On May 29th I announced on Twitter that I would be writing about RCI.

What I didn’t know was that The Bear Cave planned to write about RCI too, but through a negative light.. 🤔 In order to create anticipation, this is how Edwin Dorsey came out announcing his next report.

To be honest I thought Edwin was writing about Tesla, but I was wrong. Edwin came out with a negative report on RCI evoking a huge response on FinTwit.

While I respect Edwin’s work I don’t see how anyone could write a negative report on this business. You can’t come out setting the stage for a massive reveal using phrases like “…we don’t think it will have a happy ending” — and that you are concerned that management is more bark than bite.

Only to then come out and make the basis of your negativity on whether the EBITDA multiple is at 7x or 6x (!).

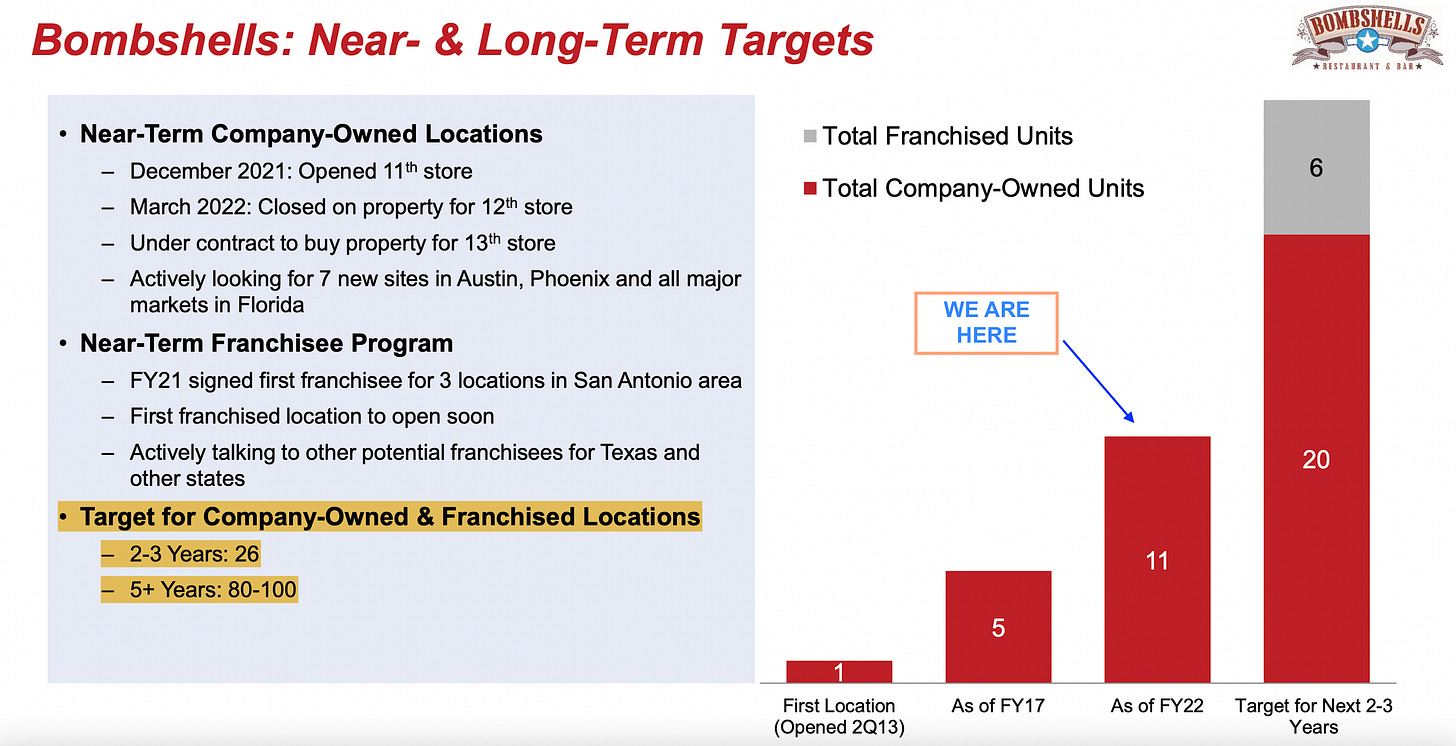

As for Bombshells that didn’t grow as management stated 5 years ago. The whole world went through Covid, and Bombshells is a new concept where management is still learning. There is always something to worry about, and mistakes do happen all the way — but that’s business. For example management started with secondary locations and found out that’s the wrong way to go, quickly correcting their mistakes.

The market isn’t giving the Bombshells prospect a serious valuation so what’s the problem? Actually you should have been giving the company credit for diversifying from nightclubs and finding other areas to allocate capital, at massive rates of return nonetheless.

Some words on Eric Langan

FinTwit pseudo intellectuals are abuzz with the red flags on RCI and its CEO Eric Langan.

Earnings Call on Twitter Spaces 🚩

Engaging in NFTs and Crypto 🚩

CEO available on Twitter 🚩

Eric has communicated openly why he is on Twitter and what he is trying to do. Further to that, RCI hospitality does not depend on any NFT or Crypto projects succeeding. It’s rather an outreach project to get people from the Crypto community in RCI nightclubs to spend money.

Finally, some people seem to be annoyed that Eric is available to speak with investors. Wait, what?

You have a CEO that has been with the company for ~20 years, owns ~7% of the company and has not sold a single share — while being open about his capital allocation strategy and his long-term plans. Eric and RCI have also been transparent about past and current problems, and what they have learned along the way.

But you, the know-it-all not-worth the tuition fees your parents paid for your education pseudo-intellectual, sees a red flag in all this and feels the urge to let everyone on Twitter know.

When you are enquired about the details of your negativity, you either don’t answer or default to empty generalities. Sir, it is you who is the red flag.

If you don’t want to invest in this kind of business, don’t invest. Do like this guy and be on your way.

Backing up for some context

RCI Hospitality Holdings (“RCI”) is a nightclub and sports bar (i.e. Bombshells) owner and operator. RCI reports in two segments, Nightclubs and Bombshells.

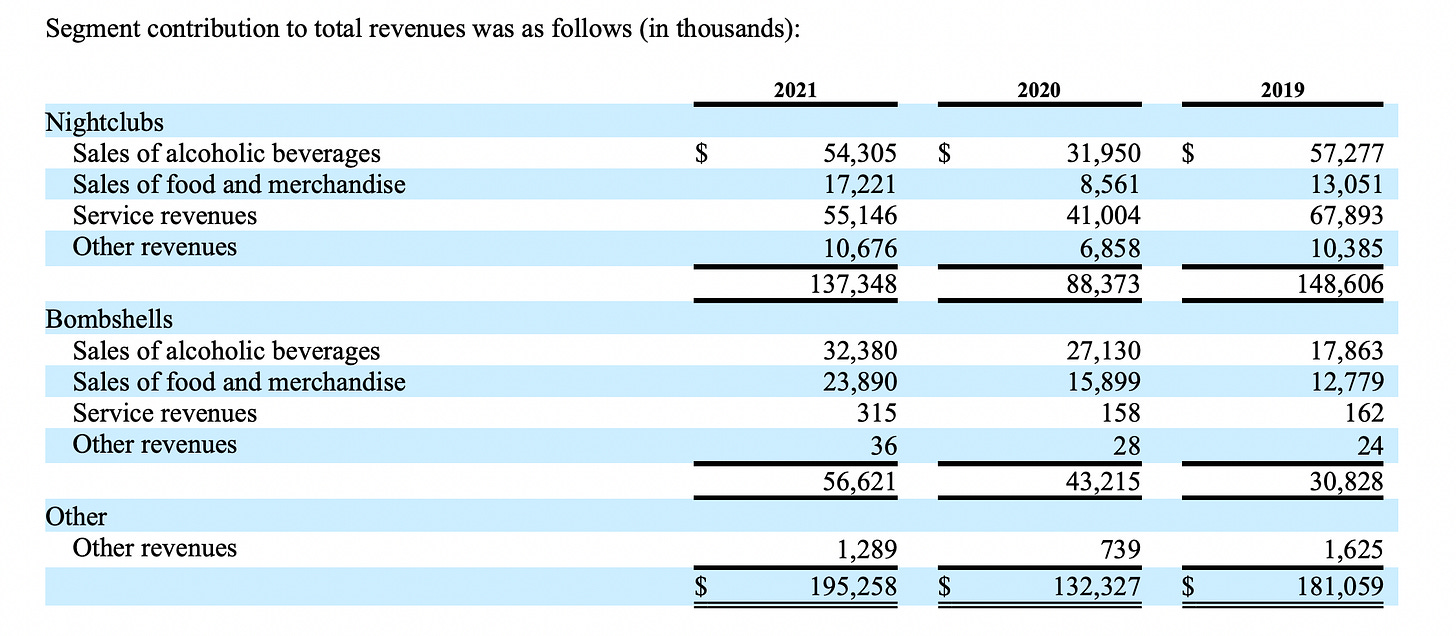

40% and 60% of Sales for Nightclubs and Bombshells respectively were alcoholic beverages. So you understand why gross margins are so high — 88% for Nightclubs and 76% for Bombshells. Highly profitable Service revenues for Nightclubs also helps!

After adjusting for asset impairments, Nightclubs delivered a 41% EBIT (non-GAAP) while Bombshells did 24%. This allowed the company to rake in FCF (free cash flow) of $36 million for 2021.

But that’s not all…

Near the end of fiscal 2021, RCI bought 11 clubs in one deal adding another ~$14mln in EBITDA (2019 numbers) for a $88 million price tag. That’s a 5X EBITDA price tag (not including the real estate) — and management believes they can earn more from these assets by cutting costs and optimising operations.

What’s the secret sauce?

RCI not only acquires nightclubs at 4-5 times EBITDA, it structures the deals in a highly beneficial way. What do I mean? 👇

RCI laid out $26 mln in cash, issued 500,000 new shares at $60/share (total $30 mln), and borrowed $32 mln to fund this acquisition. These clubs earned $14 million EBITDA in 2019 and could even earn more as management cuts the fat and boost club visibility.

But can RCI do more of these acquisitions?

The company owns 49 clubs but there are another 500 clubs that it would like to buy at the right price — so let’s just say the runway is huge.

Eric has stated that phone calls are being made and owners are looking to RCI as the designated buyer of some of these assets. The difficulties during Covid and now the fear of recession is making some owners considering to sell. This confusion is creating ample opportunity for RCI.

How does RCI plan to grow the bottom line?

Up until 2016, RCI had a weak capital allocation strategy without a strong value orientation. They were growing revenues without looking at the bottom line and committed all sorts of mistakes.

Management has attested to this multiple times.

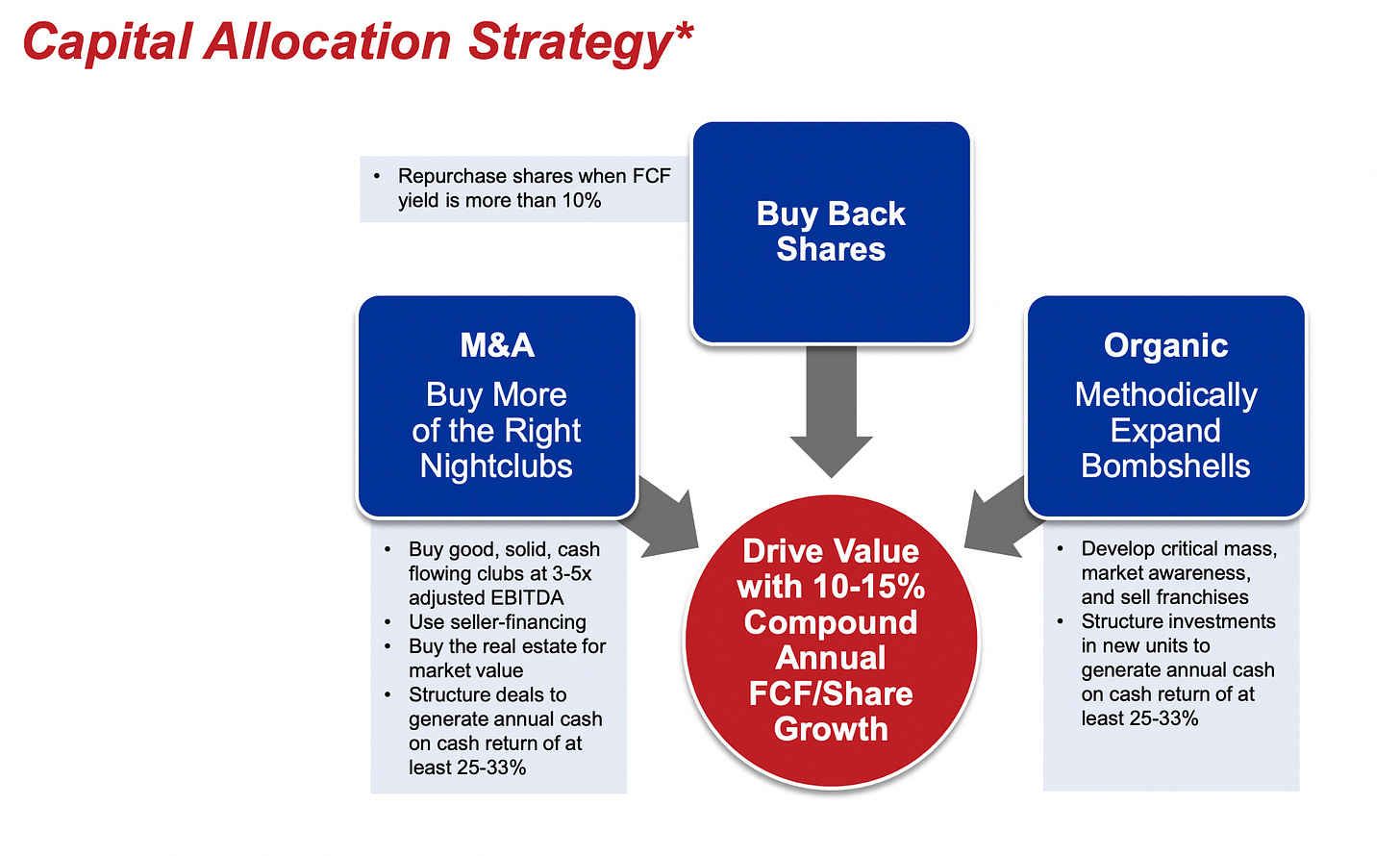

Someone pointed them to the book “The Outsiders” and everything changed since then. These rules make up their strategy since 2016:

This is how Eric Langan describes the RCI strategy:

“We would like to buy good solid cash flowing clubs at 3 to 4 times adjusted EBITDA using seller financing and acquire the real estate at market value. Our goal is to generate annual cash on cash returns of at least 25% to 33%.

Since we can’t always buy the clubs we want, our second strategy is using cash to grow organically, specifically expanding Bombshells to develop critical mass and market awareness to sell franchises. Similar to acquiring clubs, we would like to see at least a 25% to 33% cash on cash return.

The third is buying back shares when the yield on free cash flow per share is more than 10%.”

1) Bombshells

The first Bombshells was opened in 2013, and since then another 10 were developed. The target is 26 Bombshell locations in the next 2-3 years, and 80-100 in the next 5+ years.

What do the economics looks like?

On average one unit achieves revenue of ~$6 million (some are hitting $7mln) at 20-25% operating margins. That’s $1.2 - $1.5 million in EBIT per Bombshell.

One Bombshell unit costs $5 - $6 million to build, including the real estate. But the company either borrows half of that or leases the property from its owners.

Borrowing half the required investment or leasing the property cuts the investment by half, so the company only has to outlay ~$3 million in cash per unit. These are the target returns 👇

The company owns 11 Bombshells at the moment, and is opening its first franchise next quarter. RCI earned $3.5mln in operating income last quarter (Q2 2022), and the company expects to double owned unit count in the next 2-3 years.

We assume the 6 franchised units will bring in almost $2 million (6 units @ $325,000) per year in income. Immaterial yes — but still important when you can reinvest cash at ~30% returns!

2) Nightclubs

RCI has grown to 48 nightclubs as of Q2 2022, and wants to 10X that growth going forward. They aim to pay 3X to 5X EBITDA for the club, and buy the property at market prices. If the deal does not comply with their acquisition criteria , they will not proceed.

For FY21, Nightclubs achieved $137mln in sales and $56mln in EBIT (41% margin).

For FY22, the 11 clubs from the Lowrie acquisition (see above) will help proper the bottom line higher. The clubs are now back to 95% of their pre-Covid levels due to cost cutting.

But there’s further inorganic growth…

RCI plans to acquire nightclubs generating another $20 mln EBITDA during FY23. For a company selling for ~$500mln as of now, this moves the needle by a lot.

And I don’t think management’s appetite is stopping there, they have a ~500 club runway to play with.

But what happens if the company can’t deploy capital with the criteria it wants?

3) Enter Buybacks

Buybacks are one of my favourite tools to create value, as long as you do it right.

Many a company has destroyed billions in value by being overzealous in their pursuit to increase their EPS (earnings per share) via share repurchases.

Infinite discipline and patience are a prerequisite to doing this right (don’t end up like Tenneco)

But why the buyback for ants…? 🐜

Rick’s CEO is explaining that they have better uses for their cash than share buybacks. RCI is keen to only buyback shares with the cash that is in excess of capital required for Nightclubs or Bombshells growth, and always at good prices.

What about the other segments?

RCI has proven that it’s not afraid to venture into new businesses, but risk/reward is key. Bears keep mentioning RCI’s side hustles as a cause of worry for the company.

AdmireMe (an Only Fans direct competitor), a media business, an energy drink business and NFT and Crypto-related ventures. But as all these do not generate any significant revenue yet and because they cost less than a million a year to run - they are immaterial.

AdmireMe plans to launch in August, and should be viewed as more of a cheap call option for RCI. It costs barely nothing but could create millions in value for the company.

Rounding it all up

The market cap is $470mln and total debt is $178 million, giving RICK an EV of $648 million.

EBITDA was $38 million for the first six months of FY22. Annualising that comes to a run-rate of ~$80 million for the year. FY21 EBITDA was $60 million but the year is not indicative (starts October 2020, ends September 2021) as clubs were still reopening and ramping up sales plus the Lowrie deal will only take full effect within FY22.

This comes to an EV/EBITDA of ~8X for a growing, cash-flow generating business with local monopoly characteristics run by the man who built it from the ground up.

Expect the company to grow inorganically fast by acquiring nightclubs at highly accretive cash on cash returns ($20mln EBITDA targeted for FY23) and organically by continuing the Bombshells expansion.