Shouldn't I just invest in the S&P?

A conversation on Passive Vs Active investing.

For the acquaintances who casually ask, “What are you investing in these days?”

And when I tell them to do a few minutes of work on so and so names…

Proceed to tell me that they will just invest in the S&P — this is what I have to say.

I wrote all these pieces so I won’t be forced to have hour-long discussions with you on this subject.

Enjoy,

Philo 🦉

The first ever mindset piece on Philoinvestor. A very good basic foundation on markets and investing in securities.

Deconstructing Efficient Markets and constructing optimal investment portfolios

·The Efficient Market Hypothesis is an academic theory which postulates that all publicly available information is priced in the markets, and that no one can over-perform the markets or beat the indices. According to this hypothesis, stocks always trade at their “fair value” and that it’s impossible to buy cheap and sell dear. We disagree.

People have a very flawed view of the stock market as it relates to risk. They think the “stock market” is one unified thing, but that notion breeds a lot of confusion.

What's your risk?

·🗣🗣🗣 Investors speak of the “stock market” as if all securities trading on it are one and the same. What is more, their opinions of the “stock market” change together with its recent history, falling prey to the recency effect. “Invest in the stock market, you could make a lot of money.”

This is a note to all passive evangelists from me.

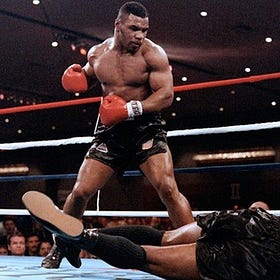

You can't beat me 👊

·Individual stock picking is considered to be too risky for the "passive investing" crowd. Let's call them that. This passive investing crowd seeks to mitigate that risk by buying the index (e.g. S&P 500) and holding for the longer term. They also expect to make a handsome profit by doing so.

An interview on investing with first principles. And how following the current narrative can hurt your pocket.

Philoinvestor: an autointerview

·In an autobiography, one writes his own biography. Here I will interview myself as an investor in order to express my views and share my mindset. I will start with general questions and move to more particular ones as the interview progresses.

The second “Rufus” piece, warning about Big Tech and potential future fragilities that could cause issues for many of these loved Mega Cap technology stocks. In their attempt to go for the safe bet, investors sometimes make risky bets.

Rufus: Quest for the safe stock

·Philoinvestor is an investment and lifestyle newsletter. Most of the content is free. Rufus needs a safe stock to invest and make profits. People are making so much money, why can’t he? Life is getting expensive, prices are going up. His lifestyle needs cash to sustain itself.

ANNOUNCEMENT

Today I will be interviewed by Brandon Beylo of the Value Hive podcast. I will send out the podcast link once it’s published.