Saudi is opening up

Vision 2023 meets Cost of Capital

Crown Prince Mohamed Bin Salman with DJT in the White House, November 18th.

The Kingdom is Open for Business

The Saudi Arabian stock market is finally opening up to foreign investors. The Qualified Foreign Investor regime is scrapped, as of February 1st.

—> This means you no longer need to comply with stringent criteria and regulations to trade on the Saudi Stock Exchange (i.e. the Tadawul)

On top of this, the Saudi CMA (the Capital Markets Authority) has alluded to the potential that the 49% restriction could also be lifted after the February 1st change goes into effect. This would mean the full liberalisation of the Saudi stock exchange.

This removes all friction from the equation, opening up Saudi stocks to the whole world. All you will need starting February 1st is an investment account and you’re ready to trade Saudi stocks.

Regulations have already been amended to allow for foreign, non-resident investors to open an account. LINK.

Why now? 🇸🇦🙏

The Saudi economy has been opening up for years, decades even — and hinting on further moves to that effect.

But the timing right now isn’t by chance: there are a confluence of factors all working at the same time 👇

To make it short, this is a structural reform of Saudi’s capital markets (and by extension its economy) in response to structurally lower revenues and structurally higher budget requirements by the Kingdom.

The Financial Front

The dividends the Kingdom makes from Saudi ARAMCO (i.e. national oil company) are falling as a consequence of lower oil prices. Meanwhile, costs for building Vision 2030 and its mega projects are in the trillions.

Saudi launched Vision 2030 in April of 2016, and has since implemented a a grand strategy to diversify its economy away from an over-reliance on oil.

—> But to diversify away from oil, you need the price of oil to stay high!

Sadly for Saudi, oil is weak right now resulting in budget constrains while some of their mega projects are met with cost overruns. Typical.

In addition to these two trends squeezing the coffers of the Kingdom — we have the trend of globalisation squeezing them as well.

The Sociocultural Front

“Ideas rule the world.” —Philo

The internet flattened the world. We see this theme globally, where the internet has reduced the friction of information dissemination to nothing.

In today’s world: everything is everywhere and everyone knows everything.

The more closed the country, the more attacks it suffers. And so, one must adapt or die.

Saudi’s younger population is being exposed to global culture (lifestyle, opportunity, consumption) via social media and the internet…

This results in a divergence between what the people now want and what Saudi, in its current state, can offer. They compare themselves and their lifestyle with what they see on Instagram. This creates a need for change.

This need for change creates the pressure to create better jobs and to raise productivity across the board as the economy is forced to become more efficient and compete on the global stage.

What can the Kingdom do to relieve these pressures and make their people happier while adapting to a new reality?

An acceleration in the opening up of the economy (and society) seems to be the smartest move. And lifting restrictions from the Saudi Stock Exchange seems like the lowest hanging fruit.

The Global Arena

By extension, this move is part of a greater strategy to improve the standing and prestige of the Kingdom on the global arena.

The primary reason is cash flow related 👇

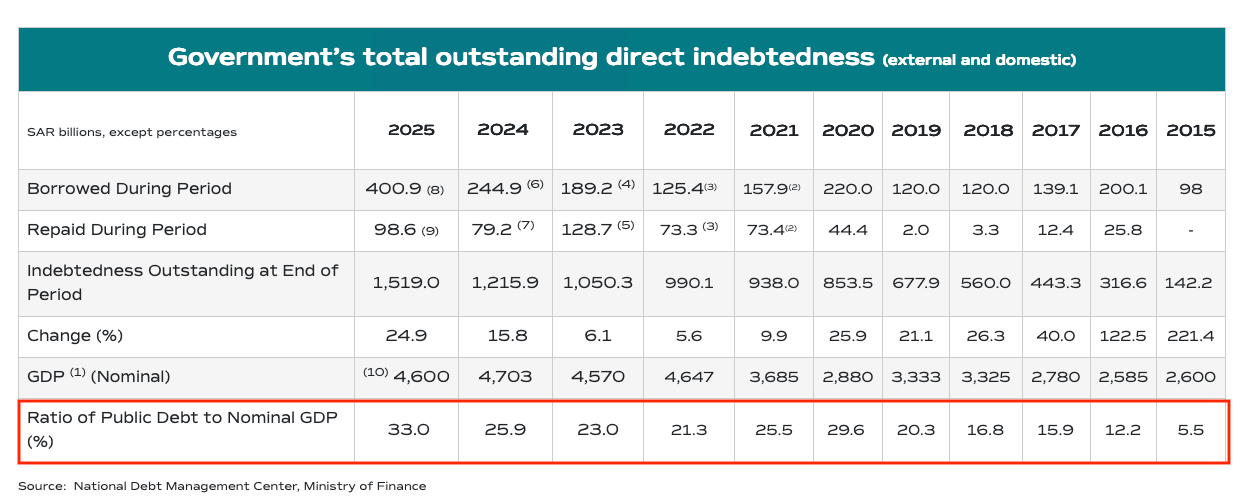

In 10 years, Debt/GDP went from 5% to 33%: Debt has 10X’d while GDP has only doubled.

The Kingdom has increasingly started tapping into capital markets to raise debt and use the capital to further its agenda (Vision 2030 etc.)

And so, optics matter greatly. The worse the optics, the more reduced the capacity of the Kingdom to borrow at good terms, and vice versa.

Saudi is strongly incentivised to open up its economy and markets, and do everything that would further their prestige and standing on the global stage.

The Opportunity

This doesn’t only allow the Kingdom to raise more money, it allows the companies in the Kingdom to raise more capital with good terms and create value.

The opening up of Saudi’s capital markets will allow companies listed on the Tadawul to potentially:

Benefit from improved valuations

Raise equity and debt from international investors

…as barriers to foreign investors are toppled

Use their valuation strategically (like American companies do)

Tadawul All Share Index (TASI)

As the name suggests, this is the all-share index of the Saudi stock exchange. It includes over 250 listed companies, all listed on TradingView here.

Sector Breakdown by Weight

Financials: 46.3%

Materials: 15.5%

Energy: 14.2%

Communication: 11%

Others: 13.1%

What’s the Trade?

“My first boss used to say the obvious is obviously wrong. If you invest in conventional wisdom you’re going to lose your butt.”

—Stanley Druckenmiller