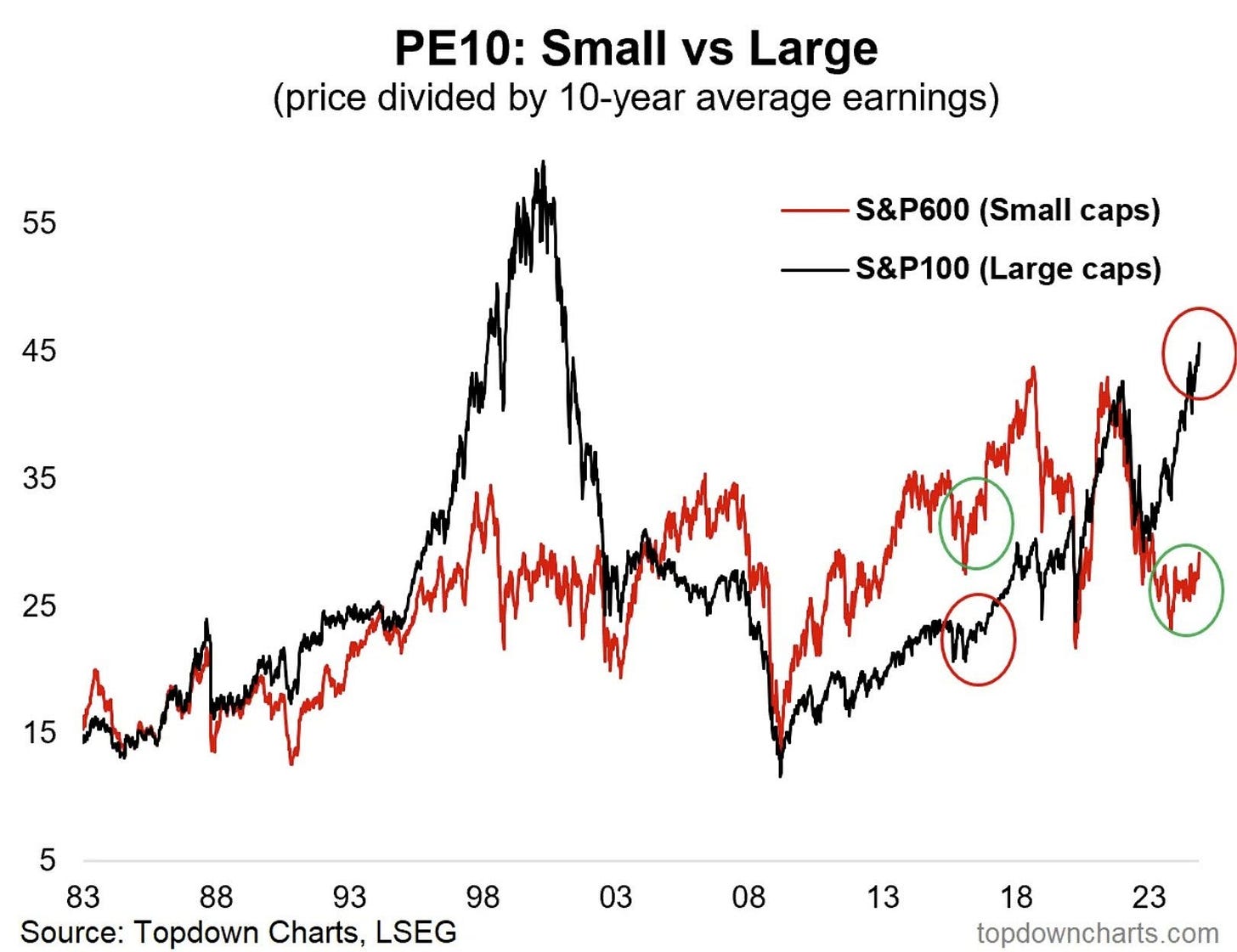

We are seeing blowouts in Crypto and Small Caps as a direct result of the Trump election. The hype is once again real in Cryptoland, and the S&P 600 is back to over-performing the larger caps.

The rhetoric from the incoming Trump administration is super-bullish and markets are reacting accordingly.

Let’s breakdown all the themes into buckets to see how they have reacted and to gauge whether the post-Trump financial market puzzle makes any sense — and if we can see what the complete image would look like.

Let’s start with Crypto…

Trump is pro-Crypto and markets reacted accordingly. On that note, Breakout by Philo served well its purpose of forcing us to follow markets with a bias on technicals, rather than letting our own bias infect our thinking.

Check out this technical commentary on BTC and ETH in Issue #7 here, to see what I mean.

BTC is up 33% for the month. ETH is up 32%, but down 30% from its peak of 2021.

Why is that?

Because of the different roles they play in the Crypto sphere. BTC is seen as a reserve asset, a replacement and substitute to the Dollar as well as a hedge against inflation.

This is why the digital asset performed well even before Trump was elected — as sticky inflation and low real interest rates kept worries on inflation on the up and up.

ETH on the other hand is more a play on broader Crypto adoption and Crypto applications (Remember NFTs and De-Fi?).

A long-term Philoinvestor follower reminded me of my piece in late-2021 which effectively called the peak in the Crypto run of 2021. For good historical context on the space, read this.

While Crypto adoption has definitely not been as expected, there are other angles to the space which keep it very much alive.

For starters, let’s look into the idea of a Bitcoin National Reserve before we move to tariffs, trade wars, the Dollar and Small Caps etc.

A Bitcoin National Reserve?

Senator Lummis (R-WY) introduced her Bitcoin Act this July, which would mandate the purchase of 1mln Bitcoins by the US and hold it for 20 years. Total Bitcoin supply is at 21 million.

“We have the money now, but we will no longer be holding it in US dollars and assets that are designed to debase at least 2% per year, we’ll be holding it in an asset that will grow in value.”

I hope you can see the joke in this. This used to be the position of early Bitcoin adopters, those who fought for an alternative to the US dollar away from the control of the Fed and the government.

But now it seems Bitcoin has come so far that even a US Senator is talking up Bitcoin as an alternative to the dollar! She seems to be suggesting that the dollar is “designed” to debase while BTC will grow in value. Nice…

Ignoring how much time it would take for this law to pass and the “Strategic” Bitcoin Reserve to start buying coins — BTC is already on a tear, and could very well hit $100,000 on hype alone.

Would I personally buy this after the multi-month consolidation we talked about in Breakout, well, already broke out? No. I could see this easily re-testing $70K.

US Dollar

Remember this chart?

Well, the DXY bounced off the support line (rosé crayon support below) and is still rallying. Things that helped the Dollar in this trend:

The Japanese walked back rhetoric of another rate hike, LOL!

German coalition collapsed right after Trump won, putting Germany and the EU in even more of a vacuum in power.

Trump win sprinkled some pro-growth feelings in markets, pushing the Dollar higher.

Treasury yields spiked bigly, widening the rate differential for the USD Vs the rest.

But the DXY is at 2-year highs and buying Dollars now means you are betting on a breakout of that trading range with no complications. I prefer to wait for better opportunities.

Remember: I went long USD/JPY literally at the bottom of that range — much better risk/reward.

Gold

Many are asking, if Bitcoin is rallying then why is Gold dropping?

Are they not both part of the inflation hedge trade? Kind of yes, but there are other things happening.

The Gold rally was/is predominantly led by global Central Banks stocking up on the yellow metal and households primarily in the East trying to shield themselves from further disasters in their currencies. Only Gold is safe in such a scenario.

On the other hand, the rally in BTC was led by Bitcoin ETF approvals — giving rise to direct coin purchases — spiking Bitcoin ETF prices — bringing in more purchases via ETFs and forcing market makers to buy Crypto direct.

Now, Crypto is spiking as the Spell of Donald is being unleashed on financial markets while Gold is selling off.

Is the inflation trade no longer on? Is the geopolitical disaster trade no longer on?

With a Trump victory — the market doesn’t want to be long safe havens (Gold, or even Treasurys) because they expect above-average growth which would affect risk assets positively (i.e. Small Caps).

And as the market is taking a wait-and-see approach to what the Donald will actually do, it’s a great time for Gold to correct a bit.

Sovereigns & Inflation

The market believes that a Trump agenda is better for stocks and worse for bonds. This is because Trump is signalling less taxes and de-regulation —which is pro growth and bullish equities.

On inflation, the narrative is that Trump will be more inflationary than Biden, due to the following:

Calls for a weaker Dollar.

Tax cuts that will eventually increase the deficit…

Impose supply shocks by raising prices of imported goods via tariffs.

And labour shortages due to mass deportations.

I note that one of the runners up for Treasury Secretary is Scott Bessent, which I have referenced several times here on Philoinvestor.

Bessent believes that this is the last chance for the US to turn the ship and save itself from a vicious cycle of excess deficits and unsustainable debt.

I don’t know if Trump will be able to do all that — in fact I don’t know if he will be able to do ANY of that!

MORE OF THE SAME — De-Regulation & Tariffs

One of the main reasons that stocks exploded post-Trump win is the expectation that a wave of de-regulation will unleash economic growth and lift all boats.

Donald is also promising a massive wave of tariffs on goods coming in from China — as a way to force their hand and get factories back to the USA.

This is nothing new, the tariffs put in place under Trump 1.0 were actually extended by Biden. Now Donald is talking about more tariffs, with the rhetoric that everyone will once again work with the US.

Well, if the USA was competitive enough — maybe those factories would have never left in the first place. The USA needs to get back its competitiveness, not engage in one-sided economic protectionism which benefits a few businesses to the detriment of everyone else.

—> This is a great explainer by Professor Wolf on the effects of tariffs.

By the way, tariffs and protectionism are a tit for tat. Everyone will responds to more tariffs, with more of their own. This should be obvious. There is no NET benefit to society.

The Small Cap Rotation

That being said, it was about time Small Caps breathed a bit from >10 years of getting absolutely destroyed by Big Tech.

The delta in the valuations of these two style buckets starting around 2022. Large caps bounced back violently while small caps fell behind.

To avoid drawing the wrong conclusions from this chart, read this piece for perspective to what is happening under the surface. Specifically the part about bifurcation.

I note the indiscriminate nature of this Small Cap rally — with even Cathie Wood’s ARK Innovation ETF up 25% for the month.

Why do I say this? Because a Trump Presidency is not going to do much for this sinking ship…

The market is not efficient…

The (Painful) Conclusion

There seems to be a lot of talk about the Trump Spell unleashing years of growth and a stock market rally with it..

It’s easy to get carried away when you see everyone jumping in the party and making money along the way too. Remember that government rhetoric does not necessarily translate to real action, or even results from those actions that get executed.

Pushing the limits of de-regulation and engaging in protectionist measures via tariffs et al. does not mean Trump will MAKE AMERICA GREAT AGAIN.

As for energy: Crude Oil production in the USA is at all-time highs, and has been on the ascent for ~15 years now. There are some patches of inefficiency that can be leaned out from this Administration, but the results will be small.

For the moment — all I see is hype and animal spirits. For this reason, I am sticking to sane business analysis and cheap valuations that offer me the risk/reward I am looking for.

We will look into the important charts of the past few weeks in the next issue of Breakout. That will include AI-beneficiaries like PLTR blowing up parabolically, moves in Crypto etc. and of course our Breakout by Philo staples.

Sincerely,

Philo 🦉

Appendix

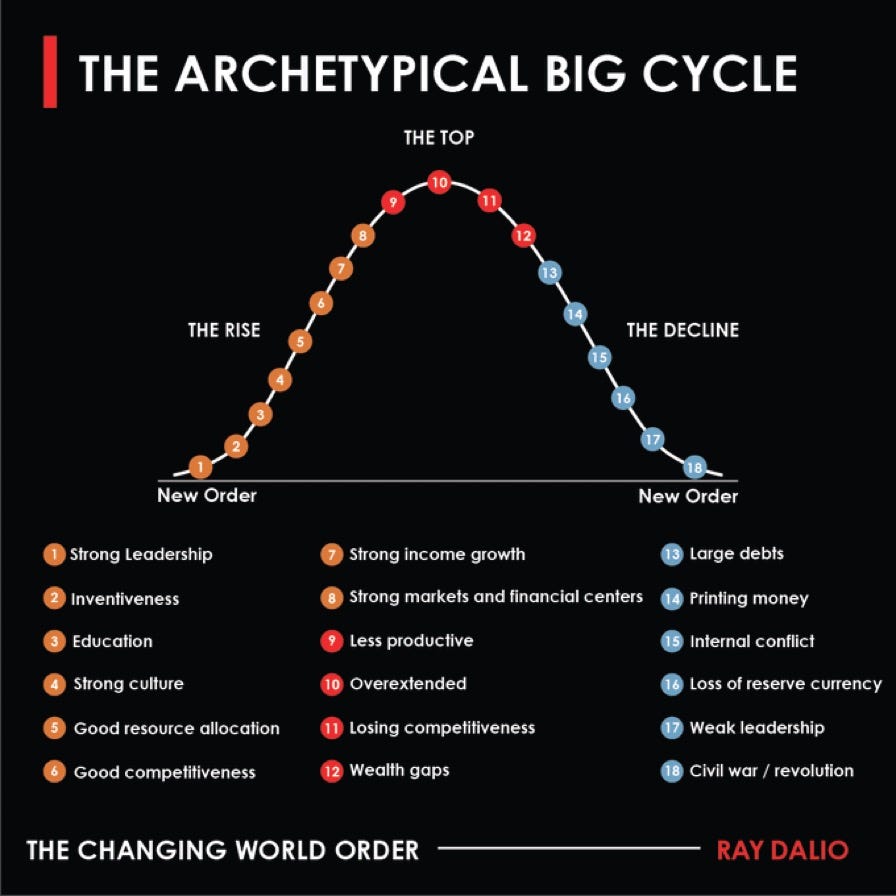

The US is at THE TOP right now.