How I made 600% on the stock that cost Ackman $400M.

Why I had to become the opposite of a typical value investor to beat Wall Street at its own game.

It was the time of post-Covid and the lockdown stock boom was tapering.

People started leaving their houses and pivoted from spending on their sofa to spending outside — hotels, bars, restaurants — you name it.

Stay-at-home stocks had already peaked by late-2021 and started to drop in anticipation of the “reopening trade”. It was now the turn of restaurants and hoteliers to make money!

By April of 2022 shares in Netflix were down by a whopping 50% — and its first quarter 2022 results were approaching.

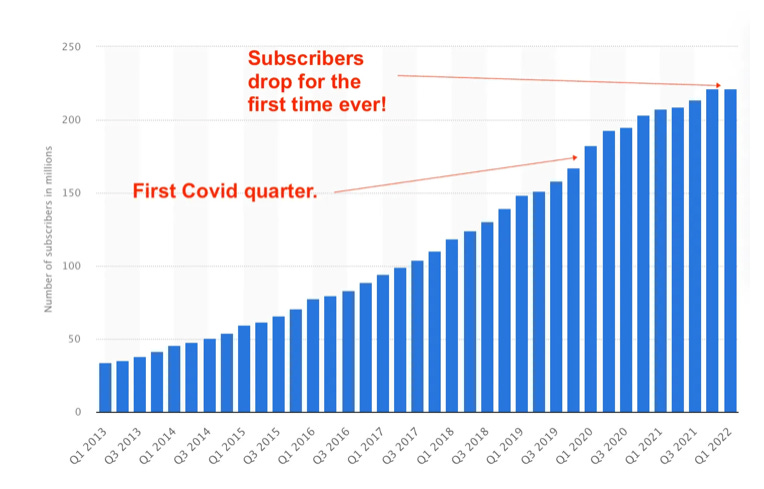

Indicated by First Covid quarter — the chart above shows the subscriber growth acceleration that Netflix benefited from because of Covid Lockdowns.

Two years later and subscribers were now starting to drop for the first time ever!

Netflix shares tanked 35% after hours when the company announced this shocking result.

I had never followed Netflix as a company and stock — but heard about it when the news hit the wires that Bill Ackman’s fund dumped their $1.1 billion position for a loss of more than $400 million.

This is the reason they gave for dumping the stock…

"While Netflix's business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company's future prospects with a sufficient degree of certainty."

Something felt off. I started to dig deeper and find out more — besides I had no idea about the sector or the company other than being a subscriber.

Mean Reversion

The subscriber binge because of Covid was bound to mean revert just a little, right?

But the market didn’t see it that way. The fear was that Netflix content was getting boring and un-engaging. Like they could not create anything binge worthy anymore. That they would never make money.

But the narrative created by the price drop — a 70% drop 2021 peak to post-results trough was now starting to hurt even more. Narrative follows price as the market adage says.

Ackman’s fund was down bad — the optics weren’t great, especially after the recent Valeant disaster for him. They decided to cut their losses and dump.

That’s when I got started.

Enter Philo

I went against the market’s narrative by writing a thread on X about Netflix still being the global leader in streaming and another one on Ackman becoming short-term and pro-cyclical.

The response? Crickets.

Meanwhile, I was conducting my research on the company and the media ecosystem to write a Philoinvestor piece for subscribers.

As I said, I had zero experience in the sector but my skills and capabilities as a generalist investor allowed me to not only get up to speed — but add dimensions and angles to analysing Netflix that others could not.

Note: You will find that most of the skills in investing and managing money are transferrable.

After concluding my research, on May 14th 2022 I sent out “Content is King but distribution is God”.

That was the title I chose for my piece on Netflix, and what a fitting title it was. Fast forward 3 years and the stock hit a high of $1,320 in late June — up 600% from the time I sent out the Netflix piece.

Ackman’s fund lost $400mln when they sold — I am up 600%.

Same stock. Opposite perspectives. Drastically different outcomes.

Going against “Value”

Traditional value investors would have run from Netflix, and they did.

It was expensive, the streaming market looked saturated, and it had just lost subscribers for the first time.

Everything in the value playbook said 'avoid.'

But I realized that in 2022, you couldn't analyze Netflix like a traditional company. This wasn't about P/E ratios and book value.

This was about network effects, content moats, and global streaming dominance - concepts that don't show up in Graham & Dodd.

More importantly, it was about optionality.

While traditional value investors were looking for cheapness — I had to see beyond that oversimplification to see the opportunity.

The Method

But the truth is — finding opportunities as a generalist investor is not a linear straightforward path.

Great investing is part alchemy, part art.

You have to blend multiple disciplines and perspectives that put you in the mental state that just “sees” these opportunities.

There are really no shortcuts in your path to becoming a master-investor — except one. Having a mentor.

In that 2-minute audio, I talk about why having a mentor accelerates everything.

Last year, I decided to create Philo's Academy — an investing education platform that builds investors from the ground up to walk the path of the master-investor.

If you're ready to develop the same multidisciplinary approach that beat Wall Street, you can apply at philomastery.com.

Philo 🦉