On Currency (Debasement) Risk.

Short essay on how currency debasement destroys wealth over time and what to do about it.

“Gold is money, everything else is credit.”

-J.P. Morgan

For the purposes of this essay, currency risk does not refer to the profit & loss implications resulting from currency price changes, but rather the risk that real returns from an investment are materially lower than its nominal returns.

The only way that can happen is through inflation - a consequence of currency debasement.

Why should I fear currency debasement?

Because the economic-political system that our countries are running on defer to currency debasement as the obvious solution to all our problems.

The monetary doctrine widely accepted and used by all major western central banks & governments enables and incentivises sacrificing the long term to “save” the short term.

All major Central Banks and Governments follow the same doctrine: that the way out of debt is through growth, which is another way for saying that they plan to borrow even more. But what happens when they stop growing? The UK offers a good example:

I wrote two threads on how economic ideas create our reality. THREAD & THREAD. Must read.

How can I protect and grow my capital? A conversation on Real -Vs- Non-Real Assets.

Those that hold their capital in fixed-currency investments like non-real assets are running currency risk. Say you have $100,000 savings in the bank earning interest, or you own a bond portfolio (whether government or corporate) worth $100,000. Every year that $100,000 loses value in real terms.

But real assets, like businesses (even fractional ownership of businesses!) and real estate are not fixed-currency investments. Their cash flows are not contracted into the future and so the business or property owner can change his prices to adjust for inflation. Lets call these assets productive assets from now on. THREAD.

The value that these productive assets produce is inflation adjusted into the future. If the operating margin earned from the sale of a single espresso by the local coffee shop is ~20% and the espresso is $1 - it will also be ~20% when the espresso costs $5. Ceteris paribus.

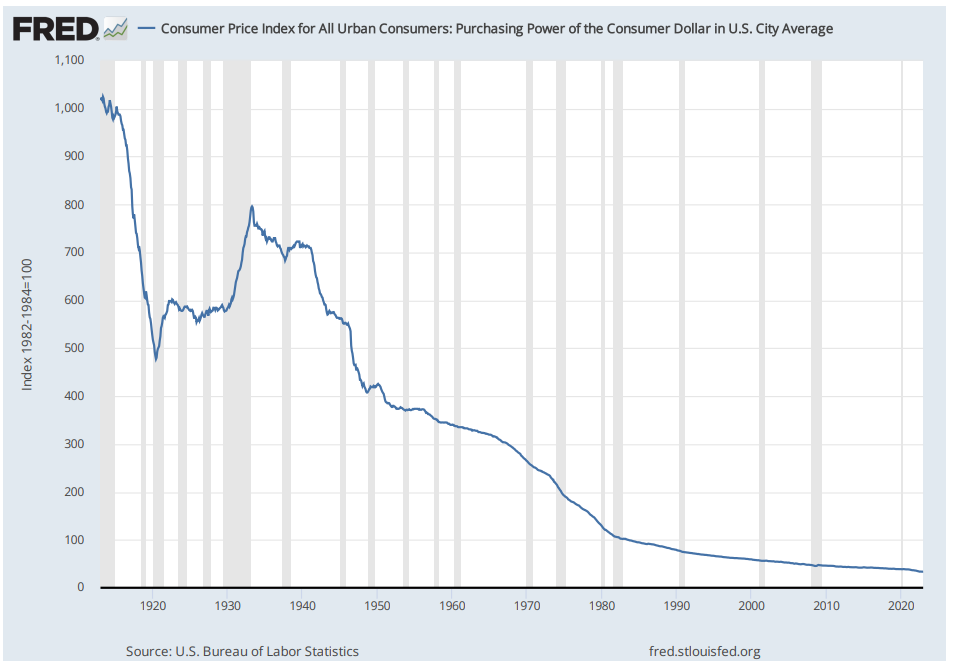

The owner of $100,000 can afford 100,000 espresso in year 0 but only 20,000 espresso in year N when espresso inflation goes up by 5X. This is purchasing power destruction.

The real diverges from the nominal more and more as time passes. While recent history might show that yearly inflation rates are mostly healthy, natural and expected - I would argue that there are scenarios that would make said rates disastrous and widely unexpected. In short, the risks for inflation are to the upside.

What are some themes that will contribute to currency debasement going forward?

Sovereign debt levels are creeping up all over the place.

Current borrowing rates are artificially low.

Quantitative Easing is irreversible.

Democracy has key flaws and leaders will never do what is needed to tip the budget into surplus, unless an external power forces them to.

Fiat currencies are not asset-backed, but they are theoretically backed by the productive capacities of the nation that issues them.

But there are risks to economic growth, as western nations are already past their peaks in their percentage share of global GDP.

More currency and less GDP = a drop in currency power.

Obvious asymmetries and conflicts of interest exist.

The system always punishes savers to reward borrowers. The sovereign is also a borrower.

Western economies are at the tail end of their growth life-cycles and global domination status.

Global military conflicts.

And much more…

I will be soon sending out two long-form essays. One on the US Dollar / American Empire and another on the Euro and the European (Monetary) Union. This short-form essay should serve as a preamble for what is to come.

Please help Philoinvestor grow by sharing it with your friends and contacts.