Self-Care Supremacy sponsored this free newsletter on Philoinvestor.

Self-Care Supremacy is an online resource on following your highest path.

💤 The first issue will be about HACKING YOUR SLEEP and achieving the best sleep possible. You can’t follow your highest path if you don’t sleep well.

Subscribe here for high-quality-of-life content.

Select Tweets from This Week

This tweet on Apple’s valuation went viral this week!

Apple’s valuation practically guarantees mediocre returns for those long index funds..

Amazon is distorting its true economics with accounting.

Buffet is offloading shares — why?

Ways in which profits in Big Cloud and Chip Stocks could get blown out of the water. “Don’t be so linear.”

Who will be POTUS? 🇺🇸

The Donald or Kamala?…

I wrote a piece on the opportunity set in markets if Trump is elected. It covers everything from legalisation of “the marijuana” to the future of the Dollar to the potential for re-shoring.

Donald talks a strong game — so does JD Vance.. Let’s see what they manage to do if they get in office.

Oh and by the way, the relationship between politics, regulators and Big Tech will only grow in importance going forward. We talk about that too 👇

Remember that whomever gets in office will have to grapple with the increasing problems the US is facing domestically and in the global arena.

If you are looking for some big picture context on this, the below is required reading.

Where is the Dollar headed?

PROBLEMS with Autos AG? 🇩🇪🇪🇺💥

Something is brewing in Autos land.

VW, the German behemoth, announced closure of 3 factories in Germany and thousands of lay-offs..

Those of you with an understanding of economics are already sensing what’s happening here.

Autos AG is having a very very tough time adapting to the new paradigm of global competition…

The transition to EV and increasing competition with Chinese manufacturers is uncovering fundamental problems in Germany — and all over.

—> That these companies are not run capitalistically — but are run in a social way, to serve all stakeholders.

IN FACT — they are run first to serve employees and the state…and only then are they allowed to serve their shareholders. Conflicts of interest are rampant and everyone is just trying to survive.

These are deep and fundamental issues at the CORE of the EU, and I see paths in which they could tear it apart — literally.

Note: Shares in Volkswagen have gone nowhere for 20 years.

I have been pointing out these issues for years, ever since the start of Philoinvestor. The first ever thread on our Twitter was on a brewing EU debt crisis.

Note: Recently I saw a RE-acceleration of these issues (to the downside🔻) as the positive momentum of post-Covid started to die down. I revised my thoughts and possible scenaria here:

Parallels to Legacy Media?

A few years back, we here at Philoinvestor educated people about the problems legacy media companies were facing as they transitioned to DTC — and how Netflix was going to continue leading the space.

I don’t need to tell you what the outcome was… And the theme is still unravelling.

If you are interested in this incredible yet ongoing story of technological development, disruption and value creation — read the 4-part series below.

CHINA! Where are they going?

I wrote this piece to offer my views on the Chinese stimulus package of last month. I started with the big picture in Chinese politics, Xi Jingping’s place as an elite in China and what he is trying to achieve going forward.

All this is of prime importance for how the Chinese stock market will behave going forward — and this is why stocks reverted back after the spike! 🔻

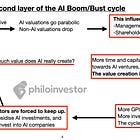

Is AI just pie in the CLOUD? 😅 🥧

Innovation does not necessarily mean business — remember that.

Who is truly making money with this?

What are the traps?

Is investing top-down into AI the solution to achieving AI exposure or?

Is Big Cloud and Big Tech overvalued when their earnings are normalised?

Are the big companies in the Semis/AI complex high-fiving each other and making this look like a massive hype we just can’t miss? 🔄

Could there be a Soros-type reflexive boom/bust in this whole process?

Just how far has AI and AI-powered applications come?

Are we still in the early days as many people seem to say?

Or are we way past the middle?

This, and much more, is what I am exploring in this series.

Downside at Google

Released from paywall. I wrote this short piece in May to address Google’s valuation and undoubted leading position in online search — in the context of the antitrust lawsuits against them. ⬅️⬅️⬅️

Note: Google has not one but TWO antitrust cases against them. Read about them in the piece below.

In August the case was heard in front of Judge Mehta, and the DOJ filed its plan to tackle Google’s anti-competitive practices.

Judge Mehta decided that Google held illegal monpolies in internet search and advertising — setting the stage for enforcement actions against Google LLC.

Let’s see what comes out of it.

Zero to Hero Investing 🦉✍️

Investing for Beginners and Professionals Re-discovering their Edge.

Join the waitlist here.

If you want to upgrade your investing that is.

Sincerely,

Philo 🦉

P.S. Don’t forget to check out the Philoinvestor Youtube. Four educational videos have been uploaded up to now — and many more are coming!

Offshore Drilling — SDRL and RIG = ❤️ L.F.E ?

The Philoinvestor community asked for an update piece on the state of the Offshore Sector and rumours on potential M&A between Seadrill and Transocean. I am working on a piece and will send it out ASAP, to subscribers only.